Fed Hike Expected Despite Ongoing Risks For Regional Banks

Raising interest rates always comes with risk for the economy, but the stakes are higher than usual at a time when banking turmoil appears to be reviving. Nonetheless, markets are expecting that the central bank will again lift rates at today’s policy meeting.

Fed funds futures this morning are pricing in a 90% probability for another ¼-point hike, based on CME data. If correct, the Fed Funds target rate will increase to a 5.0%-to-5.25% range, the highest since 2007.

There’s also chatter circulating about the wisdom that today’s expected hike should be the last for this cycle. Former Fed Vice Chair Richard Clarida recommends exactly that. “I would be in the camp of signaling a pause,” he says.

The Treasury market’s implied forecast for the Fed funds rate is on board with the outlook. The 2-year Treasury yield, considered the most-sensitive maturity for rate expectations, continues to trade well below the Fed funds rate, a sign that the market expects that the policy rate has peaked and is headed lower in the near term. Treasuries made the same forecast a few months back, only to reverse the implied forecast in the face of more rate hikes. Will this time be different? The magnitude of the implied forecast (via the size of the spread) suggests as much.

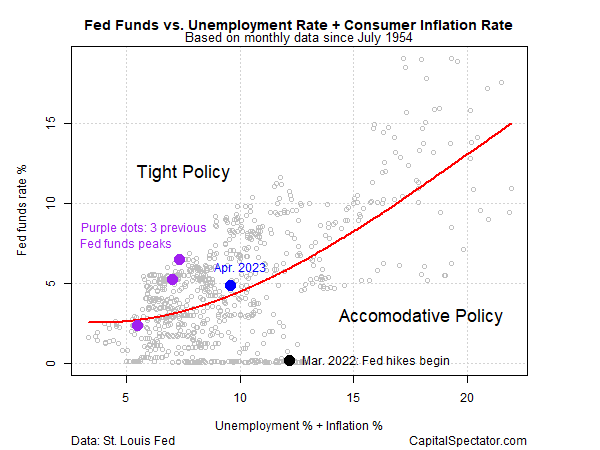

Fed policy is already modestly tight, based on a simple model that compares the target rate with unemployment and inflation.

Meanwhile, rate hikes in the current environment are relatively precarious, in part due to ongoing banking turbulence. Despite the rescue of First Republic Bank this week, regional bank stocks fell sharply yesterday, based on SPDR S&P Regional Banking ETF (KRE).

Some of the decline is due to beta risk – stocks overall tumbled yesterday. But some analysts advise that the banking crisis that started in March with the collapse of Silicon Valley Bank isn’t over. The latest haircut in regional bank shares suggests the market agrees.

The notion of raising rates when bank risk may be rising again inspires former Federal Reserve Bank of Dallas President Robert Kaplan to put rate hikes on pause. “I’d prefer to do what’s called the hawkish pause, not raise but signal that we are in a tightening stance, because I actually think the banking situation may well be more serious than we currently understand.”

Will the Fed agree and surprise markets with a pause? If not, what’s the rationale for continuing to hike at a time when the banking sector is looking wobbly again? Is inflation still a bigger risk for the Fed? Tune if for the answer, and explanation, starting at 2:00pm eastern, followed by Jerome Powell’s press conference.

More By This Author:

Total Return Forecasts: Major Asset Classes

Macro Briefing For Monday, May 1

Major Asset Classes: April 2023 Performance Review

Disclosure: None.