Fed Funds Futures Pricing In A Pause In Rate Hikes For 2019

The Federal Reserve’s recent run of raising interest rates is expected to hit a wall in 2019, according to Fed funds futures. After four rate hikes in 2018 and nine since the current cycle of tightening began in 2015, the crowd is currently anticipating that policy will remain on hold for the rest of the year, according to CME data.

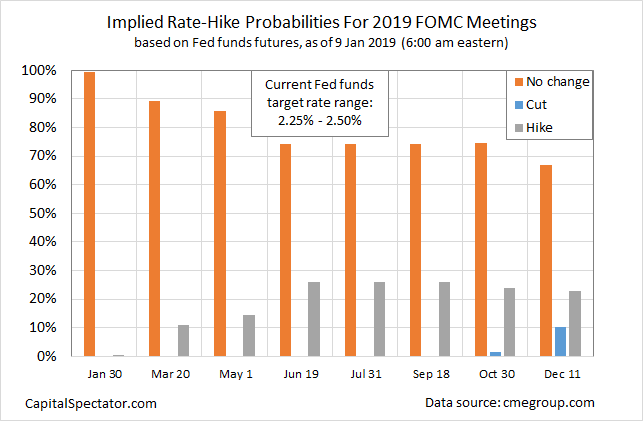

The Fed funds futures market this morning is pricing no change for the target rate – currently set at a 2.25%-to-2.50% range – for the remainder of 2019. The implied probability for keeping the target rate steady at the Jan. 30 policy meeting is currently 99.5%. The probability for no change slides in the months ahead, but even by the Dec. 11 Federal Open Market Committee (FOMC) meeting the crowd is estimating a 67% probability that the Fed will continue to maintain the current target rate.

Predicting monetary policy is prone to error, of course, but it’s striking that the market’s outlook is consistent for anticipating no change in the Fed funds rate for the rest of the year. The obvious caveats apply, of course, starting with the possibility that incoming economic data could change the market’s expectations. But for now, the view that the Fed’s tightening is on pause until further notice dominates market sentiment.

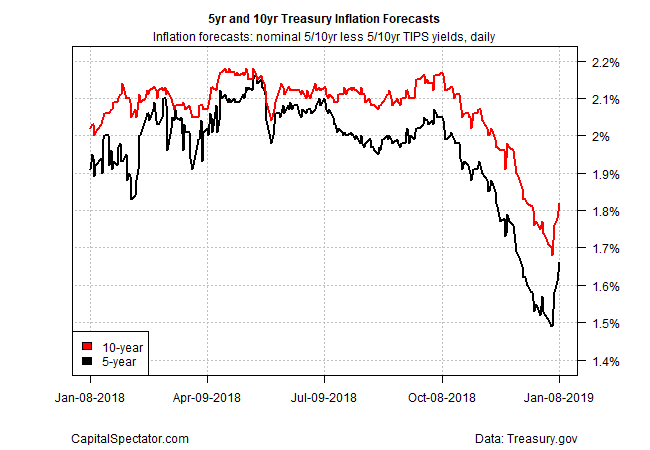

Support for a no-change forecast can be found in other markets. One example: the implied inflation forecast via the spread on nominal Treasury yields less the inflation-indexed counterparts. For instance, consider the 5-year Treasury maturities: the market’s estimate of future inflation has fallen sharply in recent months, easing to less than 1.7% as of yesterday’s close (Jan. 8) from more than 2.0% in October.

