Fed: A Psychological Battle Held Against Investors

Even if the Fed’s taper doesn’t come until 2023, the threat itself will have a material psychological effect. Will we keep a clear head in September?

The Worst Kept Secret

While investors worried that the European Central Bank (ECB) would turn hawkish as the summer months heat up, I warned on Apr. 27 that the prospect was quite laughable.

I wrote:

There seems to be some confusion about the European Central Bank’s (ECB) – and other major central banks’ – suspension of their 84-day U.S. dollar liquidity operations. For context, the swap facility was created to ensure that U.S. dollars remained abundant during the coronavirus crisis. However, keep in mind that “an important liquidity backstop to ease strains in global funding markets,” is code for avoiding a large spike in the U.S. dollar. The bottom line? The suspension of the facility is not bearish for the greenback, if anything, it’s bullish because it reduces the available supply of U.S. dollars.

If that wasn’t enough, recent whispers of the ECB tapering its bond-buying program are extremely premature. With the European economy still drastically underperforming the U.S., it’s actually more likely that the ECB increases the pace of its bond-buying program.

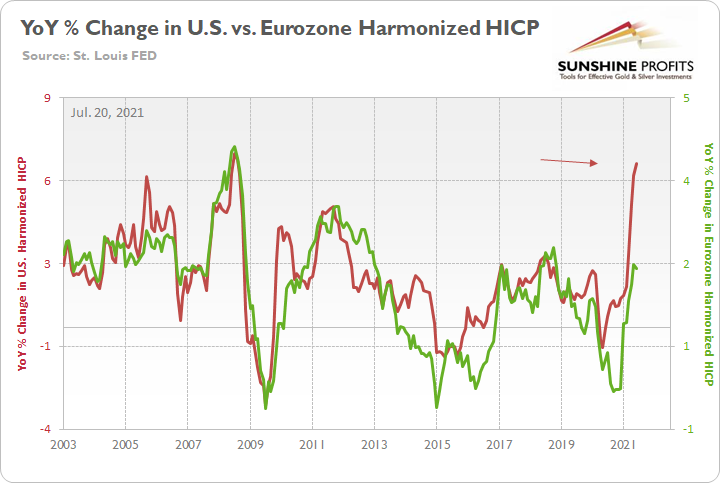

The U.S. Federal Reserve (Fed) and the ECB are worlds apart. With the Fed likely to reveal its taper timeline in September, inflation differentials highlight the regional dichotomy.

Please see below:

To explain, the green line above tracks the year-over-year (YoY) percentage change in the Eurozone Harmonized Index of Consumer Prices (HICP), while the red line above tracks the YoY percentage change in the U.S. HICP. If you analyze the right side of the chart, it’s not even close. And with the U.S. HICP rising by 6.41% YoY in June and the Eurozone HICP rising by 1.90%, the Fed is likely to taper well in advance of the ECB.

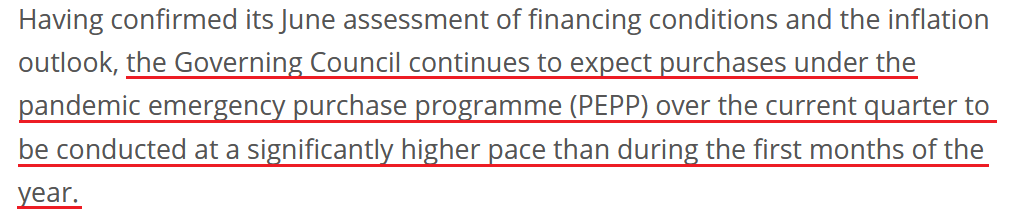

And with the ECB releasing its monetary policy decision on Jul. 22, the Governing Council “revised its forward guidance on interest rates” (spoiler alert, lower for longer) and it doubled down on its “commitment to maintain a persistently accommodative monetary policy stance to meet its inflation target.”

Please see below:

Source: ECB

On top of that:

“The Governing Council also intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favorable liquidity conditions and an ample degree of monetary accommodation.”

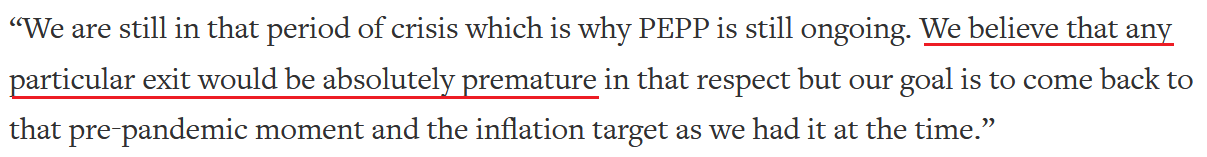

Furthermore, ECB President Christine Lagarde removed any doubt during her press conference on Jul. 22:

Source: Reuters

She added:

“The forward guidance rests on three key criteria’s if you will:

We see inflation reaching 2% well ahead of the end of our projection or rising, that’s like number one and number two, durably for the rest of the projection horizon. And thirdly, we judge that realized progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at 2% over the medium term …. So, by these three legs, we’re essentially saying, first of all, that we want to see inflation reach 3% well ahead of the end of our projection horizon.”

