FANG Vs The Market

“Davidson” submits:

As you know, I do not invest in FANG type issues, the majority of which do not build long-term shareholder equity. Every market cycle has them. They are built on ‘the new, new thing’ mentality and are often infused with investors’ wild imaginations as to future growth prospects as in TSLA owning the EV market or FB capturing most of global advertising dollars. These perceptions never prove out as there are always competitors who force investors back to reality eventually.

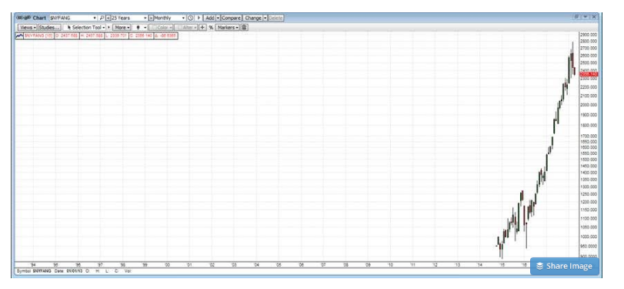

FANG issues are responsible for most of the current correction. Investors typically sell other issues a little lower as well. Seeking Alpha published a note on new FANG futures last fall. The chart of this group is below.

Economic activity continues to be strong. Once the FANG correction is over, I expect markets to rise to new highs.

Intercontinental Exchange (NYSE: ICE) announces the launch of the NYSE Fang+TM Index (NYFANG) with futures contracts available November 8.

The equally weighted index provides exposure to popular tech stocks centered on the FANG stocks: Facebook (FB), Apple (AAPL +1.1%), Netflix (NFLX -0.2%), and Alphabet’s Google (GOOGL +0.5%).

Other stocks included in the index launch: Alibaba (BABA -1.5%), Baidu (BIDU +0.8%), Nvidia (NVDA +1.3%), Tesla (TSLA -0.6%), and Twitter (TWTR -1.2%).

The combination of stocks in the index had a 28.44% annualized total return between September 19, 2014, and September 15, 2017. The Nasdaq 100 returned 14.89% in the same period and the S&P 500 returned 9.86%.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more