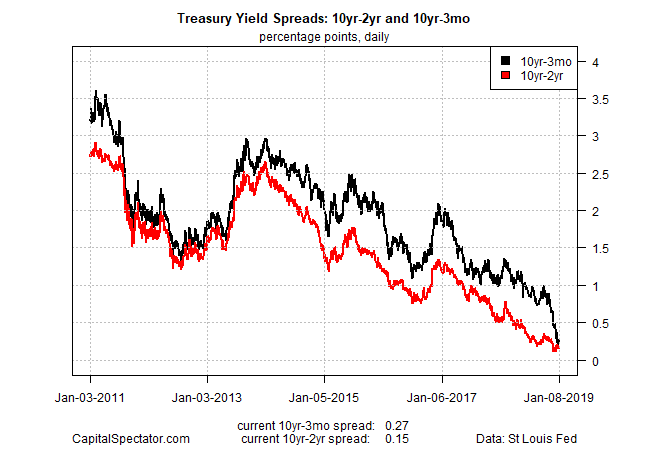

Meanwhile, the Treasury yield spread has narrowed dramatically, which also implies that the odds are lower for additional rate hikes. The 10-year/2-year spread as well as the 10-year/3-month spread are just slightly above zero, reflecting a sharp slide over the past year.

A set of moving averages for key Treasury rates also hint at the possibility that the recent jump in yields has peaked for the near term. For instance, the 50-day exponential moving average for the 10-year rate has fallen in recent weeks, dipping below its 100-day and 200-day counterparts.

Some Fed officials are now talking down the case for rate hikes. In an interview with The Wall Street Journal published today, St. Louis Fed President James Bullard (a voting member of the FOMC) says: “We’ve got a good level of the policy rate today” and so there’s no pressing case for additional hikes. The central bank, he warns, is “bordering on going too far and possibly tipping the economy into recession” if rates continue to rise — a warning that finds support in the low yield spread of late.

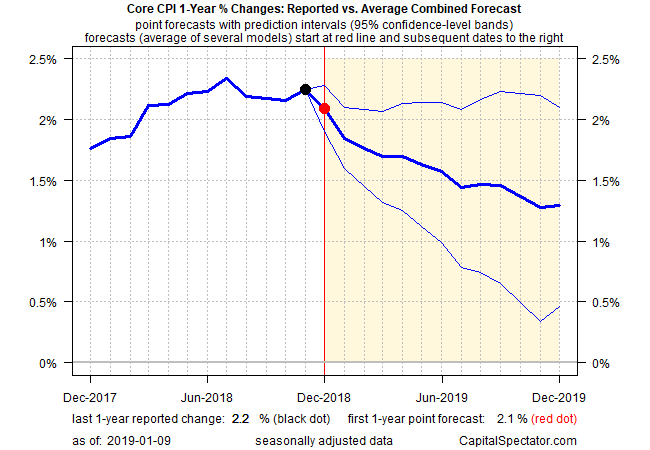

A key variable that supports the case for pausing on more rate hikes: soft inflation. The core rate of the Consumer Price Index (CPI) ticked up to a 2.2% annual rate in November (based on seasonally adjusted data). That’s modestly above the Fed’s 2.0% inflation target. But the year-over-year core CPI rate is expected to slip in the months ahead, based on The Capital Spectator’s average forecast via nine models. That’s another clue for thinking that the Fed can pause on rate hikes for the foreseeable future.

Ditto for monitoring GDP growth. A number of forecasting models continue to anticipate that output for last year’s fourth quarter will slip. The Atlanta Fed’s GDPNow model, for instance, is currently projecting that last year’s growth will ease to 2.8% (as of Jan. 8), marking the second straight quarterly deceleration.

“The Federal Reserve has positioned itself to sharply slow the pace of rate hikes this year,” advises Tim Duy, a veteran Fed analyst who’s an economics professor at the University of Oregon.

The Fed will choose recession over inflation, but as long as inflation looks to hold sustainably near the Fed’s target, there will be a “Powell put” on the economy. That’s something to remember when wrestling with the recession calls that have grown louder in recent months. If you aren’t recognizing that absent inflation the Fed has the ability and willingness to cushion the economy against shocks that could threaten to send growth sharply lower than expected, you are doing it wrong.

Bottom Line: Low inflation means the Fed can move patiently. They don’t feel compelled to maintain the pace of quarterly rate hikes. Still, that doesn’t mean they won’t. My baseline expectation is that the data flow remains sufficiently soft and economic uncertainty sufficiently high to keep the Fed on the sidelines until at least mid-year.

Disclosure: None.