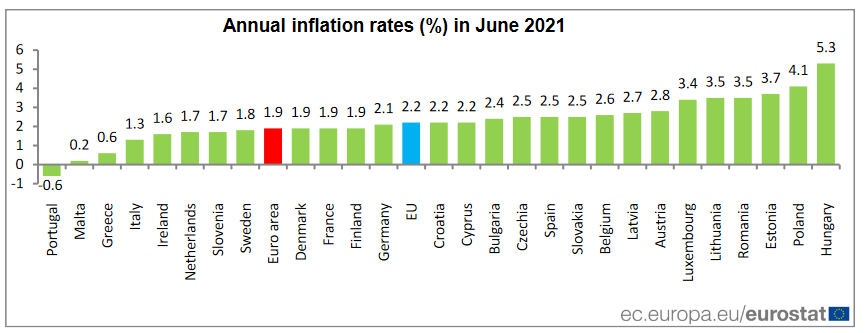

And why is this quote so important? Well, because Euro area inflation (released on Jul. 16) rose by 1.90% year-over-year (YoY) in June. And if the ECB wants inflation to reach 3% well before it turns hawkish, any talk of a forthcoming taper is much more semblance than substance.

The bottom line? With the U.S. Consumer Price Index (CPI) surging by 5.32% YoY in June and tracking well ahead of the Eurozone, again, the Fed and the ECB are worlds apart.

Kansas City Fed Has Something to Say

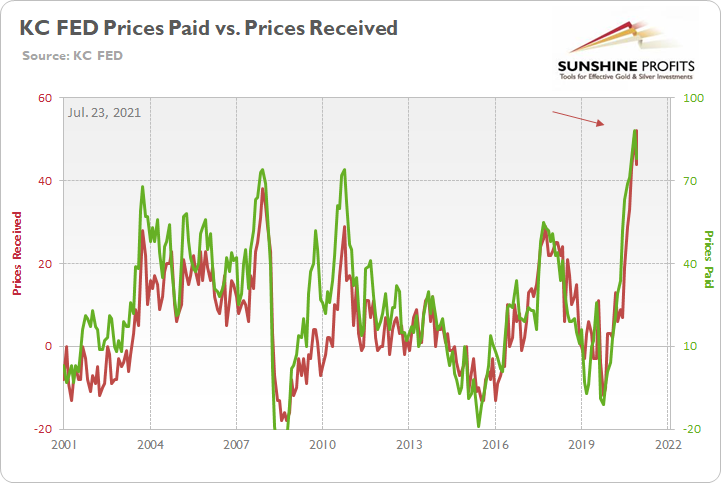

Speaking of inflation, the Kansas City Fed released its Tenth District Manufacturing Survey on Jul. 22. And with its prices paid index remaining “near record highs” and its prices received index hitting an all-time high, inflationary momentum in the U.S. remains robust.

Please see below:

To explain, the green line above tracks the KC Fed’s prices paid index, while the red line above tracks the KC Fed’s prices received index. If you analyze the right side of the chart, you can see that both remain extremely elevated.

What’s more, while the “month-over-month composite index was 30 in July, up from 27 in June and 26 in May … indexes for shipments, new orders, order backlog, and new orders for exports rose at a faster pace in July, and supplier delivery time increased.” Moreover, while the “future composite index edged down from the record high 37 in June to 33 in July, [it’s] still indicating solid expectations over the next six months.”

