Fed Moves To Quantitative Contraction, QC Did Anyone Notice?

Fed moves to Quantitative Contraction, QC

Did anyone Notice?

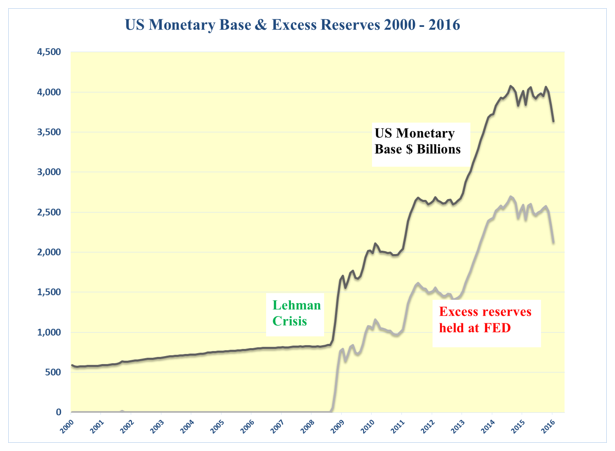

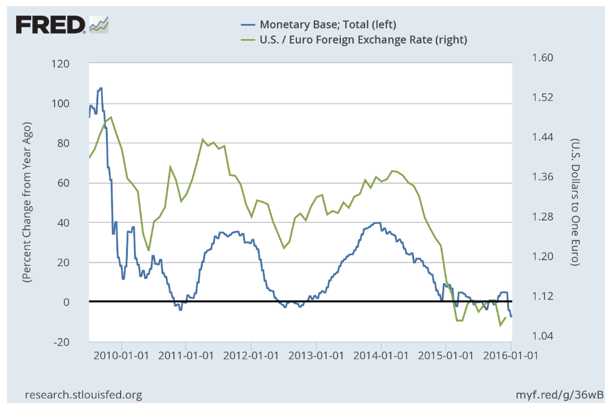

Not only did the Fed raise the Funds rate in December but it set in motion the start of the contraction of the monetary base. Quantatative Contraction, or QC perhaps? The substantial decline in the U.S. monetary base was reported by the Fed in its weekly release on January 7, 2016 that covered the two week period ended to January 6, 2015.

This is serious tightening by the Fed that should have a much greater impact than the 0.25% hike in the Funds rate. The drop was the result of a 15% decline during December of the excess reserves held at the Fed.

This drop may be accounted for by the ending of the rolling-over and re-investment of maturing debt coinciding with the year end. I asked the Fed for an explanation but have not received a reply. Whatever the reason, there has been a srerious reduction in the pool of available U.S. dollars while other countries continue to expand the amounts of their respective currencies.

When viewed as commodities any change in the relative supply of currencies will alter their relative prices. With the supply of U.S. dollars contracting under QC, the price of the U.S. dollar should continue to rise as it has been since the end of QE in 2014 with the similtaneous expansion of money in Japan, Europe and the UK. China is also allowing its currency to fall slowly. It would have done so faster without the Peg.

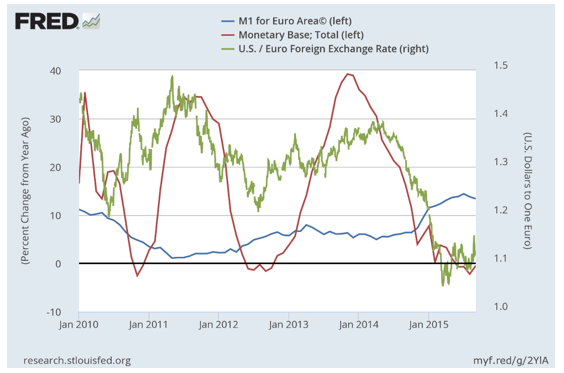

The next chart shows how the Euro rises and falls as the year-over-year rates of change of the Euro M1 and the U.S. monetary base gyrate.

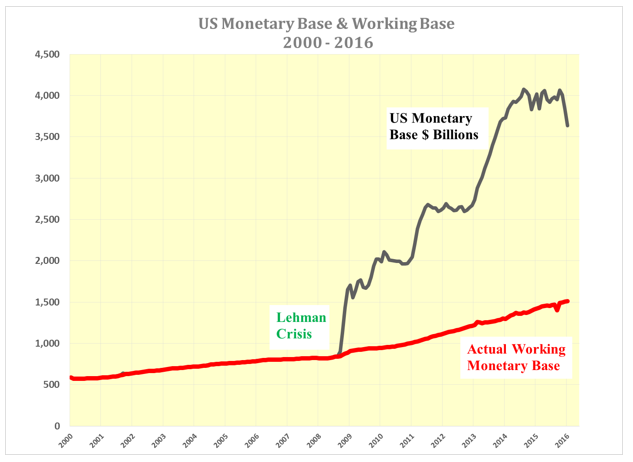

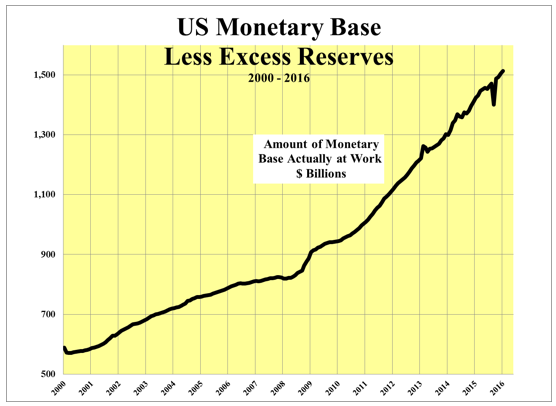

The impact of the tightening on U.S.domestic economy is unlikely to be felt in the short term the as the actual working amount of the monetary base is still rising and it is still well below the gross figure of US$3.6 trillion as shown in the first chart above.

