Flash Crash Fundamentals

Last Monday, a stock market “mini-crash” scared a lot of investors, with many questioning whether this was the start of the next big market drop. Fortunately, it was just a one-day scare, but a day like last Monday helps reinforce some lessons for long-term investors.

To start, despite the myriad reasons floated by the financial news, stocks go down simply because there are more sellers than buyers. As prices continue to fall, fear takes hold, meaning more investors want to sell and fewer are willing to buy. The sharp reversal to the upside on Tuesday and Wednesday is evidence that Monday’s fears had no basis in fact.

We operate in an interesting environment regarding stock market investing:

- With social media, email, and the financial news networks, everyone with an opinion can express it, and often these opinions move asset prices.

- Out of the vast number of predictions that drive investor behavior, very few have been derived from any sort of fundamental analysis. The predictions are driven mainly by personal beliefs and the hope of being right about the next big move.

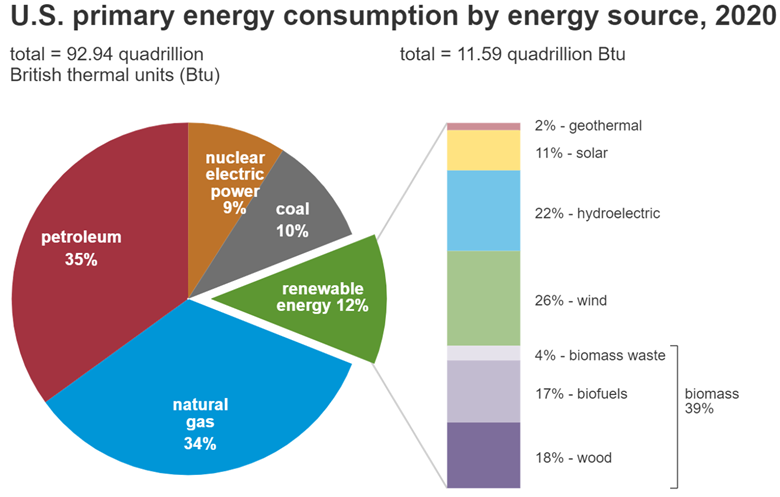

To that second point, how many proponents of a rapid shift to renewable energy sources have seen this chart from the U.S. Energy Information Administration?

A little math shows that wind and solar power contribute just 4.4% of the energy used in the U.S. That number was achieved after giving over $100 billion in tax subsidies over the last 40 years to help build windmills and solar energy sites. I am not knocking renewable energy here; I am questioning the widespread belief that renewable energy is a better place to invest than traditional oil and gas companies.

Short-term thinking is another factor that I believe hurts investors. The financial news has to entertain viewers every day, whereas I plan to invest and build my wealth for decades. The two time frames do not mesh well. I suggest you view what you see in the financial media for entertainment purposes and make your investment decisions based on a long-term plan using proven strategies that work over time.

I focus on recommending investments that generate high current income from dividends. We can build and grow an income stream in any market environment. I also tell my subscribers that when the rare, deep stock market drops occur, those are the times to build your wealth.

We all know that you make money by buying low and selling high. Fear and greed drive most investors to do just the opposite. A long-term plan makes it easier to fight the fear and buy high-quality investments when share prices get cheap.

I’ll close with one example from last week. On Friday, July 17, mall REIT Simon Property Group (SPG) closed at $124.50 per share. The following Monday, during the mini-crash, it traded as low as $114—off almost $10. But by Wednesday, Simon shares were trading above $128.

If you were/are a long-term investor who understands the powerful fundamentals behind Simon’s business, you may have gladly added a few shares on that Monday.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more