Fed Will Start Buying Bond ETFs Tuesday; Blackrock To Make Over $15 Million In Fees

Last Monday, in response to a Gundlach tweet in which the bond king said "I am told the Fed has not actually bought any Corporate Bonds via the shell company set up to circumvent the restrictions of the Federal Reserve Act of 1913" the New York Fed announced on its website that it expects to begin purchasing eligible ETFs - most notably the LQD and JNK - as part of its emergency lending programs in "early May."

And yet, day passed, and then another, and another, and suddenly early May turned into mid May and... still nothing.

Until today when the Fed announced late in the day that the facility designed to purchase eligible corporate debt from investors will launch on May 12, bringing the most controversial part of the US central bank’s emergency coronavirus lending program - one which not even Bernanke dared to activate at the depths of the financial crisis perhaps realizing that there would be no extrication from that particular moral hazard - online following weeks of anticipation.

The Fed's Secondary Market Corporate Credit Facility "will begin purchases of exchange-traded funds (ETFs) on May 12" the New York Fed website said, nearly two months after it was was first announced in late March, and served a key role in keeping financial markets relatively calm since then.

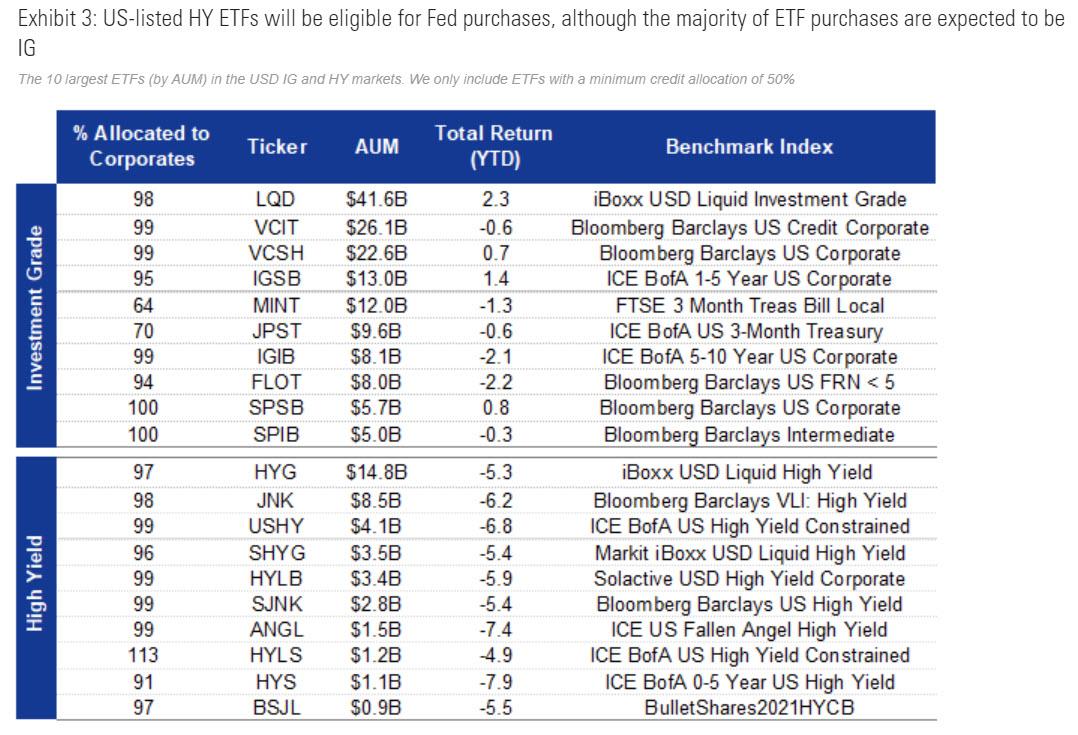

The NY Fed then again lists the ETFs that will be eligible for purchase:

As specified in the term sheet, the SMCCF may purchase U.S.-listed ETFs whose investment objective is to provide broad exposure to the market for U.S. corporate bonds. The preponderance of ETF holdings will be of ETFs whose primary investment objective is exposure to U.S. investment-grade corporate bonds, and the remainder will be in ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds. The SMCCF will consider several additional factors in determining which ETFs will be eligible for purchase. Those considerations include: the composition of investment-grade and non-investment-grade rated debt, the management style, the amount of debt held in depository institutions, the average tenor of underlying debt, the total assets under management, the average daily trading volume, and leverage, if any.

As the Fed further adds:

To expedite implementation, the SMCCF will begin by transacting with Primary Dealers that meet the Eligible Seller criteria and that have completed the Seller Certification Materials. Additional counterparties will be included as Eligible Sellers under the SMCCF, subject to adequate due diligence and compliance work.

We previously listed all the ETFs that the Fed will likely acquire via Blackrock.

The document offered more information on the strategy the Fed would pursue:

Corporate-debt buying, including via ETFs, will occur in three stages, according to the agreement: a “stabilization” phase, an "ongoing monitoring" phase, and a "reduction in support" phase.

