Exactly One Year After The Bear Market, Futures Hit Record High For 9th Day

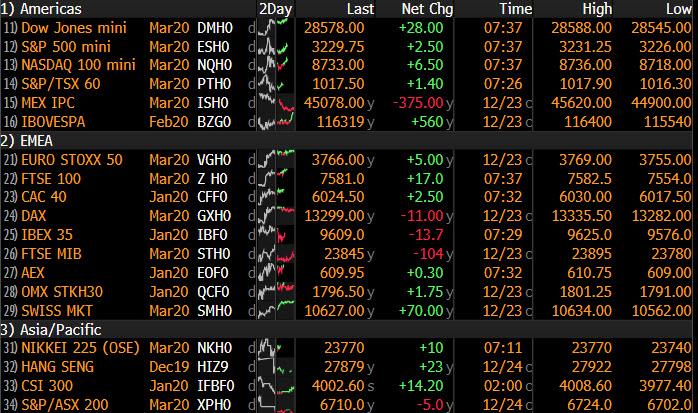

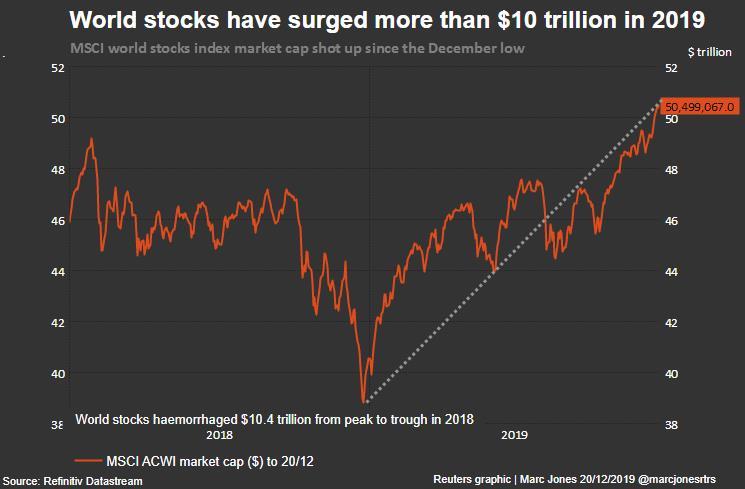

World stocks hit another record high on Tuesday on track for their best year in a decade in an extremely low-volume overnight session, with the S&P set to for an intraday record high for the 9th day in a row, the longest such streak since March 1998, as China’s latest policy easing pledges added to the optimism generated by what Reuters lazily fell back to as sign of trade war optimism (just how many times can one recycle the exact same thesis).

"It’s been a strong run-up to Christmas for stock markets and it seems traders are taking a little breather in this shortened trading week," analyst Craig Erlam told Reuters.

“It’s been a good few weeks for investors, spurred primarily by the de-escalation in the trade war, with Trump only this weekend claiming it will be signed very shortly.”

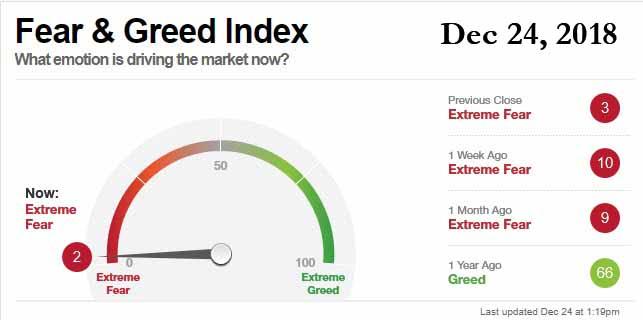

Amid an eerie holiday calm, a mirror image of the chaos observed one year ago today when the S&P briefly dipped into bear market territory...

... unleashing investor panic and a near-liquidation among professional and retail investors alike...

... most asset classes held on to the extraordinary gains they’ve notched in 2019. The $45 trillion MSCI World Index is up 25% year-to-date - entirely on the back of multiple expansion (!) - its top performance in a decade. And since all of the year's upside was due to money printing and lower rates, gold advanced, on track for its best year since 2010, as mixed U.S. data Monday kept hopes of interest-rate cuts alive.

All three main US index futures pointed to a new record open a Christmas Eve-shortened half-day session. Boeing continued to rose in pre-market trading after a 3% surge on Monday, when the planemaker announced the termination of its troubled CEO.

The European Stoxx 600 index also traded in record-high territory though many continental markets were closed for Christmas and others saw thin trading volumes. Shares fluctuated in London and Paris while they dipped in Madrid. Markets in Germany and Italy were closed, anticipating Wednesday’s holiday that will close market on both sides of the Atlantic, while emerging-market shares dipped.