The major negative impact of a "strong" U.S. dollar should be on U.S. exporters and U.S. multinationals. On the positve side there should be a significant importation of deflation even though this may result in the further exportation of the U.S. manufactuing base.

In turn, this may lead to the reversal of the Fed’s action even going as far as having to introduce negative interest rates. Eventually, this should be good for gold and silver and non-U.S. currencies but it will take time for market participants to wake up to the full implications of the decline of the gross U.S. monetary base now underway.

The Quantitative Contraction should, however, put serious upward pressure on the U.S. dollar and thereby slow U.S. exports as well as have a negative impact on the reported earnings of U.S. multinationals.

Looking at the very rapid contraction of the U.S. monetary base over the past two weeks while Europe is still easing, there would appear to be little doubt where the U.S. dollar is headed over the next few months should the U.S. Quantitative Contraction continue.Perhaps the Fed will change direction when imported lower prices cause domestic inflation to tip into deflation and the US manufactuing base begins to dwindle as it did in the 1990s.

More important, would be the impact on the Canadian dollar which is also falling relative to the U.S. dollar. As though it isn't enough that the Canadian dollar is being pummeled with the price of oil falling in U.S. dollars.

Some areas of the Canadian economy should benefit from the falling loonie:

Tourism, farming, vintners, manufactuing, mining, lumber and property prices to name but a few. This should be sufficient to help the banks that are suffering from foreign disinterest.

Oil still lower and longer

My long held expectation that the price of oil will fall below US$20 per barrel before bottoming should soon come to pass as Iran cranks up production to 500,000 barrels per day now sanctions have been lifted and potentially to 1 million barrels per day within 6 months. Thereafter, the recovery should take more time as inventories act as a buffer, diminishing any hope of a V shaped price rebound.

The Saudi sale of Aramco seems to be an act of desperation throwing the baby out with the bathwater as the oil price tanks. They should have thought of that at US$150 a barrel. At this level it seems to be panic selling like so many underwater margin players.

It might also be that the Saudis are willing to undergo more pain to spite Iran rather than cut production and lose market share to their enemy. Doing so would also put further pressure on high cost marginal producers and rebalance the oil market but this is not happening as quickly as anticipated.

It takes time for a major industries such as energy and mined commodities to adjust to lower prices. Thus there seems to be little point in trying to catch a falling sword. There will be ample time to re-invest in the oil industry during the bottoming process that may take a year or more if the action of other extracted commodities such as precious, ferrous and non-ferrous metals are anything to go by.

On top of this, markets have to contend with computer generated front running that is driving many hedge funds to return capital to their respective investors. Furthermore, commodity traders like Glencore are still in difficulty with the shares of those that are publicly traded flirting with the lows reached last August but without any accompanying fanfare.

DJII Remains Underpriced by a Wide Margin

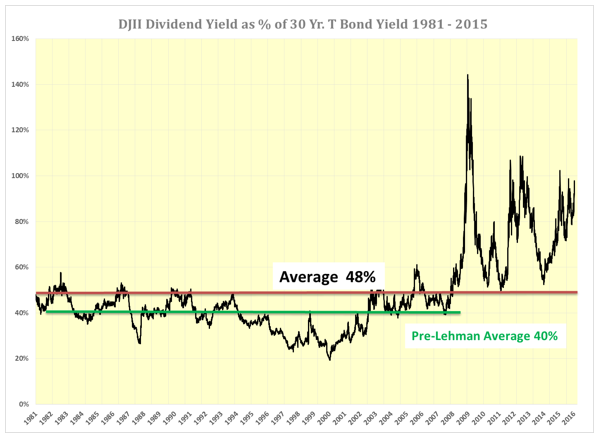

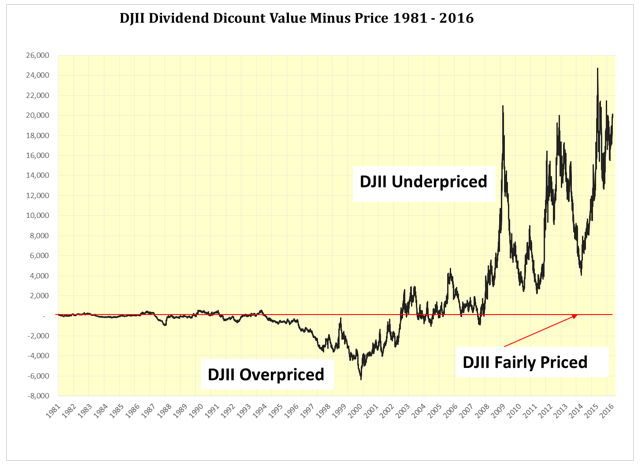

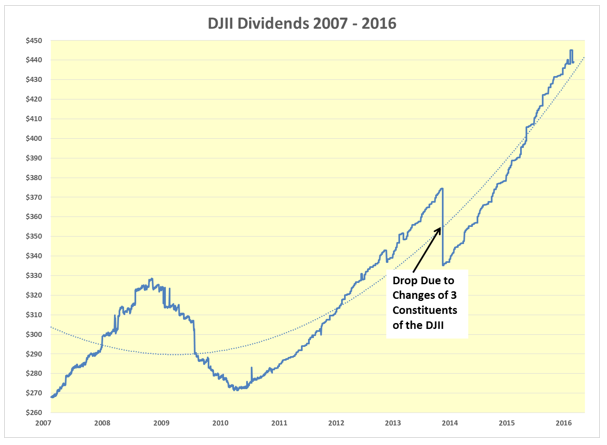

The dividend discount value of the DJII at 37,200 remains well in excess of its price of only 15,988 which below the 16,103 level of last Labor Day despite the 2.2 % rise in dividends from $429.88 to $439.19 and the drop in the 30 year T Bond yield from 2.88% to 2.81%. The DJII yield of 2.75% stands at 97.8% of the of the 30 year T bond yield compared to 92.7% on Labor Day. Pre Lehman the average was only 40%. Compared to 48% today.

On an after-tax basis the DJII yield is far above that of the 30 year T Bond and screams value, particularly as the dividend of the DJII tends to rise over time whereas bond coupons remain static. It is incredulous that investors seeking yield should buy bonds when the DJII is so cheap.

While I have been recommending the purchase of the DJII on the basis of its value for all of this decade it is has been the right move for a Canadian commentator or investor not only because of the improvement in the price of the DJII in US dollars but also because of the 45% extra kicker from the relative depreciation of the Canadian dollar. A somewhat better return than seeking safety by sitting in Canadian bonds.

DJII Dividend Discount Value at 37.200 well in excess of its Price of 15,988

Fear of financial collapse, economic, political and social turmoil are scaring corporations and investors into inaction. Lack of direction in the USA and in other countries is causing investors and corporations alike to sit on vast piles of cash estimated by Bloomberg at US7$ trillion. Investment in long term bonds is happening out of necessity by pension and insurance companies as well as a flight to perceived safety.

An expected shortage of U.S. Government paper this year should keep long rates low even if the Fed rate is slowly increased. While Donald Trump may not be elected it looks as though some of his policies will be enacted by the new President. Infrastructure should be a major fiscal expenditure over and above the recently enacted US$305 billion bill that should see a renaissance of roads, bridges, high speed railways and airports, which should help economic activity for a good number of years.

The extent by which the DJII is underpriced is demonstrated in the following chart.

With 30 year Bond rates likely to either fall or at worst remain steady, the other part of the dividend discount model is the dividend of the DJII which is close to a record level.

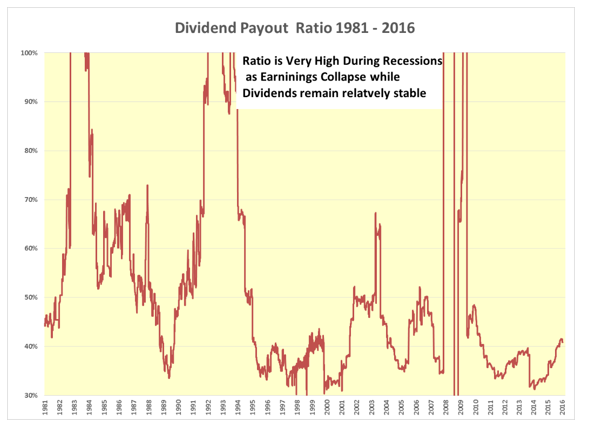

Furthermore, the payout ratio remains low suggesting that unless another U.S. recession is imminent the aggregate DJII dividend should remain intact. Even the Exxon and Chevron seem determined to maintain their respective dividends this year.

The DJII remains well below its dividend-discount value and investors should take advantage of this opportunity to switch out of cash and bonds and buy good quality dividend paying shares that have a good record of increasing dividends on a regular basis, the Dividend Aristocrats.

Oil will eventually recover but there is no need to rush to buy.

Base Metals

In my last blog I thought it was time to start looking at my first love again particularly copper, nickel and zinc as economic activity continues to strengthen and LME inventories decline. I am still looking and I am encouraged that the LME inventories are falling. However, they are still not yet at critical levels and more production such as Freeport’s Cerro Verde mine is about to start up offsetting some of the closures in the copper industry.

Data Sources: US Federal Reserve, Dow Jones, Bloomberg and the London Bullion Market

more

So, is this a reduction in excess reserves, Tony? Interesting article and charts. Also I wrote about low rates and you confirmed that.

It certainly looks like it. The next Fed report on the monetary base will be released at 4.30 pm today