"Purchases will be focused on reducing the broad-based deterioration of liquidity seen in March 2020 to levels that correspond more closely to prevailing economic conditions,” the document said. It listed an array of metrics that would guide investments, including transaction costs, bid-ask spreads, credit spreads, volatility and “qualitative market color."

“Once market functioning measures return to levels that are more closely, but not fully, aligned with levels that correspond to prevailing economic conditions, broad-based purchases will continue at a reduced, steady pace to maintain these conditions.”

The document also explained how much the Fed will pay Blackrock for engaging in perfectly risk-free purchases of ETFs at the Fed's command. In other words, not only will Blackrock frontrun the Fed, but the Fed will pay Blackrock for the privilege.

Blackrock's compensation for doing something the NY Fed's desk is perfectly capable of doing itself (furthermore, since it only has to buy and never has to sell, the Fed can just hire any millennial on tweetdeck - they have precisely the required skill set; now if selling is ever required the Fed may have trouble finding traders that actually are familiar with that particular skill, but we digress). Here the key fees are:

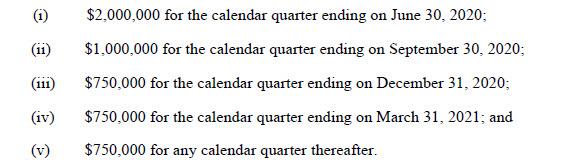

Fixed SMCCF Program Management Fee, as follows:

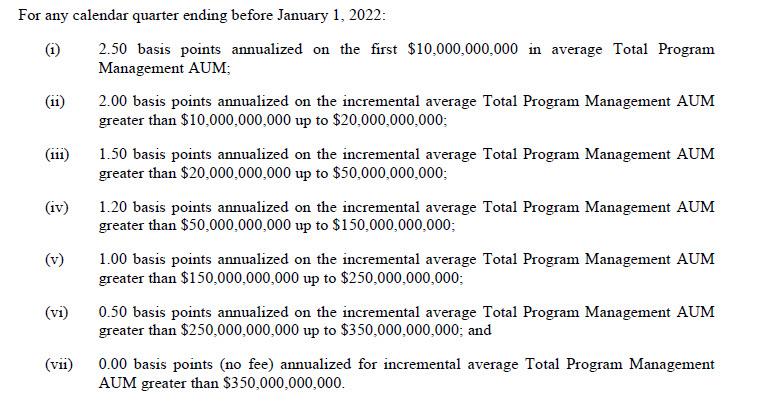

An AUM-Based SMCCF Program Management Fee, as follows:

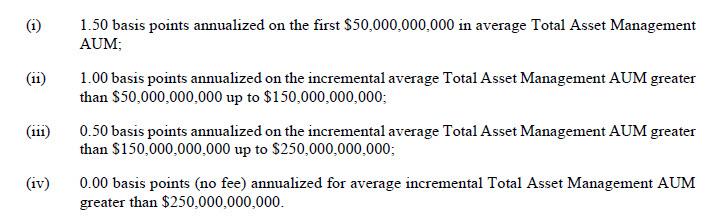

An SMCCF Asset Management Fee, as follows:

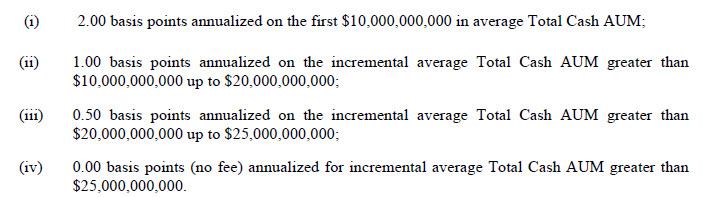

And an SMCCF Cash Management Fee:

So in addition to earning over $5MM just for just sitting there, looking pretty over for the next 12 months (and this program will last far, far longer than that), BlackRock will also make - assuming only payments under the AUM-Based SMCCF Program Management fee and the SMCFF Asset Management Fee and ignoring any cash AUM-linked payments - approximately $7.5 million on the former, as asset purchases cap $350BN, and another $3.5 million on the latter, with a $250BN cap. In short, Blackrock is set to make over $15 million for simply waving bond ETFs in on behalf of the Federal Reserve.

Since such a role has neither custody risk nor transaction risk, we look forward to the Congressional hearings in which Larry Fink, that noble crusader for the common man, explains why US taxpayers had to pay him billions and billions for doing, well, pretty much nothing.

Oh, and all of this of course excludes all the profits that Blackrock will pocket from simply purchasing ETFs on its own account ahead of the Fed, something which Blackrock's head of global allocation team, Rick Reider last month admitted the world's largest asset manager will do.

Below we attach the full Schedule D (pdf link here) listing all the payments that will be due to Blackrock, so that readers can be shocked at their own pace.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

When the government starts buying companies up what do you call that? USSR.