Fed 'Dovish Pivot' Sparks Panic-Bid In Bonds, Stocks, & Gold

Image source: Wikipedia

Between the 'dovish' dots and the optimistic inflationary comments (and SEP), The Fed delivered more than the doves could have hoped...

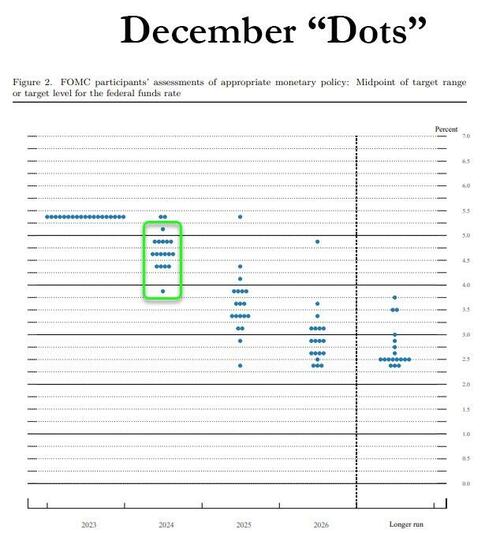

Looking at the distribution of 2024 dots:

- 2 no cuts (4 in Sept)

- 1 one cut (4 in Sept)

- 5 two cuts (4 in Sept)

- 6 three cuts (3 in Sept)

- 4 four cuts (2 in Sept)

- 1 six cuts (0 in Sept)

This is the most confused "year ahead" FOMC we have seen in years

Stocks soared...

The dollar tanked...

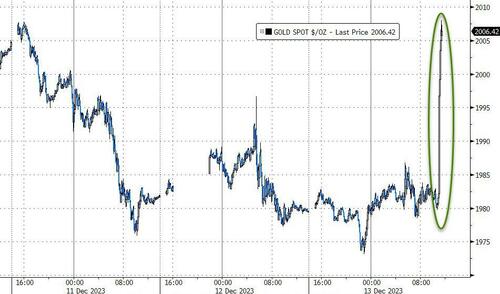

Gold ripped higher, back above $2000...

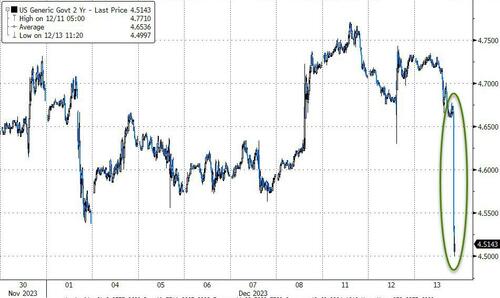

And Treasury yields are crashing lower with 2Y yields down over 23bps now...

...to its lowest since early June...

Finally, as the Fed continues to push towards where the market was, the market pushes further away, now pricing in 135bps of rate-cuts for 20124...

Source: Bloomberg

Here's what's odd:

-

In Sept, Fed saw 2 cuts in 2024, 5 cuts in 2025

-

Now, Fed sees 3 cuts in 2024, 4 cuts in 2025

So, is The Fed frontloading (in an election year) at the expense of 2025?

Now, will Powell crush this?

More By This Author:

Core Producer Price Inflation Tumbles To 2.0% - Near 3 Year LowsMcLayoffs Incoming: McDonalds Embracing Google's AI For Online Ordering

IBM Slapped With Federal Civil Rights Complaint After Racist CEO's "Obviously Illegal" Hiring Practices Leak

Disclosure: None