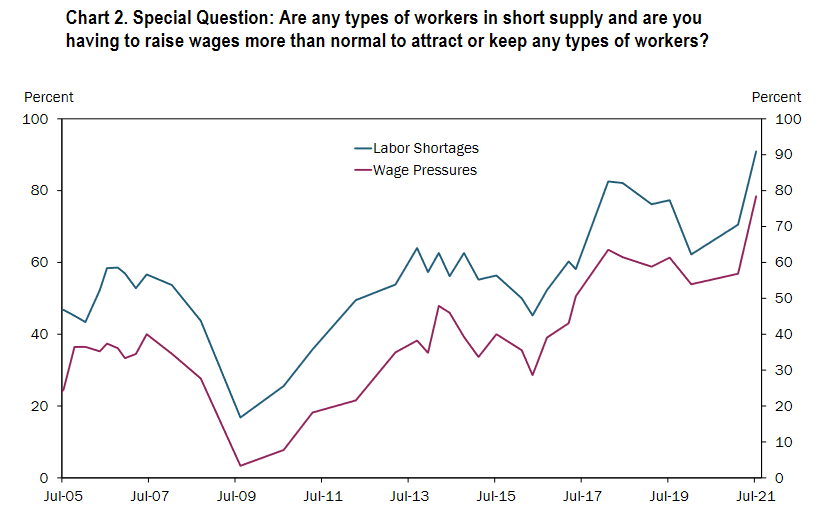

On top of that, “91% of firms reported workers were in short supply, more than any time previously asked in survey history. Wage pressures also surpassed survey records as 78% of firms reported having to raise wages more than normal to attract or keep workers. To attract new talent, 72% of manufacturers reported raising compensation, 60% reported hiring less qualified workers with more on the job training, and another 60% increased advertising for open positions.”

Please see below:

Source: KC Fed

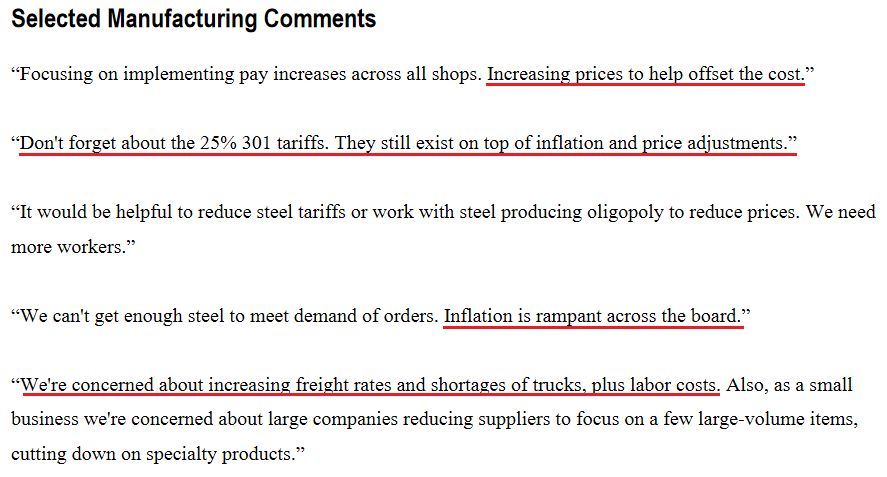

For anecdotal evidence, please have a look at respondents’ opinions about the current economic climate:

Source: KC Fed

Who’s Talking About Inflation? Harley-Davidson?

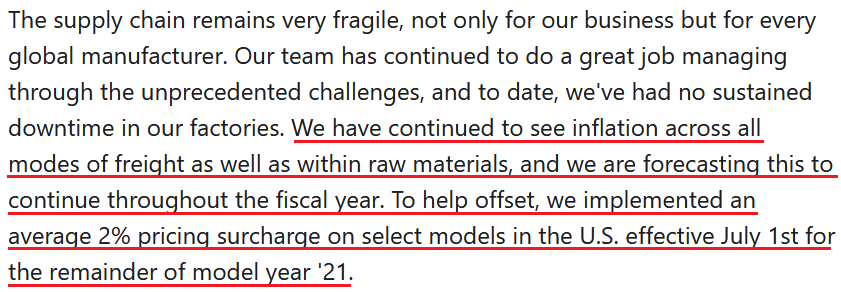

Finally, Harley-Davidson – an American motorcycle manufacturer – is also sounding the alarm on inflation. During its second-quarter earnings call on Jul. 21, CFO Gina Goetter said the following:

“In terms of impact within the quarter and as you think about the margin change, the raw material increase was worth about two points of margin. So it was fairly material. And then you add on top of that all the logistics rate inflation that we're seeing that was roughly another three points of margin. So, those headwinds that are coming at us are roughly five points of margin within the quarter.”

And how is the company responding to the inflationary pressures?

Source: Harley-Davidson/The Motley Fool

The bottom line? With inflation surging and the Fed likely to announce its taper timeline in September, the time-tested relationship of ‘U.S. dollar up, PMs down’ will likely be a major storyline during the Autumn months.

In conclusion, the gold miners continued underperformance of gold is an ominous sign for the PMs’ medium-term outlook. With the former unable to gain any traction even while the U.S. 10-Year real yield languishes, the threat of a Fed taper is having a material psychological effect on investors. Moreover, with the ECB turning dovish at a time when the Fed is turning hawkish, the EUR/USD’s plight has helped uplift the USD Index (the currency pair accounts for nearly 58% of the USD Index’s movement). As a result, while the PMs’ long-term outlook remains bright, a rising U.S. dollar will likely dampen their performance over the next few months.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

It seems that the "transitional" inflation has transitioned and continued inflating.Only a slobbering fool or an enemy agent will think that this is good. There is this seriousproblem now and no way to slow it even if they wanted to.