Exxon Buys More Of What The World Wants

Last week the Energy Information Administration (EIA) released their 2023 International Energy Outlook. It came out on Wednesday, the same day that Exxon Mobil (XOM) confirmed their acquisition of Pioneer Natural Resources (PXD), and they’re linked in more ways than simply their announcement date.

When energy companies issue long term energy forecasts they’re well aware that environmentalists will pore over them looking for an absence of fealty to the UN’s Zero By 50 goal – that is, that emissions of greenhouse gases will be eliminated by that date in order to limit anthropogenic global warming to 1.5 degrees C above the levels of 1850.

BP concluded that publishing data and forecasts was so fraught that they handed off their Statistical Review of World Energy after seven decades to the Energy Institute. But the EIA is unburdened by such concerns, and their latest publication should have agitated climate extremists more than XOM investing $60BN in adding oil and gas production.

The EIA produces several scenarios (“cases”) incorporating high versus low global GDP growth, oil prices and zero-carbon technology, along with a Reference Case which is based on current policies. They warn that they’re making projections not forecasts, although the difference is a subtlety only meaningful to the EIA.

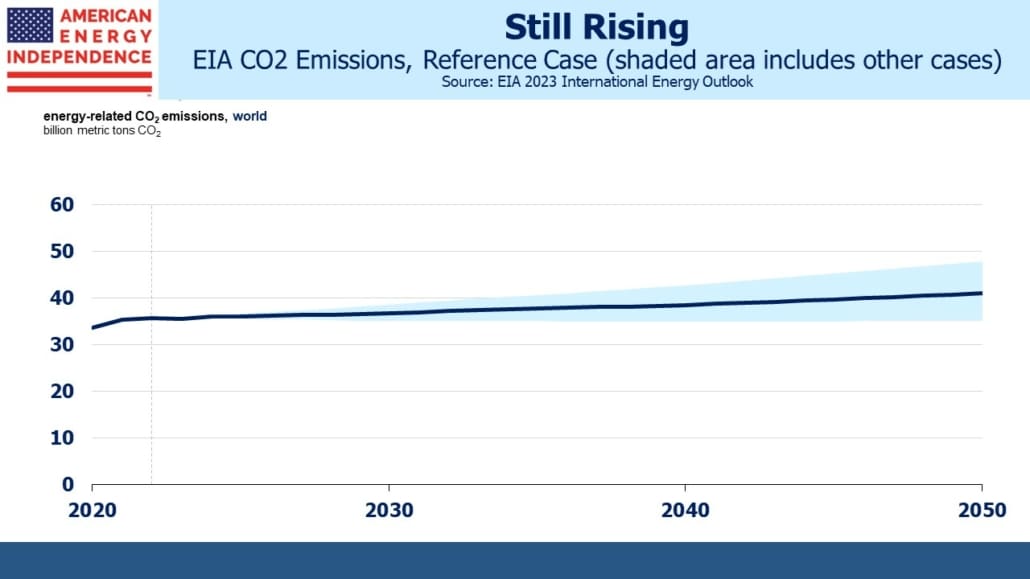

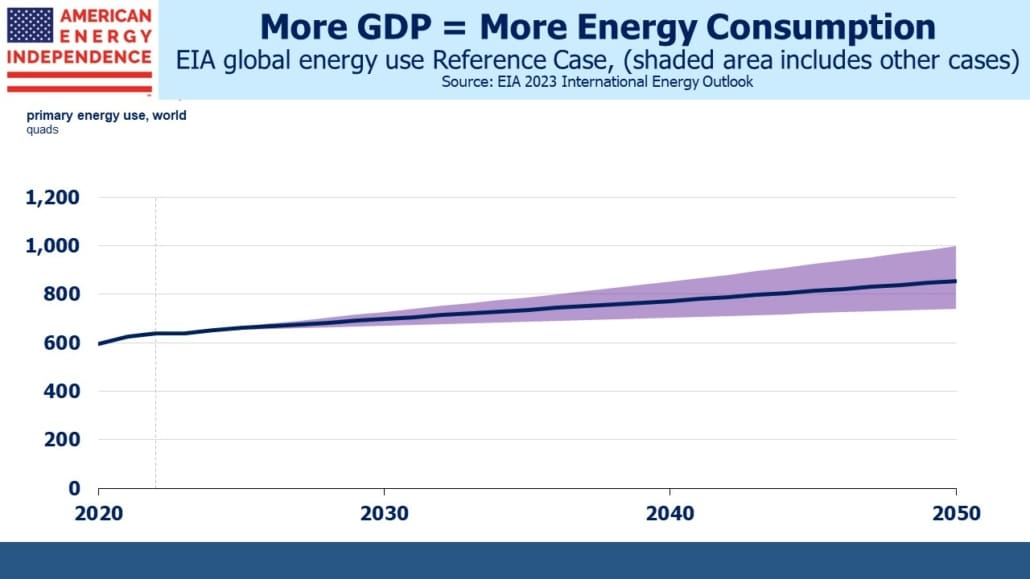

The headline could be, “EIA Forecasts Increase In CO2 Emissions By 2050” if their publications received such coverage. Higher living standards and population in developing countries will more than offset improving energy efficiency. When people have more disposable income, they use more energy. There is no historical precedent suggesting that can be avoided, so the EIA projects primary energy consumption will grow from 640 Quadrillion BTUs (Quads) to 856 Quads, a 1.1% annual growth rate.