Earlier in the session, the MSCI index of Asia-Pacific shares ex-Japan was flat while its all-country benchmark was unchanged, having added 3% this month and 24% since the start of 2019. One day after their biggest slump in a month and a half, blue-chip shares in China rose 0.7% after Premier Li Keqiang said the government was considering more measures to lower corporate financing costs and hinted at "targeted" cuts in banks' reserve requirement ratio. On the other end, Korean shares weakening 0.7%, pressured by Monday’s data that showed exports in the first 20 days of the month had fallen again.

As discussed previously, after nothing worked in 2018, 2019 was the mirror image, when everything worked, and world markets headed into the end of a stellar year, with most major asset classes, from emerging market bonds to U.S. tech shares, enjoying robust returns. But, as Reuters notes, uncertainty remains on how long the trade truce will last as Trump kicks off his re-election campaign next year. Worries have also re-emerged how Britain will navigate its Brexit, with concerns pushing to a near four-week low versus the euro and a three-week trough against the dollar. The pound was modestly higher at $1.2953 versus highs above $1.35 after the Dec. 12 general election.

“Risks to the outlook receded this year, which supported financial markets, but we cannot say the same thing about next year,” said Hiroshi Miyazaki, senior economist at Mitsubishi UFJ Morgan Stanley Securities in Tokyo.

Elsewhere in FX, the dollar edged up against its major peers but still was heading for a monthly decline; the euro slipped closer to a two-week low.

In rates, the 10Y yield traded roughly unchanged, at 1.9348% following Monday’s slight rise in yields following lackluster demand for two-year bills at auction. Another bond auction is due on Tuesday. Yields have risen more than 20 basis points off the 1.69% levels of early December, lifted by the equity rally and signs the U.S. Federal Reserve has paused its rate-cutting cycle. In Japan, two-year bond yields hit 16-month highs after the message from the minutes of the Bank of Japan’s meeting prompted money markets to erase rate cut expectations.

In commodities, Brent oil futures ticked up 0.2% after Russia’s energy minister said cooperation with OPEC to support prices would continue. U.S. crude inventory data, due on Tuesday, is also forecast to show a second straight weekly decline.

Market Snapshot

- S&P 500 futures up 0.06% to 3,229.25

- STOXX Europe 600 up 0.02% to 418.36

- MXAP down 0.1% to 170.05

- MXAPJ down 0.1% to 550.34

- Nikkei up 0.04% to 23,830.58

- Topix down 0.07% to 1,728.22

- Hang Seng Index down 0.2% to 27,864.21

- Shanghai Composite up 0.7% to 2,982.68

- Sensex down 0.3% to 41,538.15

- Australia S&P/ASX 200 up 0.1% to 6,794.20

- Kospi down 0.6% to 2,190.08

- German 10Y yield rose 1.0 bps to -0.242%

- Euro down 0.06% to $1.1082

- Brent Futures up 0.3% to $66.59/bbl

- Italian 10Y yield rose 2.3 bps to 1.26%

- Spanish 10Y yield fell 0.7 bps to 0.436%

- Brent Futures up 0.3% to $66.59/bbl

- Gold spot up 0.4% to $1,491.97

- U.S. Dollar Index up 0.07% to 97.73

Top Overnight News

- Wall Street sleuths are wondering whether the Fed is quietly doing more to calm the U.S. repo market than just the headline-grabbing liquidity injections that have captivated observers for months. The amount outstanding in the New York Fed’s foreign reverse repo pool -- a place where other nations’ central banks can park cash -- has shrunk by 18% since peaking at $306 billion in mid-September

- Trump has promoted a White House aide who was subpoenaed in the House impeachment investigation but declined to testify. The aide, Robert Blair, has been named a special representative for international telecommunications policy

- After a decade-long debt crisis that made Greece a bond-market pariah, the country now enjoys the luxury of having no financing needs for 2020. Yet the government’s 2020 budget shows it still plans to sell new debt

- India’s government should avoid a fiscal stimulus to spur the economy, and focus instead on cutting public debt so that financial resources can be freed up for investment, the International Monetary Fund said

- Queen Elizabeth II will urge Britons to “overcome long-held differences” less than two weeks after a bitterly-fought general election offered an end to three-and-a-half years of political deadlock over Brexit

Asian equity markets were mixed with price action range-bound amid the ongoing holiday lull and with several early market closures in the region for Christmas Eve. ASX 200 (+0.1%) was uneventful in today’s shortened trading session as outperformance in the commodity-related sectors counterbalanced weakness in tech and financials, while Nikkei 225 (Unch.) also meandered on the marginal ebbs and flows in the domestic currency with outdated BoJ minutes from the October meeting doing little to spur price action. Hang Seng (-0.2%) and Shanghai Comp. (+0.7%) conformed to the non-committal tone amid the reduced hours in Hong Kong and with the mainland also kept indecisive after the PBoC skipped open market operations, although Chinese Premier Li noted that China will study further steps to lower financing costs including RRR and targeted RRR cuts. Finally, 10yr JGBs were initially lackluster following the similar holiday-quietened trade in USTs and with demand sapped by a lack of buying from the BoJ which were only in the market for treasury discount bills, although prices were later supported following the 2yr auction results which were mixed but still attracted a higher b/c.

