Exxon’s Darren Woods Gets A Biden-Era Dividend

Darren Woods has had a surprisingly good four years. On Wednesday, Exxon Mobil’s chief executive scored a victory at the oil driller’s annual meeting, and clinched re-election.

Weeks earlier he closed his takeover of rival Pioneer Natural Resources. And Exxon’s (XOM) valuation has soared as oil and gas exports hit a record. All of this under a U.S. president who pledged to fight climate change.

As Biden was taking office, Exxon was on shaky ground. The company’s stock price had plummeted more than 40% during Donald Trump’s presidency. Shareholders fretted over how Exxon would prosper in a world transitioning from dirty energy sources. In early 2021, little-known activist fund Engine No. 1 got three directors on Exxon’s board. Exxon also invited climate-activist investor Jeff Ubben to join Woods’ band of directors.

But it was hardly a turning point. Three years later, climate activists haven’t made peace with Exxon, but Woods has escalated his defense. He took one group to court to block a shareholder proposal. When that prompted pension giant Calpers to vote against the entire board, Woods came out on top. This week he easily won support from shareholders.

Investors are supportive most probably because the company is flourishing. While Exxon pumped about the same amount of fossil fuels last quarter as it did in the first quarter of 2021, earnings from those barrels have nearly doubled. The $60 billion deal to buy Pioneer could add another $15 billion of value from expected cost savings, by Breakingviews calculations. In one of the most unforgiving antitrust environments in recent years, Woods managed to give only one concession in that deal: that Pioneer’s founder wouldn’t be on his board.

Woods’ success owes something to his doggedness and efficiency drives, and much to the war in Ukraine, which has helped push oil prices up. But some White House policies may have moved the needle. Biden has approved far more permits for federal land drilling than Trump. He has also increased associated fees, but still, in some regards, that allows oil firms to ramp up oil drilling into a tight market. Some tax credits buried within the Inflation Reduction Act benefit fossil fuel companies. And measures meant to discourage use of Chinese parts in electric vehicles have slowed that whole industry – happily for oil producers who stand to lose from the rise of cleaner-fueled cars.

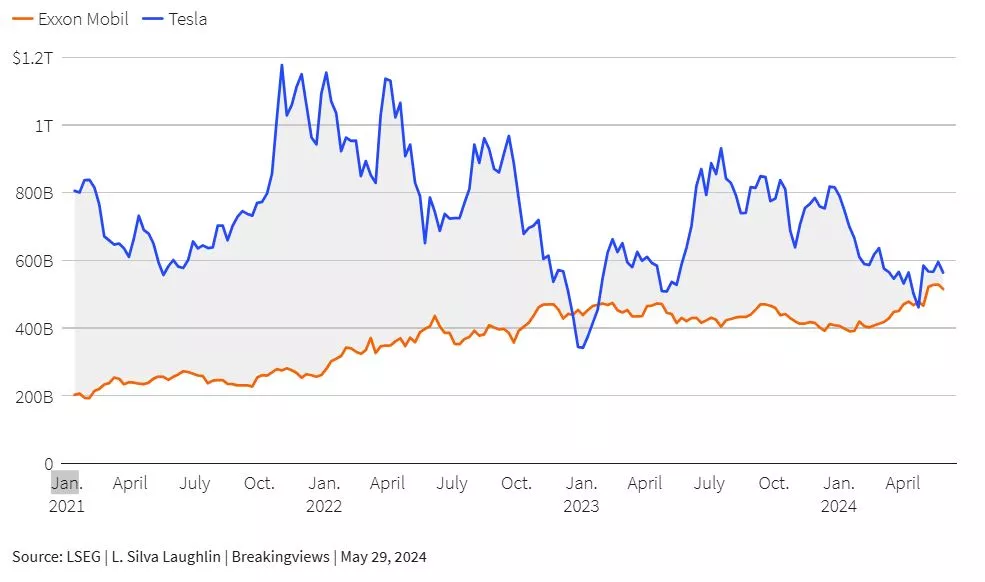

There’s no better token of Exxon’s good run than its market capitalization, which at $510 billion has almost closed the gap with Tesla. Back in January 2021, Elon Musk’s automaker was 4 times as big. Everyone knew the Biden age would create winners and losers – but few would have guessed Woods would be one to come out on top.

Exxon's value has gained on Tesla's

Context News

Exxon Mobil investors voted to re-elect Chief Executive Darren Woods and Lead Director Joseph Hooley on May 29 by wide margins, despite opposition from shareholders including California pension giant Calpers. Exxon said its 12 director nominees were all easily re-elected with between 87% to 98% support and average support of 95%, just below last year’s 96% average. Calpers said it had voted against all sitting members of the board after Exxon sued investors who had submitted a climate-related proposal for the company’s annual meeting. The litigation is ongoing even though the proposal was withdrawn.

More By This Author:

A Review Of The Largest ETFs In The World

Q1 2024 U.S. Retail Scorecard - Friday, May 31

S&P 500 Earnings Dashboard 24Q1 - Friday, May 31

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more