Federal Revenues Signal Economic Snap Back

U.S. Treasury Building Cash

The Federal Government’s revenues have rebounded sharply over the past two weeks, suggesting that the economy has snapped back to trend, with no lasting effects from the government shutdown, contrary to the worries of the Washington-Wall Street chattering classes. But meanwhile, the Treasury has started borrowing significantly more money to repay the accounts it raided while it sought to avoid the debt ceiling.

New supply [of Treasuries] will be unusually heavy for a week in which only bills are offered. Net new supply will total $23 billion if the 4 week bill comes in at $45 billion as the TBAC estimates. The Treasury boosted the 13 and 26 week bill offerings by a total of $6 billion above the TBAC forecast. It may be starting the payback of the accounts it raided. That should exert a little drag on the market during a week in which the Fed buys only $11 billion in Treasuries.

Without the massive mid month Fed MBS settlements [Fed buying mortgage backed securities], there probably will not be enough cash to support rallies in both stocks and bonds until the next round of MBS settlements, which begins on November 13. The markets will get less help until then. Then the fun begins anew. I see no reason that the “buy the dip” mantra should not continue to work.

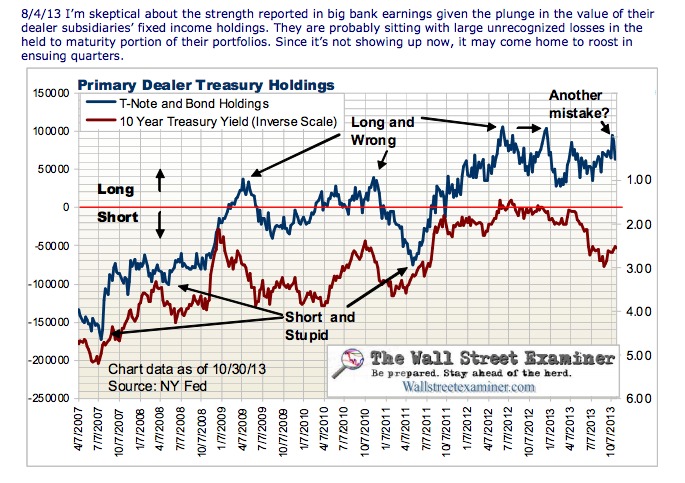

Primary Dealer Trading

Primary Dealers cut their Treasury coupon positions in the week ended October 23. The Primary Dealers are now net long $62.9 billion in coupons. They had gone massively longer in them during the week of October 9. The October 9 position--$94.5 billion--was the largest long position that they held since last December, which was a horrible time to be heavily long. The last 3 times the dealer's total Treasury coupon long position was that large was at the top of the top in bond prices.

Will this be a repeat? We’ll just have to see, but their track record has been routinely awful in this regard.

Track data that matters, and stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the Wall Street Examiner Professional Edition. Click this link to try WSE's Professional Edition RISK FREE for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved.