Extreme Hype Required To Get Attention: Climate, Politics, And $10 Million Bitcoin

Image Source: Unsplash

A target of $1 million for Bitcoin is so passee. The new target is $10 million. To get anyone’s attention, the targets need to be bigger and bigger. But beware of the prediction trap!

Prediction Inflation

A few days ago I saw a Tweet proposing Bitcoin would hit $10 million.

I also saw Tweets that we need to vote for Biden because “Trump would suspend the constitution”.

Other political Tweets said only Biden would save the world from climate change.

And we cannot ignore predictions that AI will soon end humanity. I have seen many AI predictions on that note recently.

To get attention, we are in the midst of a huge competitive prediction of inflation.

Who Owns the Most Bitcoin?

To understand the implications of a $10 million price for Bitcoin, let’s discuss Who Owns the Most Bitcoin?

According to the Bitcoin research and analysis firm River Intelligence, Satoshi Nakamoto, the anonymous creator behind Bitcoin, is listed as the top BTC holder as of 2023. The company notes that Satoshi Nakamoto holds about 1.1m BTC tokens in about 22,000 different addresses.

A wallet address linked to Binance has 248,597 Bitcoins but that could be a commingled account.

The third largest wallet is anonymous. It has 118,300 Bitcoins.

The 10 largest wallet has 59,300 Bitcoin.

Bitcoin Math

If Bitcoin hit $10 million Satoshi Nakamoto would be worth about $11 trillion.

The anonymous third wallet would be worth $1.18 trillion dollars.

I believe we are at least approaching dollar limits of absurdity if indeed we are not already well beyond that point.

How would anyone cash out? Clearly, it would be impossible.

And what tax rate would apply even if one tried to cash out? We do not know what tax rates will be if Bitcoin would even hit something much more modest like $200,000.

If you don’t think there will be more taxes to pay for debt and interest on the debt, then you are not thinking.

The Prediction Trap

For at least a dozen years we have been hearing about the end of the world as we know it if we do not address climate change.

But the world didn’t end. Now what? What’s more dire than the end of the world due to mass starvation?

The prediction trap for climate change triggered. End-of-the-world predictions and mass starvation are as extreme as it gets. And everyone has already seen and read those predictions.

Ho hum. We need something newer, more dire, so let’s discuss costs.

Cost to Tackle Climate Change

Image clip from WSJ video, arrow and question added by Mish

On March 20, 2023 I commented Don’t Worry, It Will Only Cost $131 Trillion to Address Climate Change

That is up from February 25, 2019 when I noted AOC’s Green New Deal Pricetag of $51 to $93 Trillion vs. Cost of Doing Nothing

Five, ten and even 50 trillion cost estimates are so out of date. We now need to throw $131 trillion to address the problem.

This escalation has a purpose. The UN hopes to convince you that AOC’s $50 trillion Green New Deal is cheap.

Peak Gretta

End of the world due to climate change is also passee. I am sad to report there is no bolder headline possible. Even Gretta is having a difficult time being any more angry.

It’s already too late to save the world. So, the headlines have morphed into something less dire but more immediate.

Instead of predicting the end of the world, which by now should have happened many years ago by some accounts, the message has shifted to the preposterous idea that “only Biden can save the world.”

Peak Bitcoin Silliness

If we add three more zeros to Bitcoin, Satoshi Nakamoto will be worth a quadrillion. Why not? But then what?

Have we reached the end of Bitcoin prediction silliness?

Hype With a Timeline

The following Tweet has a very modest price target but also a presumption of something impossible to know.

Over the last few weeks I’ve had dozens of conversations with analysts, traders, bankers, and PMs. One thing is abundantly clear: NOBODY on Wall Street understands Bitcoin.

— Mike Alfred (@mikealfred) November 22, 2023

There are people who trade it occasionally. There are even some who have noted its 100%+ year to date…

“When Bitcoin rips to $100,000+ over the next 12-18 months, there will be a lot of shock and panic buying by tradfi. Mark it.”

Certainly, that’s possible. But it’s not “Mark it” guaranteed. Bitcoin could also fall back to $25,000 in the next 12 months. Why can’t it?

The same person also has a Tweet on why Bitcoin will hit $45,000 by the end of the year. It could. But it’s not guaranteed.

Anyone who disagrees does not understand Bitcoin.

Endless Hype Everywhere

The endless hype is everywhere.

Gold bugs do it too, and Tesla predictions by Cathy Wood and ARK are downright hilarious.

One wonders if these people are trying to convince others or themselves.

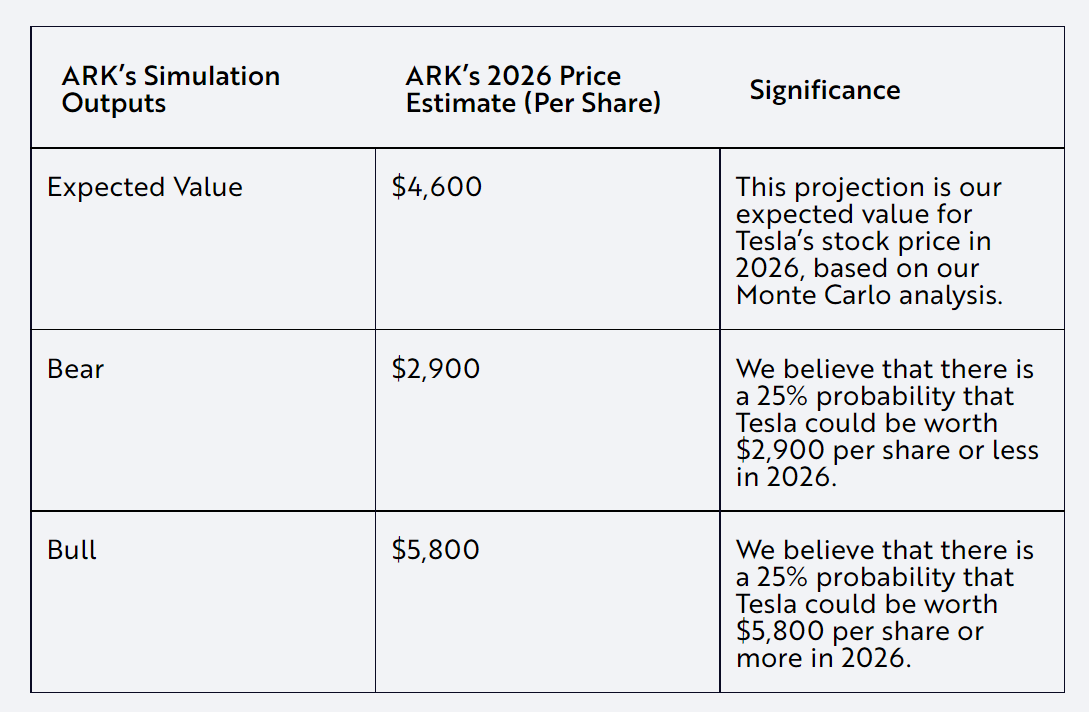

Cathie Wood’s Ark Open Source Model Predicts Tesla Shares Will Hit $4,600 by 2026

ARK’s Monte Carlo Simulation Results posted at Ark Investments

On April 19, 2022, I noted Cathie Wood’s Ark Open Source Model Predicts Tesla Shares Will Hit $4,600 by 2026

The “bear case” downside is $2,900.

On April 19, 2022, Tesla (TSLA) was worth $342.72. After a recent rally of 96 percent that topped at $299.29, Tesla is now $240.

The Echo Chamber

In Search of the Echo Chamber

— Mike "Mish" Shedlock (@MishGEA) November 22, 2023

Someone questioned me today because of a single issue. Could be anything [Trump, Bitcoin, Israel]

"I used to think you knew what you were talking about, but ...you have TDS, don't understand Bitcoin" whatever.

What they really mean is "Nobody…

What they really mean is “Nobody gets to disagree with me and if you do, I question everything you say, about anything.”

Useless Predictions vs a Simple Idea

It is very rare for someone to discuss a case for Bitcoin without the hype and without predicting anything. But here goes.

This is a position on Bitcoin that makes sense. No hype or predictions, just a simple statement.

— Mike "Mish" Shedlock (@MishGEA) November 27, 2023

However, it applies most to nations as opposed to individuals.

We have a lot of financial freedom in the US plus safety nets. And there has been no hyperinflation. https://t.co/WDCmO72jVL

“There is an uncanny historical justice aspect to Bitcoin where generally speaking, the less financially privileged you are, the faster you understand how useful it is. The more financially privileged you are, the slower you understand how useful it is.“

Wow! That’s a clearly well-reasoned position on Bitcoin.

I added “This is a position on Bitcoin that makes sense. No hype or predictions, just a simple statement. However, it applies most to nations as opposed to individuals. We have a lot of financial freedom in the US plus safety nets. And there has been no hyperinflation.“

The Case for Bitcoin

Lynn Alden makes a similar case, also without the hype. For discussion, please see her November 2023 Newsletter: The Monetary Gates Are Open

Any asset is better than cash in a country experiencing hyperinflation. Bitcoin meets that requirement better than buying an extra loaf of bread that can go stale.

Dollars don’t work because foreign governments restrict access to dollars or exchange them at official rates instead of what they are worth on the black market.

A Word About Hyperinflation

Bitcoin was founded on the belief of creating better money. It has failed that mission except in extreme hyperinflation cases where barter has taken hold.

Please don’t tell me the US dollar is headed for hyperinflation because it isn’t.

Hyperinflation is a complete collapse of the currency. That implies the dollar would head to zero vs the Yen, Yuan, Euro, and even the Peso.