Top Asian News

- Thailand Narrows CPI Target Amid Subdued Price Pressures

- Sri Lanka Appoints Lakshman as New Central Bank Governor

- Moon Says Japan Ties ‘Crucial’ as Leaders Seek to Repair Damage

European equity markets tread water in the run-up to the early Christmas closures and with a bulk of the regional bourses already away on holiday (full closure available on the Newsquawk headline feed). DAX, FTSE MIB and SMI cash markets are among those shut, whilst FTSE 100 (+0.1%), CAC 40 (Unch), AEX (Unch) and IBEX 35 (-0.3%) trade without a clear direction. The latter, however, experiences mild pressure on the back of index-heavy BBVA (-1.1%) - whose shares declined after sources stated that the ECB has asked Spain’s High Court to provide information regarding a probe into spying involving BBVA, to evaluate the potential impact on the bank’s governance. Sectors are likewise largely uninspiring, but energy names see some outperformance as most oil-giants remain open – with Royal Dutch Shell (+0.8%) piggybacking on Sterling’s post-election declines and stable energy prices. In terms of other individual movers, PSA (-0.6%) resides towards to bottom of the CAC after the Co. was reiterated with an underperform rating at RBC. Meanwhile, Vivendi (-0.2%) shares are modestly subdued amid the ongoing spat with Mediaset regarding its pan-European merger plans which drew criticism from Vivendi.

Top European News

- Deutsche Telekom Weighed T-Mobile-Comcast Merger in 2015

- Turkey Development Bank to Sign Protocol for TRY750m Funds

- Italy’s PM Says Highway Concession Decree Is Fair: Messaggero

In FX, markets traded with no conviction ahead of the festive season with DXY just above its 200 DMA around 97.71/7; for reference, its 21 DMA resides at 97.61. Similarly, EUR/USD and GBP/USD move relatively sideways – although the former dipped below its 50 and 21 DMA which both reside around 1.1083 to a low of around 1.1071 before paring some downside, whilst the latter manages to remain afloat above yesterday’s 1.2905 low. Elsewhere, USD/JPY retains its 109.00+ status heading into the Christmas break having largely side-lined the out-of-date BoJ Minutes from its October meeting with the pair reflecting the non-committal risk tone across the holiday-thinned market. Meanwhile, the antipodeans remain choppy within tight 20-pip ranges, albeit the Kiwi saw mild impetus heading into the Asia close and currently hovers in proximity to yesterday’s high around 0.6640. The Aussie overall remains flat intraday amid a paucity of pertinent data releases and with no clear risk tone. Finally, USD/CNH heads into the partial session modestly north of the 7.00 mark after seeing another stable Yuan reference rate setting with the next level to the upside at 7.0163 (21 DMA), and with traders eyeing US-China developments early next year, particularly details surrounding the timing of the Phase One deal signing.

In commodities, WTI and Brent futures hover in mild positive territory around the USD 60.50/bbl and USD 66.50/bbl levels respectively and both within tight USD 0.20/bbl ranges. News-flow has remained light as markets wrap up for the Christmas holidays and thus provide little impetus to the complex. Meanwhile, spotgold trades on a firmer footing having yesterday surpassed its trendline resistance at USD 1487/oz and briefly topping its 100 DMA (USD 1492.30/oz) in recent trade, although the move was fleeting. From a macro-perspective, there is little by way of fresh fundamental factors to prompt the upside in gold, but light volumes could result in unexplained price action. Elsewhere, copper prices are similarly in the green; prices are back above the 2.80/lb mark with possible upside derived by China’s Environment Ministry issuing 2020 scrap metal import quotas – which sees high-grade copper scrap allowances for just over 270k tonnes (vs. 560k tonnes of copper scrap quota in 2019) alluding to a potential rise in the red metal’s demand within China.

US Event Calendar

- 10am: Richmond Fed Manufact. Index, est. 1, prior -1

What Bear market it's up for 10 years??? lol Where was that Panda??