Fed Reaches The End Game As US Data Disappoints Yet Again

Image Source: Unsplash

Widespread falls in key retail sales components and broadening signs that inflation pressures are rapidly moderating means we are getting very close to the peak for Federal Reserve policy rates. A 25bp hike in February still appears odds-on, but the case for additional hikes is looking less convincing.

Broad, steep declines in retail sales

In what is yet another disappointing set of US activity data, retail sales fell 1.1% month-on-month in December, worse than the -0.9% figure the market was expecting. Meanwhile, November's contraction of -0.6% was revised to an even weaker -1% MoM print.

The damage was widespread with 11 of the 14 main components posting monthly declines including motor vehicles/parts (-1.2%), furniture (-2.5%), electronics (-1.1%), gasoline stations (-4.6%), department stores (-6.6%) and non-store retailers (-1.1%). Of the three that didn’t fall we have food/beverages flat on the month, sporting goods up 0.1%, and building materials up 0.3%.

Retail sales levels (February 2020 = 100)

Image Source: Macrobond, ING

Lower gasoline prices obviously had a big impact given this is a dollar value report, but even if you exclude them, retail sales fell 0.8% after a 0.9% fall in November. The decline in autos is no surprise given the drop in unit volumes already reported while variable weather patterns may also have played a part, particularly in eating out. Nonetheless, the breadth of weakness, including the internet, underlines the weaker consumer spending story as worries about squeezed incomes and falling asset prices weigh on sentiment.

Can spending on services offset the gloom?

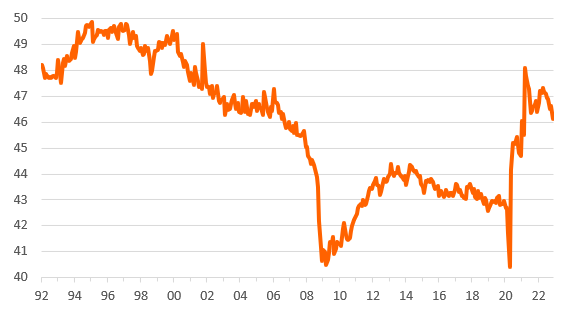

The core 'control' group, which omits volatile components such as autos, gasoline, and building materials and better tallies with broader consumer spending activity were also poor – falling 0.7% MoM rather than the 0.3% consensus. We can only hope that spending on services is holding up better. As the chart below shows, retail sales as a proportion of total consumer spending remain well above pre-Covid trends, so it may well be that overall spending holds up better as consumers gradually re-balance their spending back towards services.

Retail sales spending as a proportion of total consumer spending

Image Source: Bloomberg

An increasingly benign inflation backdrop argues against the need for more major hikes

Meanwhile, the producer price inflation report showed that pipeline price pressures were also weaker than expected in December and November. Headline PPI fell 0.5% MoM rather than at the -0.1% rate expected while November was also revised down a tenth of a percentage point. Core PPI (ex-food & energy) was in line at just 0.1%, but November’s rate of price increases was revised down two-tenths of a percent.

So we have further evidence of weaker activity and an increasingly benign inflation backdrop, which clearly suggests we are in the end game for Fed rate hikes. Today’s numbers, coming after the softer CPI report, should cement expectations for a 25bp Federal Reserve interest rate hike in February and at the margin diminish the case for additional rate hikes – currently, we expect a final 25bp in March. With recessionary forces intensifying and inflation looking less and less threatening, the prospects for Fed rate cuts later in the year are growing.

More By This Author:

Jump In UK Services Inflation Provides Ammunition To BoE Hawks

Bank Of Japan Defies Market Speculation - Keeps Policy Steady

FX Daily: Dazed And Confused

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more