Fed Cuts 25bps, Ends QT As Expected; Two FOMC Officials Dissent

Image source: Wikipedia

First, a quick preview of how we got here:

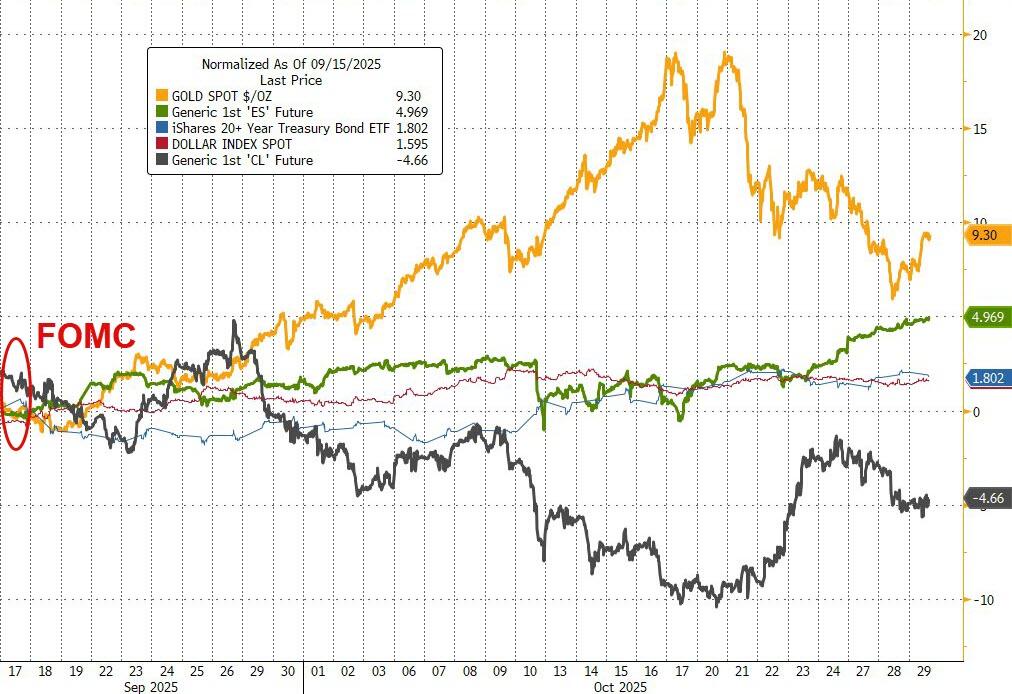

Since the last FOMC meeting (on Sept 17th), Gold has dramatically outperformed across asset-classes (even with its recent plunge) followed by US equities. Oil prices have tumbled the most while the dollar and bonds have risen in value. Bitcoin is basically unchanged since the last FOMC meeting, having collapsed after reaching record highs intramonth...

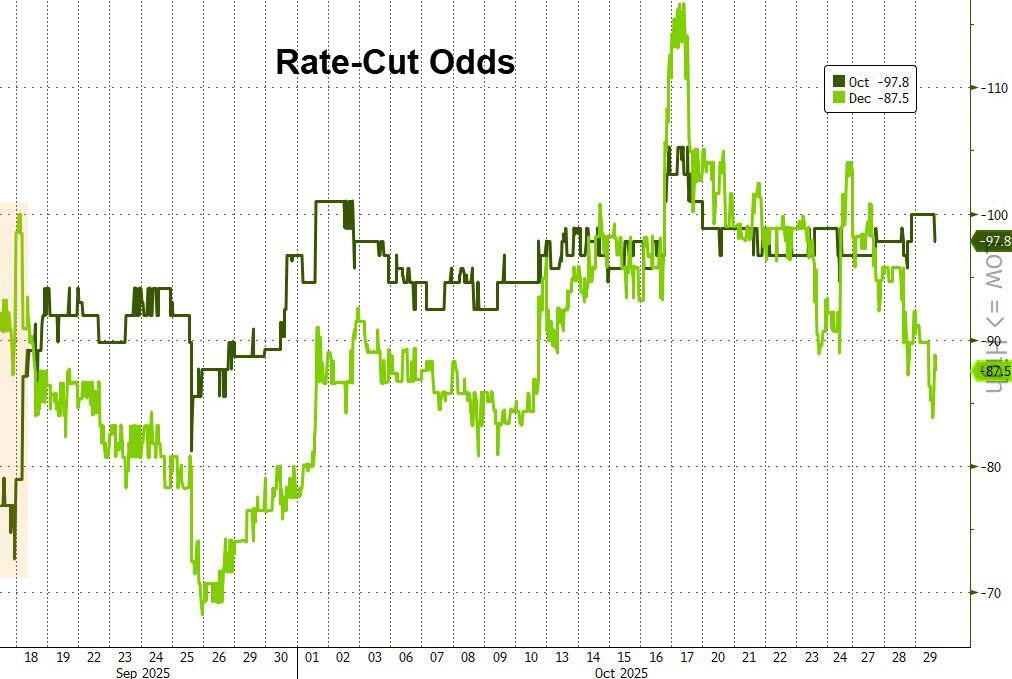

The market has grown more dovish since the last Fed meeting, now fully pricing in a 25bps cut today (and is almost certain that December will see another 25bps cut)...

