Federal Tax Revenues Tank As Biden Administration Goes Right On Spending

The US government ran a surplus in April, as it generally does in tax return month. But federal tax revenues collapsed year-on-year and the fiscal 2023 deficit is still close to $1 trillion despite the small April windfall.

The budget deficit decreased by $176.18 billion in April as tax receipts rolled into the Treasury leading up to tax day, according to the Monthly Treasury Statement.

A surplus sounds like good news, but digging into the data reveals that federal revenues are falling even as spending continues unabated.

The Treasury took in $638.52 billion in April. That was more than double the receipts in March. This is to be expected as the government collects a large amount of tax revenue in April. But compared to April 2022, tax receipts were down 26.1%. That plunge in revenue pushed the April budget surplus down by 43% compared to last year’s.

Falling tax receipts are a big problem for a government that continues to spend around half a trillion dollars every single month.

Last year, strong tax receipts helped to paper over the spending problem. The federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it won’t last. And government tax revenue will decline even faster if the economy spins into a recession.

In a nutshell, the US government faces a double-whammy of falling receipts and increasing spending.

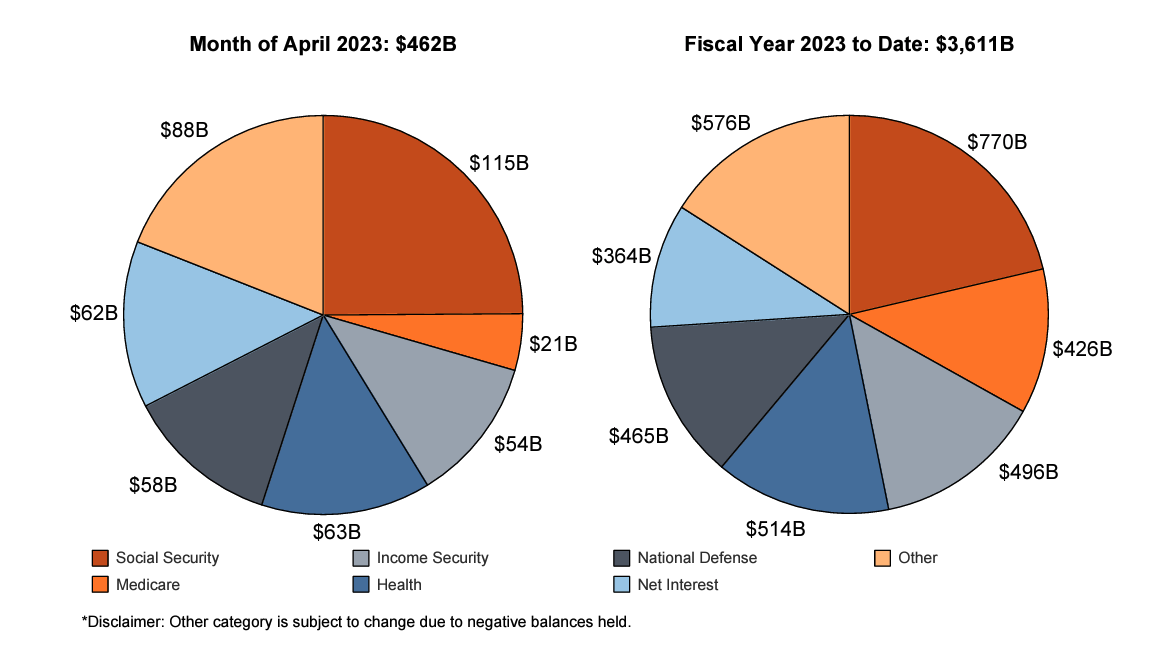

And the real problem is on the spending side of the ledger. Last month, the US government blew through another $462.34 billion.

(Click on image to enlarge)

The CBO now projects that the fiscal 2023 budget deficit will come in at $1.5 trillion. That would be bigger than any deficit run by the Obama administration during the Great Recession and higher than last year’s $1.3 trillion shortfall.

Even with the US government up against the debt ceiling, there is no indication that the spending freight train will slow down any time soon. Congress passed a $1.7 trillion omnibus spending bill for 2023 that increased outlays by about $1.5 billion over fiscal 2022.

Of course, this is only one component of federal expenditures. The US government is still handing out COVID stimulus money, and in March 2021, Congress approved $1.9 trillion in spending to address the pandemic. Last year, it passed the euphemistically named “Inflation Reduction Act.” Meanwhile, the US continues to shower money on Ukraine and other countries around the world. All of that spending will pile on top of this most recent allocation of funding.

Meanwhile, the Federal Reserve raised interest rates by another 25 basis points in May. That will add to the quickly ballooning interest cost.

Interest payments on outstanding debt in the first seven months of fiscal 2023 totaled $460.3 billion. That was a 31% increase over the same period last year.

And interest expense was already skyrocketing in 2022. According to an analysis by the New York Times, net interest costs rose by 41% last year. According to the Peterson Foundation, the jump in interest expense was larger than the biggest increase in interest costs in any single fiscal year, dating back to 1962.

The cost of financing the debt will almost certainly rise even more once Congress raises the debt ceiling. At that point, the US Treasury will have to sell a significant number of bonds to catch up with its deficit spending. That flood of paper will likely drive Treasury rates higher. Currently, the Treasury is running “extraordinary measures” to fund government spending since it is against its borrowing limit.

If interest rates remain elevated or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

In October, the national debt blew past $31 trillion. It now stands at $31.46 trillion. It will remain there until the fake debt ceiling fight resolves and it will then spike quickly toward $32 trillion.

According to the National Debt Clock, the debt-to-GDP ratio stands at 120.3%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt-to-GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

To put the debt into perspective, every American citizen would have to write a check for $94,830 in order to pay off the national debt.

A Big Problem for the Fed

The soaring national debt and the US government’s spending addiction are big problems for the Federal Reserve as it battles price inflation.

And now it has to deal with the extra pressure of a budding financial crisis.

As you’ve already seen, the push to raise interest rates is putting a strain on Uncle Sam’s borrowing costs. But there is an even bigger problem. The Fed can’t slay monetary inflation — the cause of price inflation — with rate cuts alone. The US government also needs to cut spending.

The US government can’t keep borrowing and spending without the Fed monetizing the debt. It needs the central bank to buy Treasuries to prop up demand. Without the Fed’s intervention in the bond market, prices will tank, driving interest rates on US debt even higher.

A paper published by the Kansas City Federal Reserve Bank acknowledged that the central bank can’t slay inflation unless the US government gets its spending under control. In a nutshell, the authors argue that the Fed can’t control inflation alone. US government fiscal policy contributes to inflationary pressure and makes it impossible for the Fed to do its job.

Trend inflation is fully controlled by the monetary authority only when public debt can be successfully stabilized by credible future fiscal plans. When the fiscal authority is not perceived as fully responsible for covering the existing fiscal imbalances, the private sector expects that inflation will rise to ensure sustainability of national debt. As a result, a large fiscal imbalance combined with a weakening fiscal credibility may lead trend inflation to drift away from the long-run target chosen by the monetary authority.”

This clearly isn’t in the cards.

Something has to give. The Fed can’t simultaneously fight inflation and prop up Uncle Sam’s spending spree. Either the government will have to cut spending or the Fed will eventually have to go back to creating money out of thin air in order to monetize the debt.

More By This Author:

The CPI Is Two Months Away From Bottoming Before The Next Leg Up

Federal Budget: TTM Deficit Surges To $1.9T As Tax Revenues Collapse

A Big Disconnect