Fundamental Flaw in Bitcoin

The fundamental flaw in Bitcoin is that except in very rare cases of direct barter, Bitcoin requires conversion to fiat to use.

You cannot realistically buy a car with Bitcoin, pay rent with Bitcoin, or do much of anything with Bitcoin without converting Bitcoin to local currency.

You might think you can due to “Bitcoin Accepted Here”. But the merchant inevitably takes that Bitcoin and sells it for dollars (local currency).

Every such transaction is a preference by the holder of Bitcoin to have cash over Bitcoin. Every such transaction increases the liquidity of Bitcoin but also puts negative price pressure on it.

Conversion to fiat is a taxable event. This combination makes Bitcoin ideal for speculation but terrible for use as money.

Bitcoin believers think this will change. But why would it?

Nonetheless, assume it does. At what price? $1,000,000? $10,000,000? $2,000?

What About Taxes and Reporting?

In the name of preventing money laundering, the government might easily demand the reporting of every transaction over $600 or so. Does anyone believe this won’t happen?

Governments cannot take your Bitcoin away directly, but they sure can restrict its use in transactions in a number of ways.

If the Fed told merchants they could not accept Bitcoin not a single merchant in the US would.

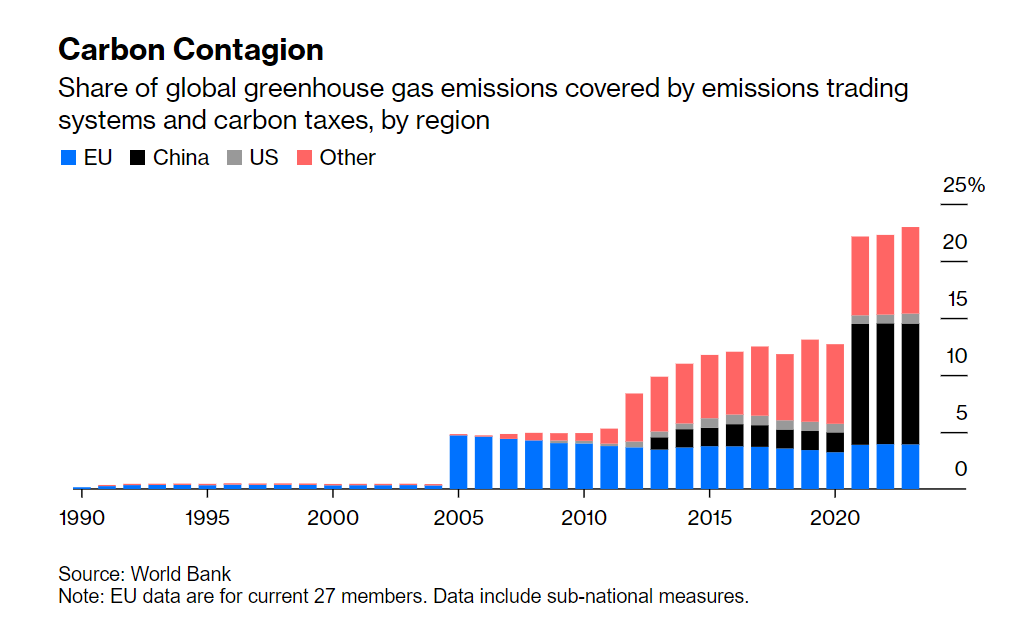

The higher Bitcoin gets, the more obvious the tax target becomes. Even Republicans are sponsoring tax hikes to address climate change.

Carbon Taxes

Please note that Two Republican Senators Align With the Sierra Club, Endorse a Carbon Tax

Very few people own Bitcoin in any significant degree. This makes them a very easy tax target for governments needing money.

Understanding Bitcoin’s Weaknesses

Bitcoin advocates say we don’t understand Bitcoin. I suggest that as a general rule, they do not understand the key points I make here.

Meanwhile, the overwhelming use for Bitcoin is speculation (≈99.9+ percent).

How would Satoshi Nakamoto cash out his $11 trillion? Who is the buyer on the other end? Downgrade that to $1 trillion or even $100 billion and ask yourself the same question.

The irony in the hype is that the higher Bitcoin goes, the more likely governments will act to tax the hell out of it or restrict its use.

Discussion is Moot

This entire discussion is all moot because Ocasio-Cortez Says World Will End in 12 Years

That was on January 23, 2019. Thus, in little more than seven years the world will end.

Does anyone care to top that $10 million prediction with only seven years remaining?

On the off chance the world does not end in seven years, would someone please give me estimates of electricity demand and cost if Bitcoin were to get to $10 million?

More By This Author:

It’s Not Easy To Avoid Buying Items Made Or Sourced In China

Is The Great American Dream Still Alive?

Are The Fed And ECB Different? In What Key Way Are They Alike?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more