Fed Policy Just Slammed Into A BRIC Wall

The Fed’s plan of withdrawing $1 trillion in liquidity this year via QT has slammed into a BRIC wall.

Year to date, the Fed has shrunken its balance sheet by $116 billion. This sounds like a lot of money until you put it in perspective.

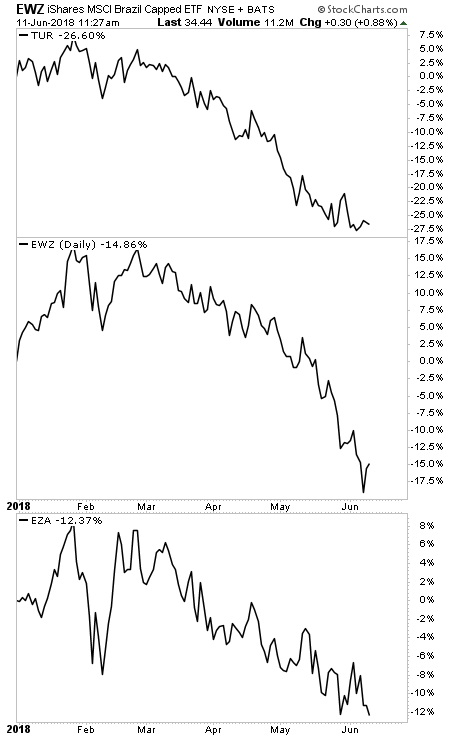

That measly little drop has blown up emerging market currencies resulting in an emerging stock market meltdown everywhere from South Africa, to Brazil, to Turkey.

Put simply, the Fed has only shrunken its balance sheet by less than 3% and already it’s creating a crisis in the emerging market space.

The Fed will now HAVE TO “walk back” its QT program as well as its intended rate hikes for this year. The alternative (a deflationary crisis in emerging markets that will eventually seep into the US) is too ugly.

This is the “White Swan” I’ve been forecasting since end of March 2018. It will mark THE blow-off top for the markets. Yes, I mean THE top will be in for years to come.

We just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead. ...

more

Great title.