February 2014 Industrial Production Improves

The headlines say seasonally adjusted Industrial Production (IP) improved in February. Econintersect‘s analysis using the unadjusted data concurs – but adds that the downward revision of the previous months makes this data set less good than what appears at first glance.

- Headline seasonally adjusted Industrial Production (IP) increased 0.6% month-over-month and up 2.8% year-over-year.

- Econintersect‘s analysis using the unadjusted data is that IP growthaccelerated 0.1% month-over-month, and is up 3.2% year-over-year.

- The year-over-year rate of growth has accelerated slightly 0.1% from last month using a three month rolling average. The data has settled down in a tight growth range.

- Industrial production is being affected by large movements in utilities. This is distorting the underlying trends.

- The market was expecting 0.0% to 0.5% month-over-month (consensus 0.3%) versus the headline increase of 0.6%%.

- The seasonally adjusted manufacturing sub-index (which is more representative of economic activity) was up 0.8% month-over-month – and up 1.5% year-over-year .

- Backward revision was moderate and down for the previous 3 months - making is analysis worse than what it would be at first glance.

- Combine that the month-over-month data is comparing a moderately revised downward December data, and the manufacturing portion had a significant decline – makes this report much worse than appears at first glance.

IP headline index has three parts – manufacturing, mining and utilities – manufacturing was up 0.8% this month (up 1.5% year-over-year), mining up 0.3% (up 6.1% year-over-year), and utilities were down 0.2% (up 8.3% year-over-year). Note that utilities are 9.9% of the industrial production index.

Comparing Seasonally Adjusted Year-over-Year Change of the Industrial Production Index (blue line) with Components Manufacturing (red line), Utilities (green line), and Mining (orange line)

Unadjusted Industrial Production year-over-year growth for the past 12 months has been between 2% and 4% – it is currently 3.7%. It is interesting that the unadjusted data is giving a smooth trend line.

Year-over-Year Change Total Industrial Production – Unadjusted (blue line) and the Unadjusted 3 month rolling average (red line)

/images/z ip3.PNG

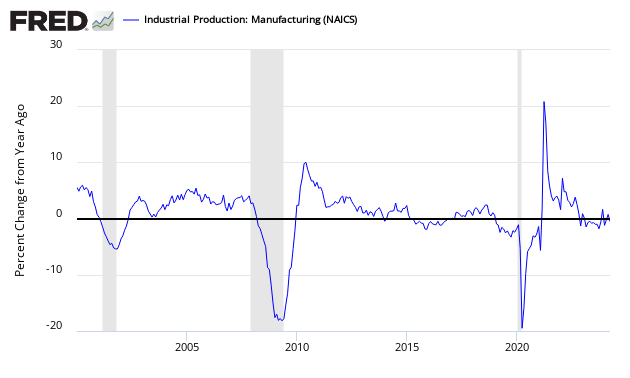

Economic downturns have been signaled by only watching the manufacturing portion of Industrial Production. Historically manufacturing year-over-year growth has been negative when a recession is imminent. This index is not indicating a recession is imminent.

Seasonally Adjusted Manufacturing Index of Industrial Production

Seasonally Adjusted Capacity Utilization – Year-over-Year Change – Seasonally Adjusted – Total Industry (blue line) and Manufacturing Only (red line)

Econintersect uses unadjusted data and graphs the data YoY in monthly groups. IP seems to have settled down to be somewhat predictable in the New Normal. It appears that industrial production has returned to pre-recession levels.

Total Industrial Production – Unadjusted

/images/z ip1.PNG

Industrial production growth is NOT recessionary, and that the industrial portion of the USA economy is doing better than many other elements. Keeping it real, here is a comparison between the survey predictions and the hard data. Industrial Production is the long blue bars.

Comparing Surveys to Hard Data

/images/z survey1.png

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Caveats in the Use of Industrial Production Index

Industrial Production is a non-monetary index – and therefore inflation or other monetary adjustments are not necessary. The monthly index values are normally revised many months after initial release and are subject to annual revision. The following graphic is an example of the variance between the original released value – and the current value of the index. Note that in general the current values are better than the original values – this is normally a sign of an improving economy.

Total Industrial Production – Unadjusted – Original Headline Index Value (blue line) and Current Index Value (red line)

/images/z ip2.PNG

This index is somewhat distorted by including utility production which is noisy, based primarily on weather variations. There is some variance between the manufacturing component of industrial production which monitors production, and the US Census reported Manufacturing Sales. While it is true that these are slightly different pulse points (inventory not accounted in shipments) – they should not have different trends for long periods of time.

Comparing Year-over-Year Change – Manufacturing Industrial Production (blue line) to Inflation Adjusted Manufacturers Shipments (green line)

Econintersect determines the month-over-month change by subtracting the current month’s year-over-year change from the previous month’s year-over-year change. This is the best of the bad options available to determine month-over-month trends – as the preferred methodology would be to use multi-year data (but New Normal effects and the Great Recession distort historical data).

None.