More notably, rate-cut expectations have barely changed since the last FOMC with 46bps of cuts priced in for 2025 and 69bps more priced in for 2026...

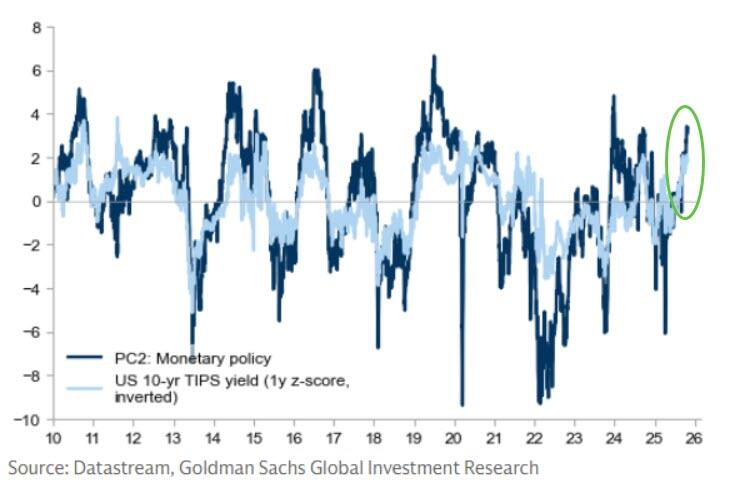

Finally, before we get to the meat and potatoes of today's statement, we note that Goldman Sachs models show monetary policy at its most dovish in years...

And bear in mind that financial conditions have never been 'easier'...

So as we detailed in the FOMC preview, the two main questions for traders today is:

1) will the statement/presser provide support for the market's current dovish future take (given the market's anticipation of a 25bps cut, Goldman notes that it would likely be a high bar for the FOMC to change its plan on the basis of alternative data, and in any case the data have not given them any reason to), and,

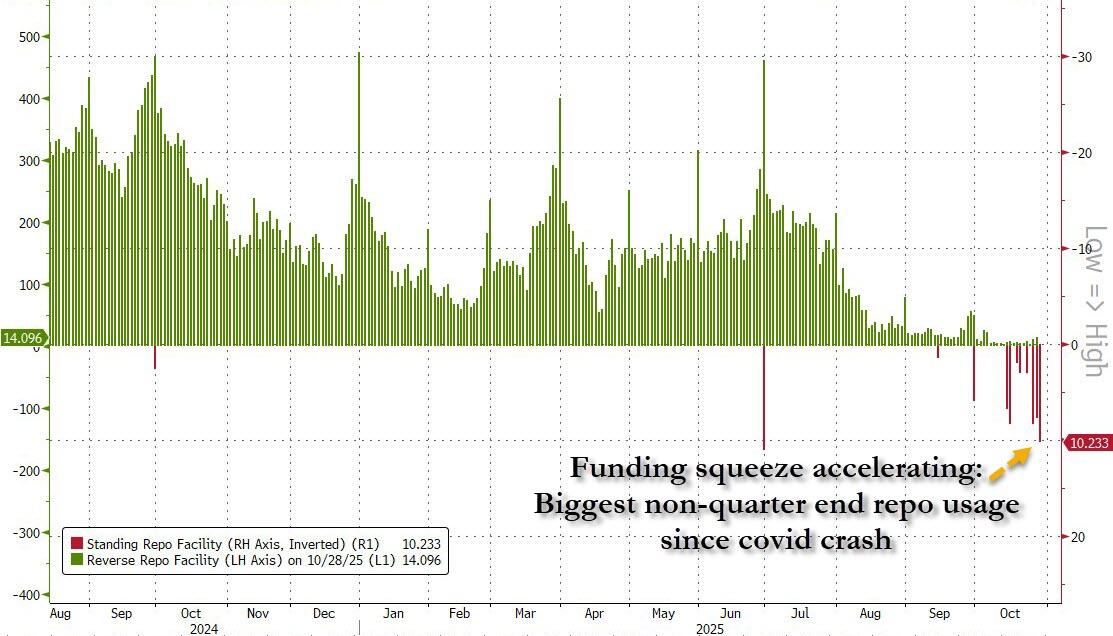

2) will Powell officially announce the end of QT, as we discussed extensively in recent weeks (here and here), as a result of deteriorating conditions in money markets, the Fed is expected to announce changes to its balance sheet program. Fed Chair Powell suggested that the level of reserves will likely hit an ample level within a couple of months, although as we highlighted, the combination of reserves and reverse repos is now the lowest it has been since 2020 resulting in a creeping increase in the SOFR rate.

