Fed Holds Rates, Signals QT Taper; Blames Trump 'uncertainty' For Stagflationary Outlook

Image source: Wikipedia

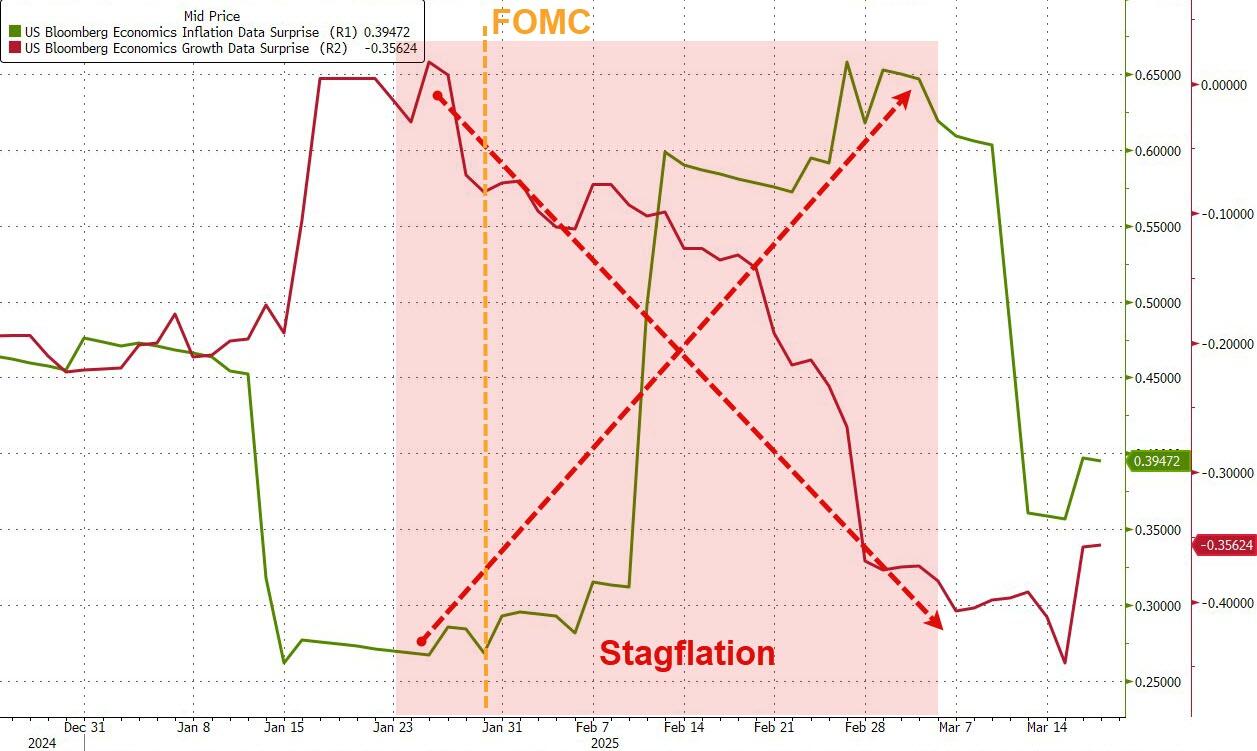

Since the last FOMC meeting, on Jan 29th, a lot has changed...

From an economic perspective, growth expectations have plunged and inflation prints have been wildly noisy...

Source: Bloomberg

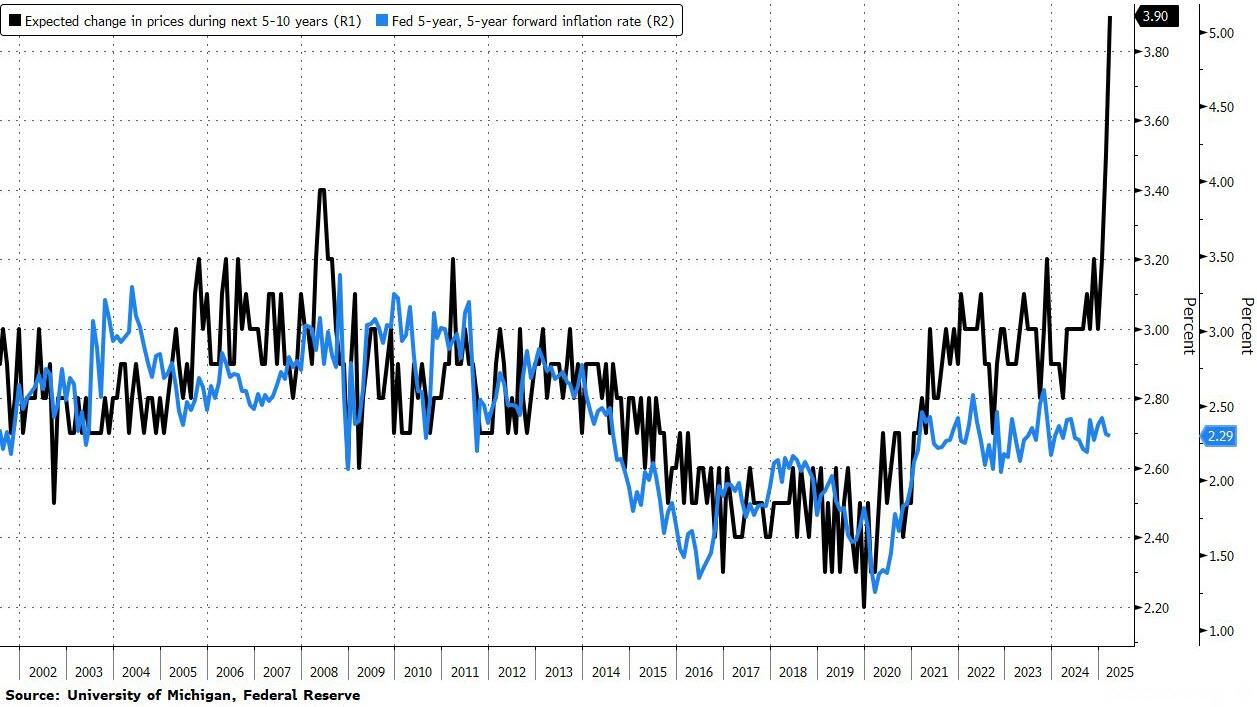

... (especially the idiotically partisan UMich inflation expectations)...

Source: Bloomberg

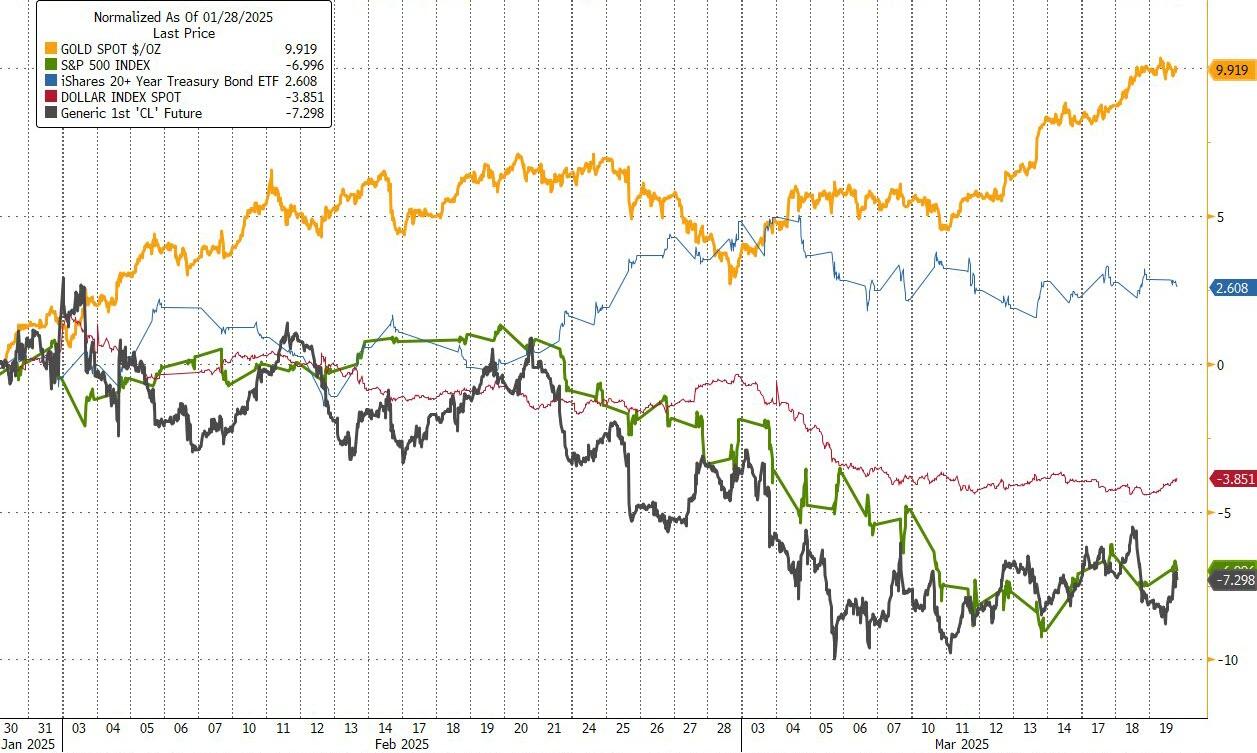

Gold has been the dramatic winner since the last FOMC meeting while oil and stocks have been clubbed like a baby seal. Bonds are bid but the dollar has been dumped...

Source: Bloomberg

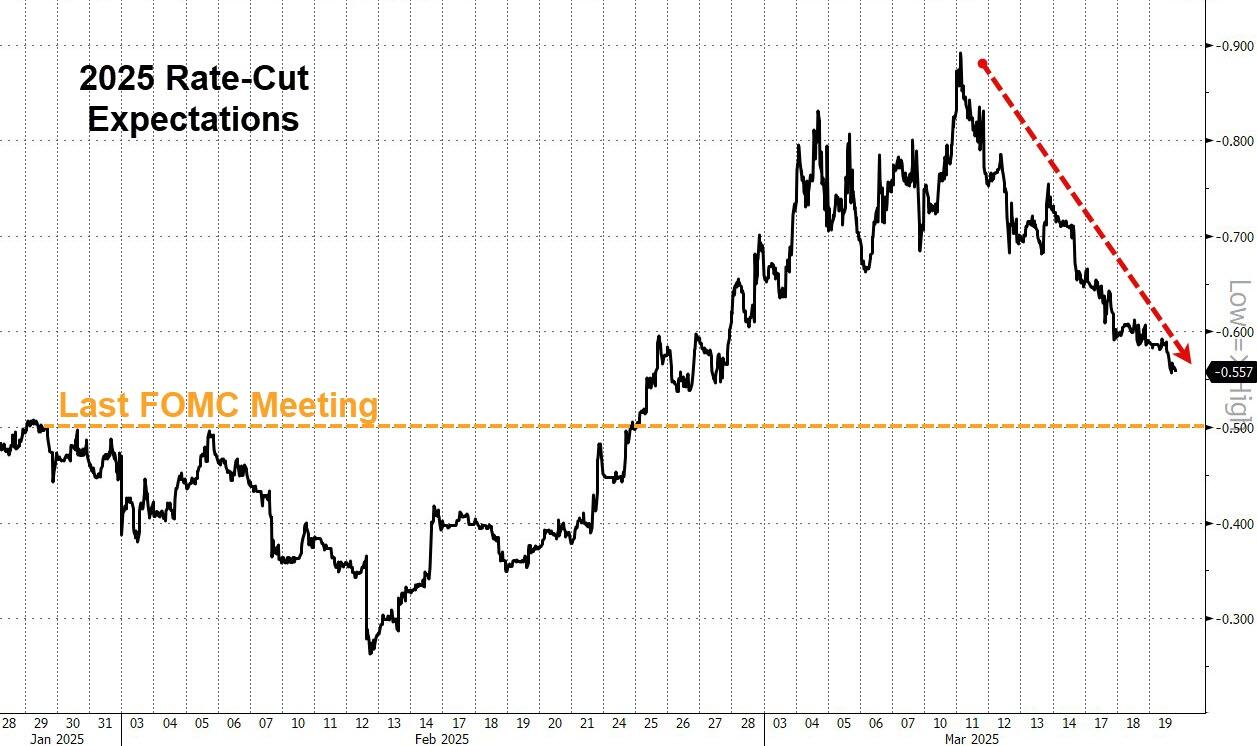

Interestingly, as stocks have tumbled in the last two weeks, so have rate-cut expectations, back more in line with where they were after the last FOMC meeting (just 56bps now, from almost 100bps two weeks ago!)...

Source: Bloomberg

On the bright side, mortgage rates have plunged since the last FOMC meeting...

Source: Bloomberg

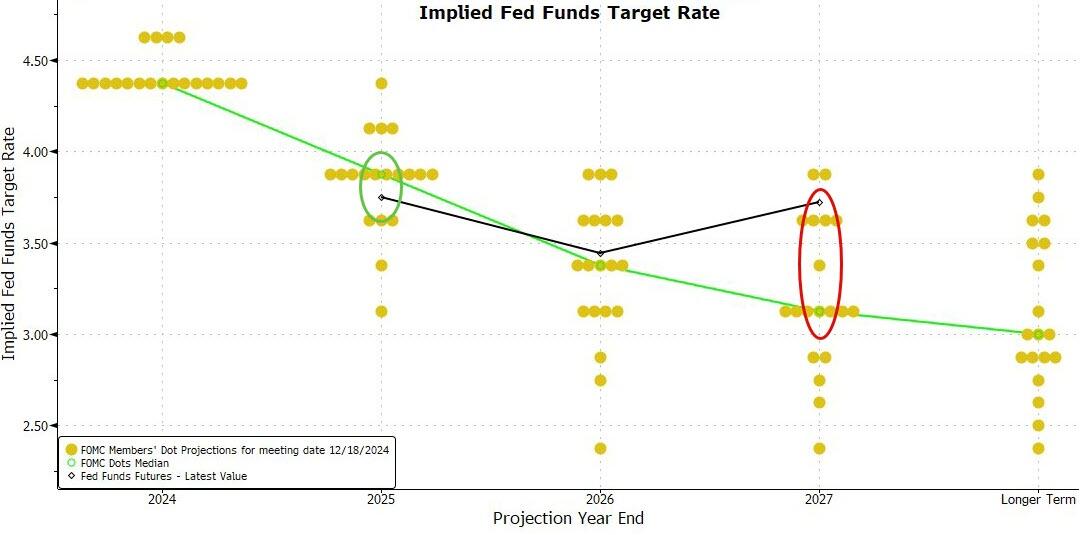

Finally, before everything goes just a little bit turbo, we note that the market is currently significantly more dovish than The Fed's dots this year and dramatically more hawkish in 2027...

Source: Bloomberg

Rates are expected to be a nothingburger today.

So will today's fresh Dot-Plot adjust to the market?

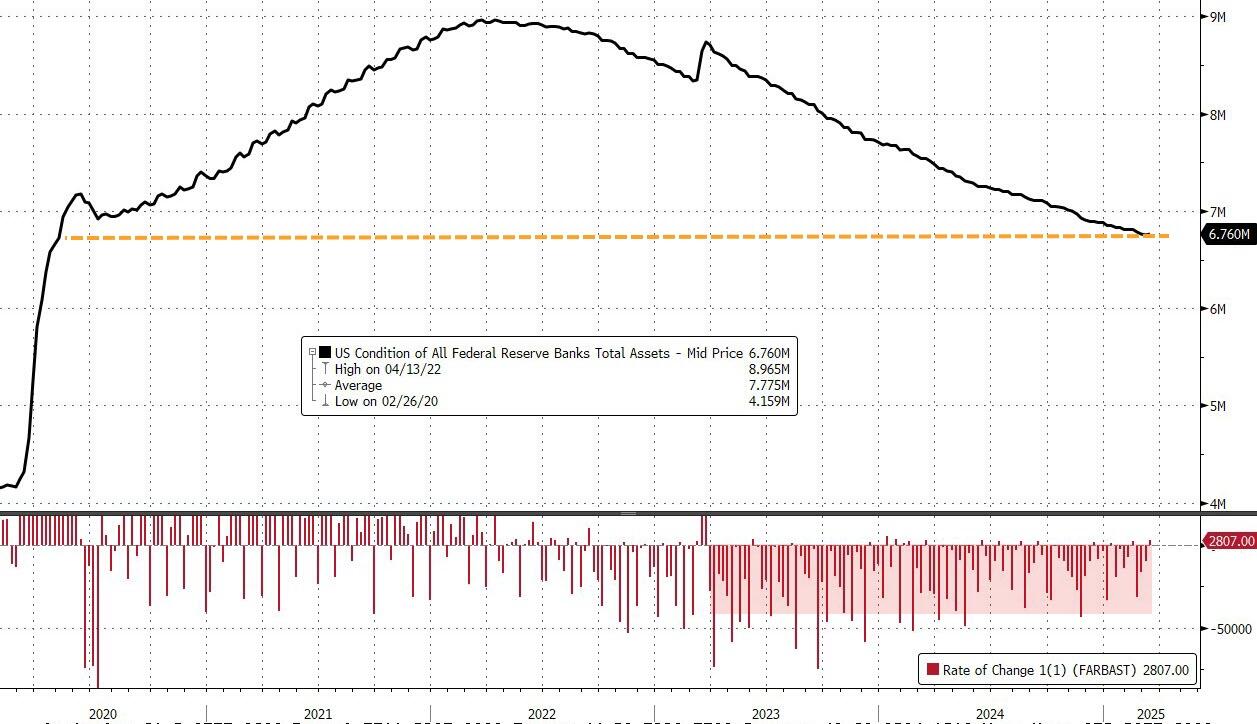

More importantly, what will The Fed do about its QT program?

Key Headlines:

As expected, no change in rates:

- *FED HOLDS BENCHMARK RATE IN 4.25%-4.50% TARGET RANGE

But, the economic projections are not pretty:

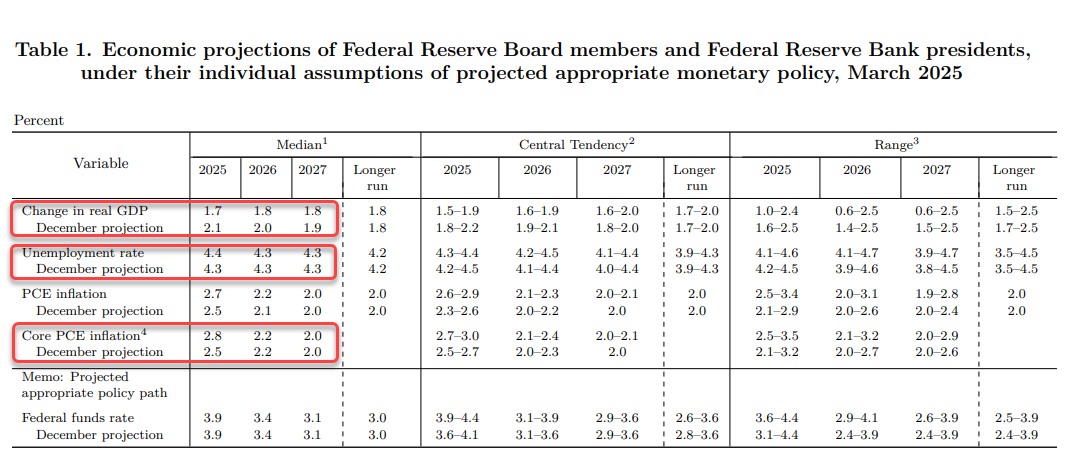

- *FED SHARPLY REDUCES 2025 GROWTH PROJECTION, MARKS UP INFLATION

- Fed cuts year-end GDP forecast from 2.1% to 1.7%

- Fed raises year-end core PCE forecast from 2.5% to 2.8%

- Fed raises year-end unemployment forecast from 4.3% to 4.4%

(Click on image to enlarge)

Perhaps of most note:

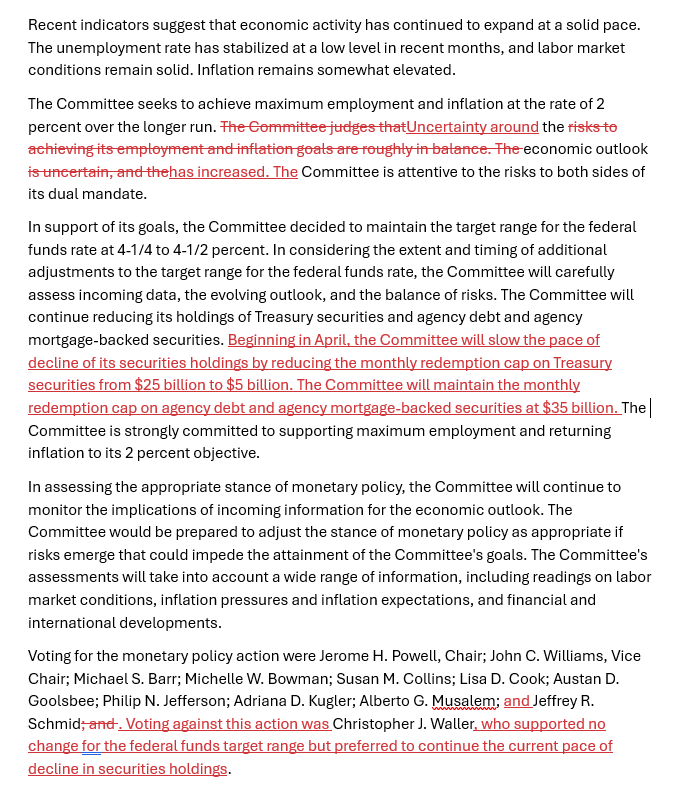

Fed removes language that "risks to inflation and employment are roughly in balance"

Trump's fault:

- *FED SAYS UNCERTAINTY AROUND ECONOMIC OUTLOOK HAS INCREASED

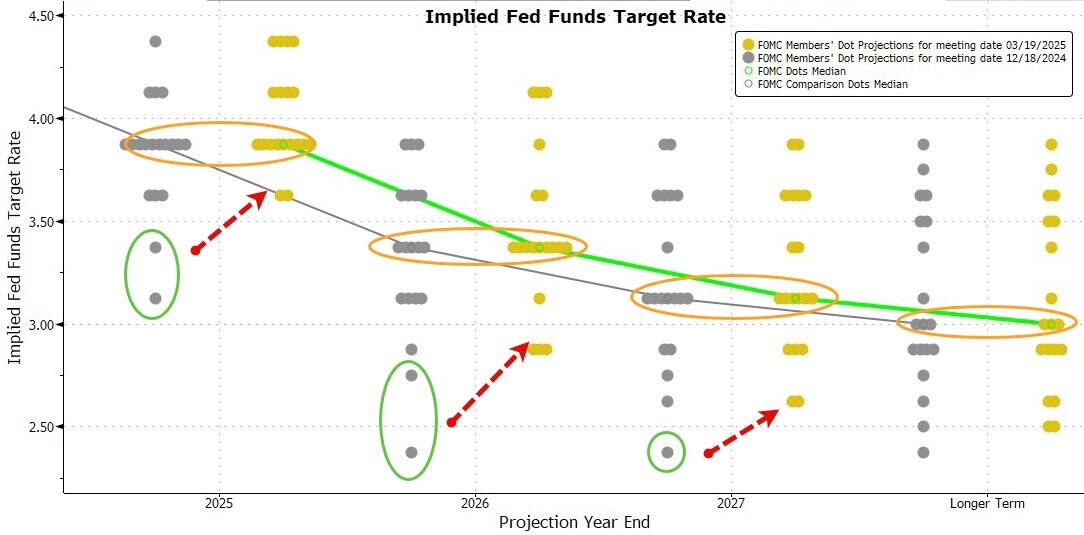

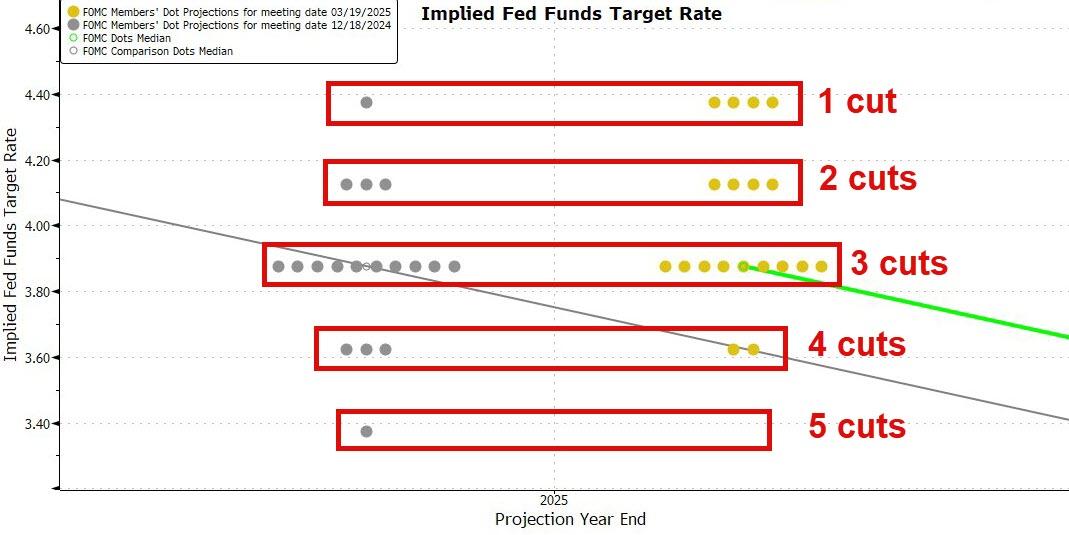

The median of the rate cut forecasts are unchanged from December (still at a two cut median)...

...but the dovish tails all shifted hawkishly...

- four for 1 cut now (up from just 1 in Dec)

- four for 2 cuts (up from 3 in Dec)

- nine for 3 cuts now (down from 10 in Dec)

- only two for 4 cuts (down from 3 in Dec)

- and none of the FOMC members see 5 cuts in 2025 (down from 1 in Dec)

And finally, the QT Taper is on...

- *FED TO SLOW BALANCE-SHEET RUNOFF STARTING APRIL 1

Notably Fed's Waller dissents because while he supported no change for the federal funds target range but preferred to continue the current pace of decline in securities holdings.

Read the full redline of the FOMC statement below:

More By This Author:

Stellar 20Y Auction Stops Through, Highest Bid To Cover In Almost A YearKey Events This Week: Fed, BOJ, BOE And Economic Updates Galore

Poor 30Y Auction Tails As Foreign Buyers Flee

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more