Fed, BoJ And U.S.-China Talks To Shape USD/JPY Direction

Image Source: Pixabay

- USD/JPY in focus amid Japan’s fiscal optimism but vulnerable to Fed dovishness

- Fed, BoJ, ECB, and BoC rate decisions dominate the week

- Renewed dialogue between US-China lifts sentiment, but the dollar may stay fragile

Risk appetite remained firm heading into a busy 48 hour period for markets, where major central banks decide on interest rates, technology companies will report their quarterly results, and more to the point, Trump will meet Xi Jinping in a meeting expected to last three hours. Ahead of the Trump-Xi summit, warm words were shared by Trump who said that things will work out very well with the Chinese premier, adding that he plans to ease tariffs on Chinese goods tied to fentanyl dispute. Meanwhile Trump also said he will talk about Nvidia’s Blackwell AI chips, sending the company’s shares 5% higher in pre-market and lifting futures on the Nasdaq 100 and S&P 500 to new record levels. In FX space, the yen was weakening amid ongoing risk-on sentiment across financial markets. The USD/JPY’s direction could become clearer this week, with the Federal Reserve and Bank of Japan rate decisions to come in the next couple of days.

Japan’s fiscal expansion vs. monetary tightening

Despite the dollar’s weakness this year against most other major currencies, the USD/JPY currency pair has held its own well until now. This is partly because of the ongoing risk rally keeping demand for the low yielding JPY downbeat, with traders using the currency as a carry trade. Shorting the dollar meanwhile is expensive as the overnight financing costs can be significant given that US interest rates are among the highest in the world.But back to Japan, here there is increased hopes that Japan’s new government will embark on an aggressive fiscal expansion. While this could boost economic growth significantly, there is a risk it could further increase the government’s debt and raise the nation’s debt-to-GDP ratio even higher than what it is right now, should growth not materialise as much as expected.

But if the fiscal expansion does lead to sustainable GDP growth, then this will be increasing the pressure on the Bank of Japan to respond by tightening policy. But they could be forced to act sooner than expected if inflation doesn’t go down fast. Traders will be looking for clues about the near-term path of policy at Thursday’s policy meeting, with many analysts anticipating a rate hike to come in December.

What about the Fed?

Across the Pacific, the Federal Reserve is widely tipped to cut rates again tomorrow. Should Chair Jerome Powell sound more dovish than markets expect, the US dollar index could find itself under renewed downward pressure.

Attention will also be on Thursday’s meeting between Presidents Trump and Xi, where investors hope some progress will be made in the trade talks. Any further delays or scaling-back of tariff measures would likely provide a further boost to sentiment.

However, even if the Trump–Xi summit brings a positive surprise, it may not be enough to offset the dollar’s broader drift lower. The Fed, ECB, BoJ, and BoC all meet this week, with the Fed expected to trim rates by 25 basis points. Dollar positioning is less one-sided than earlier in the year, which could limit any outsized reaction to dovish rhetoric. Recent soft CPI data has already reduced the chances of a hawkish surprise.

That means the USD/JPY could potentially move back below 150.00, especially if the BoJ springs a hawkish surprise or signals a steeper path to normalisation than expected.

Meanwhile, Japanese policymakers will be watching the yen closely, and history shows they’re not shy about intervening. Should USD/JPY surge towards the 155–160 region, Tokyo could step in to support the yen once more. Until then, the USD/JPY trend is likely to stay rangebound, awaiting direction from the Fed–BoJ policy mix and the Trump–Xi headlines that could set the tone for weeks to come.

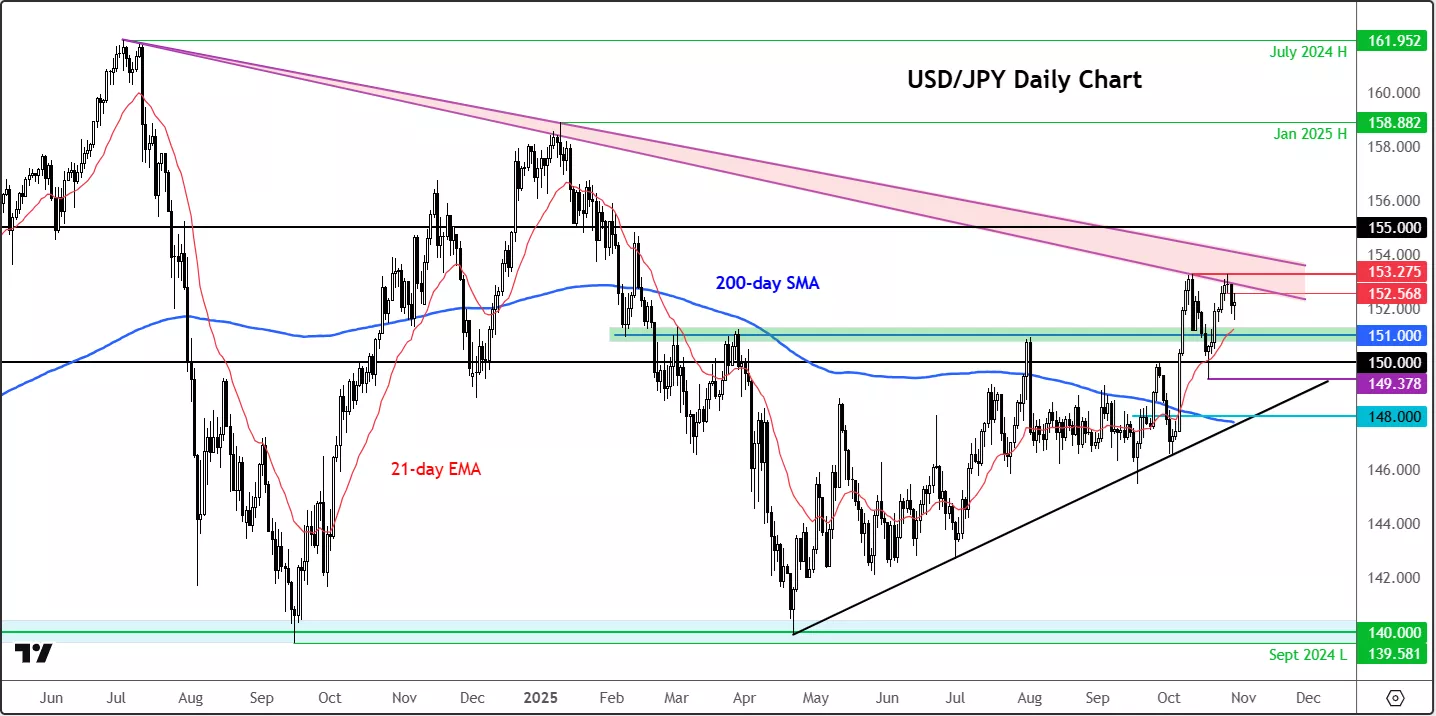

USD/JPY technical analysis and key levels to watch

(Click on image to enlarge)

From a technical standpoint, USD/JPY still carries a mild bullish bias, even as broader dollar sentiment weakens. Resistance around 153.20–153.30 has capped recent upside moves. Here, a bearish trend line comes into play and a potential double top could form. But a potential break above could open the door to 155.00. On the downside, initial support sits at 150.90-151.20, and then the 150.00 mark as a major level. Bearish below it.

More By This Author:

Gold Eases As Risk Appetite Improves On U.S.-China TalksS&P 500 Remains On The Front Foot

GBP/USD Hit By Soft UK Data Ahead Of US CPI And FOMC Next Week