Meanwhile, usage of the Fedʼs repo facility has picked up, suggesting that some participants may be growing tighter on cash.

With that in mind, here are the key headlines from the FOMC Statement:

- The FOMC cut the federal funds rate target range by 25 bps to 3.75%-4.00%, as expected.

- The vote was 10-2, with two opposing dissenters (see below).

- The Fed announced that QT (aka the run-off of Treasury securities from the Fed’s balance sheet currently capped at $5 billion per month) would conclude on December 1, as also became consensus in recent days as a result of turmoil in funding markets.

- There were twp dissenting votes, one from Fed Governor Stephen Miran in favor of a 50-bps cut, and one from Jeffrey Schmid, who voted for no rate cut.

-

The Fed statement maintains description of the labor market, noting that “job gains have slowed, and the unemployment rate has edged up but remained low through August,” adding “more recent indicators are consistent with these developments” and “downside risks to employment rose in recent months”

Here is a statement redline...

... where the key highlights are the following:

- Replacing that economic activity has "moderated" with "expanding at a moderate pace", which is actually a bullish revision.

- Noting that while job gains have slowed "this year", the unemployment rate has edged up but "remained" low and added that "through August, more recent indicators are consistent with these developments."

- On inflation, the Fed added that inflation has moved up "since earlier this year" and remains somewhat elevated.

- On QT, the Fed said that the Committee "decided to conclude the reduction of its aggregate securities holdings on December 1", which is a bit later than some had expected, as November had emerged as the target month for QT ending.

In its implementation note, the Fed clarified the details of how QT will end:

"Effective October 30, 2025, the Federal Open Market Committee directs the Desk to:

- Undertake open market operations as necessary to maintain the federal funds rate in a target range of 3-3/4 to 4 percent.

- Conduct standing overnight repurchase agreement operations with a minimum bid rate of 4.0 percent and with an aggregate operation limit of $500 billion.

- Conduct standing overnight reverse repurchase agreement operations at an offering rate of 3.75 percent and with a per-counterparty limit of $160 billion per day.

- Roll over at auction the amount of principal payments from the Federal Reserve's holdings of Treasury securities maturing in October and November that exceeds a cap of $5 billion per month. Redeem Treasury coupon securities up to this monthly cap and Treasury bills to the extent that coupon principal payments are less than the monthly cap. Beginning on December 1, roll over at auction all principal payments from the Federal Reserve's holdings of Treasury securities.

- Reinvest the amount of principal payments from the Federal Reserve's holdings of agency debt and agency mortgage-backed securities (MBS) received in October and November that exceeds a cap of $35 billion per month into Treasury securities to roughly match the maturity composition of Treasury securities outstanding. Beginning on December 1, reinvest all principal payments from the Federal Reserve's holdings of agency securities into Treasury bills.

- Allow modest deviations from stated amounts for reinvestments, if needed for operational reasons."

Commenting on the statement, BBG rates strategist Ira Jersey was surprised by the “hawkish” dissent and adds that it "may change our opinion about the pace of cuts going forward, but there’s still little in the data to make us shift our opinion about the shape of the yield curve. There’s little in the statement or with the end of QT that’s likely to change the shape of the yield curve."

Jersey continues: “The timing of the decision was a coin flip, and the committee erred on the side of caution. Runoff will continue in November, before the Fed enters ‘net neutral’ on December 1. MBS runoff will continue at current pace and be used to fund T-bill purchases, while Coupon Treasury runoff will be reinvested in full at auction.”

Schmid's dissent prompted more questions, including this one from Renaissance macro's Neil Dutta: "I don’t think it really matters. In a divided Fed the best you can do is string a bunch of 25s out. But, Schmid’s dissent looks more perplexing than Miran’s in my view. After all, Schmid supported a 25bper in September and since then, we have seen inflation come in weaker than expected."

All we can say is Schmid better not have any outstanding mortgages.

Tradestation strategy head David Russell points to the lack of data as a catalyst, but points out the growing dovish sentiment within the Fed which will only get stronger once Trump replaces Powell: "The Fed is grasping in the dark because of the shutdown, but the rate-cutting trend remains in place. Miran’s aggressive dissent is a reminder that change is coming at the Fed and the new chairman is likely to be more dovish. The shutdown threatens to weigh on both jobs and consumption, so the bias toward easier policy may increase going forward."