The EIA includes some other dramatic changes

Their Reference Case assumes that non-fossil fuels will increase their share of primary energy and fulfill 58% of the increase in world energy consumption over that time. Increased global electricity consumption will be met primarily (italics added) by zero-carbon technologies. This is an extraordinary projection. Much of the rich world is dedicated to decarbonizing its power supply and electrifying more of its energy use – such as by shifting to Electric Vehicles (EVs) in the transportation sector. And yet, because of an increasing middle class in poorer regions such as Africa and much of Asia, electricity generation will consume more coal and gas than it does today. Perhaps most disappointingly, CO2 emissions from coal are projected to be the same in 2050 as today. The case for increased use of natural gas has never been stronger.

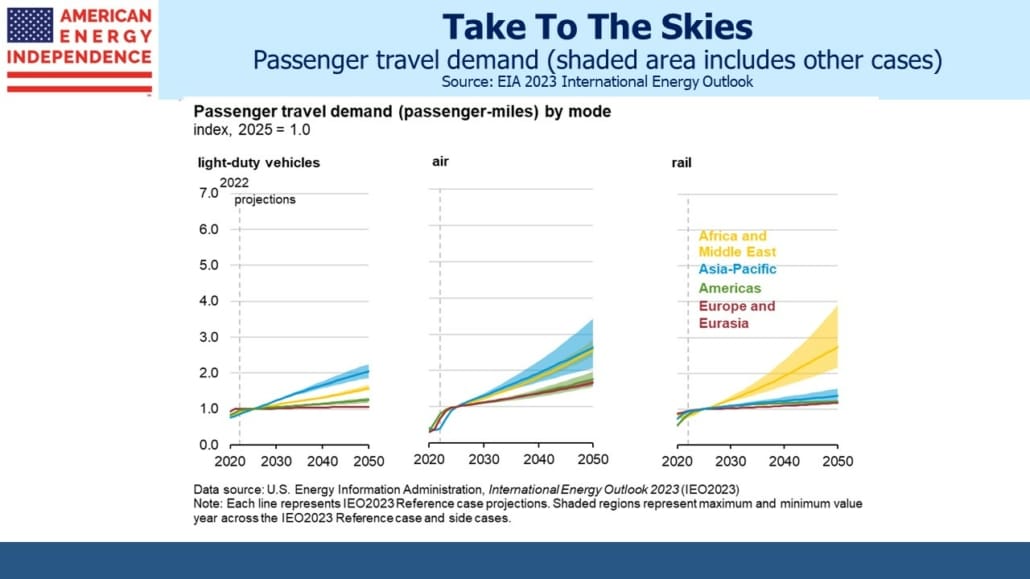

Aviation will more than triple.

The EIA sees EVs reaching 36% of new auto sales by 2050, which would still mean 1.4 billion internal combustion engine cars on the world’s roads. India’s energy consumption per capita will increase by 140%. China’s use of coal in iron and steel production will fall by 70%.

Other long-term forecasts typically see fossil fuel use declining over the next several decades. The International Energy Agency (IEA) in their Stated Policies Case (STEPS) expects fossil fuel consumption to peak within the decade, higher non-fossil fuel composition of primary energy and slower overall demand growth. They expect CO2 emissions to fall, but not by much.

Which brings us to XOM’s acquisition of PXD. Two years ago Engine No 1 criticized the company’s strategy, pushing it to be better prepared for the energy transition by focusing on short-cycle projects and renewables. Since then, XOM has committed $17BN to carbon capture and storage technology, biofuels and hydrogen. Nonetheless, a year ago critics such as Climate Action 100+ were complaining that 73% of their capital allocation was misaligned with the UN’s Zero By 50.

And now they’ve doubled down on the Permian basin in Texas. If production increases, Plains All American should be one of the beneficiaries. XOM also notes that they plan to accelerate PXD’s plans for zero-emission production from the wells they’re acquiring by fifteen years.

XOM’s long term outlook probably has much in common with the EIA.

The IEA’s scenario for reaching the UN’s target sees declining overall energy consumption. That only seems possible with extended slow growth in GDP and/or population.

The increase in M&A activity in the sector shows that boards are becoming comfortable making new long-term commitments to traditional energy. Oneok’s recent acquisition of Magellan Midstream, and Energy Transfer’s pending buy of Crestwood, are two more examples. They’re reaching the same conclusion as the EIA, which is that the world is going to need more of every kind of energy. America is well positioned to be part of the solution, especially with cheap natural gas.

More By This Author:

Terrorists Create Geopolitical RiskFiscal Policy Moves Center Stage

Just In Time Oil