KPMG chief economist Diane Swonk told BBG TV that “we are going to see a lot of tension going forward because this is a really difficult time. One, we’re flying blind. Two, we’ve got inflation is up and unemployment is edging up as well, and the labor market is slowing. You add all of that together and you get this sort of stagflation width, which is what makes this Fed likely to have more dissents that go in both directions going forward.”

Meanwhile, former Fed vice-chair who currently works at Pimco Richard Clarida, noted that he expects "to see more of this in the remainder of Powell’s term for sure. If you just looked at the dots, you have a pretty divided committee in terms of the case for preemptive cuts from here, with inflation at 3%."

Peter Boockvar at the Boock report goes one further and writes that while there was no real surprise, "the Schmid dissent makes me more confident that Jay Powell is going to push back on a December cut being the lay up the markets think it is."

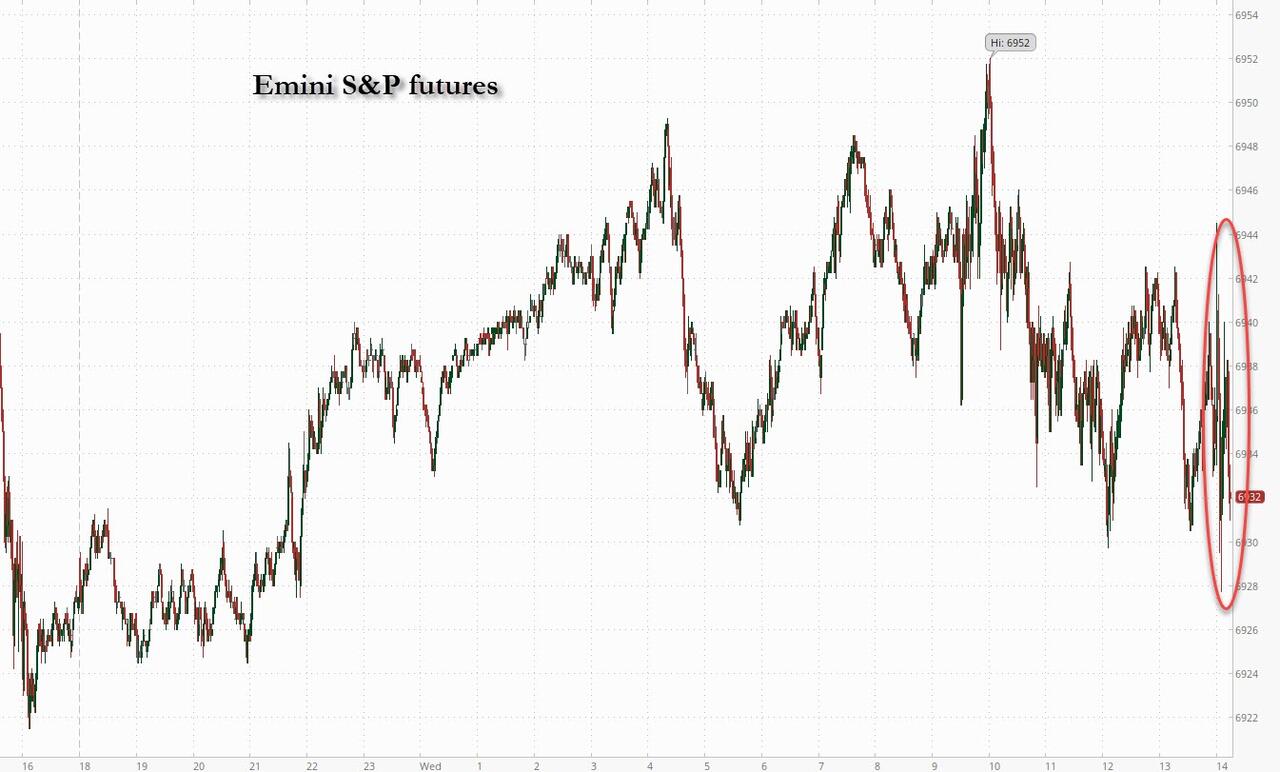

And while Schmid dissent was a bit of a surprise, the bulk of the statement was largely in line with expectations, and as a result stocks have barely budged...

.. while 10Y yields and the dollar are fractionally higher ahead of Powell's presser which begins at 2:30pm.

More By This Author:

Bank Of Canada Cuts 25bps As Expected, Cites Weak Growth

Google Deal With NextEra Will Restart Iowa Nuclear Plant In 2029

Retail & Central Bank 'Dip-Buyers' Emerge As Gold Drops Below $4000

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more