EUR/USD Weekly Forecast: Political Uncertainty Weighing, Eyes On U.S. Data

Image Source: Pixabay

The EUR/USD weekly forecast remains softer due to political and policy turbulence during the week. The pair fell to two-month lows around 1.1540 before a modest rebound above 1.1600.

The US dollar strengthened at the week’s outset as global risk sentiment weakened. The persistent US government shutdown, unresolved budget negotiations in Congress, and fresh trade friction with China revived risk aversion and the dollar’s safe-haven demand. Meanwhile, the euro faced pressure because of the political instability in France due to the resignation of Prime Minister Sebastien Lecornu.

Additionally, the ongoing shutdown has resulted in limited US economic data. Investors focused on the Federal Reserve’s September meeting minutes, which suggested a divided committee over further rate cuts. Due to rising labor market concerns, a slim majority favored two more rate cuts this year. Meanwhile, Trump hinted at a massive tariff increase on Chinese goods later this week, which put a hold on monetary easing expectations, leading to equity sell-offs and a moderate dollar pullback.

From the Eurozone, mixed economic data and deteriorating confidence restricted the euro’s recovery. A decline in German factory orders and industrial output underscored concerns about weak regional growth. Meanwhile, ECB president Christine Lagarde emphasized that disinflation goals had been achieved and the policy was in a good place.

Late in the week, the euro recovered modestly as Emmanuel Macron reappointed Sebastian Lecornu. The decision eased French political tensions as the dollar softened amid fading risk appetite. Overall, the pair remains sensitive to political and policy developments in Europe and the US.

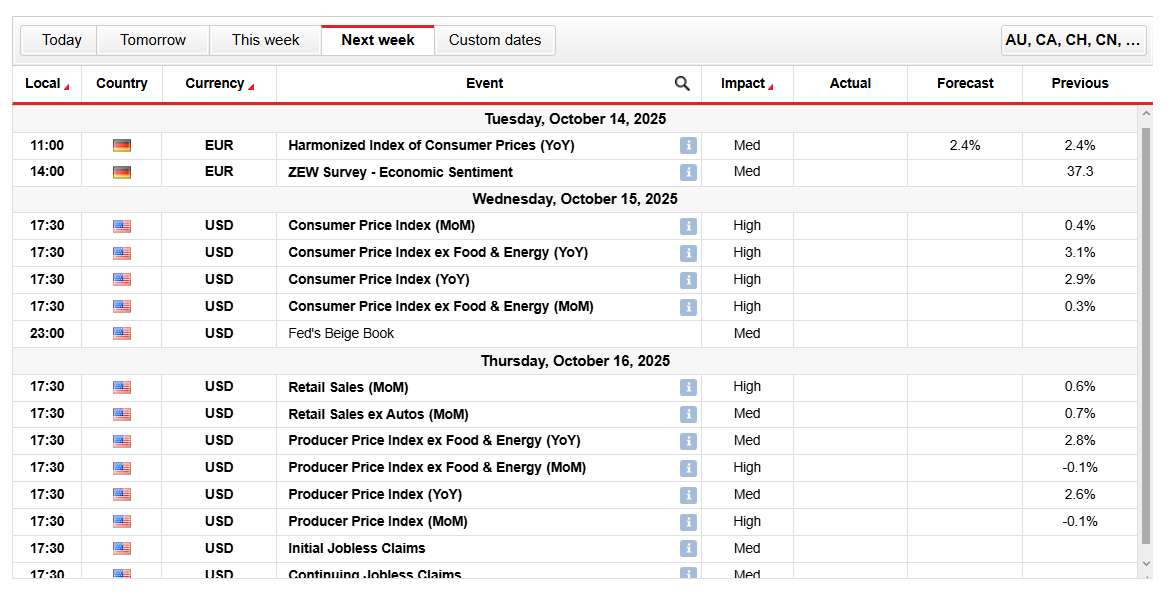

EUR/USD Key Events Next Week

(Click on image to enlarge)

EUR/USD Key Events Next Week

Market volatility could increase with Key Eurozone and US data releases in the coming week. Euro traders will be closely monitoring Germany’s HICP and ZEW sentiment. The US, the Consumer Price Index, Producer Price Index, and Retail Sales could guide inflation and policy expectations. Meanwhile, the Fed’s Beige Book could impact rate-cut outlooks and overall risk sentiment.

EUR/USD Weekly Technical Forecast: Stays Pressured Below 1.1700

(Click on image to enlarge)

EUR/USD Daily Chart

The EUR/USD weekly technical forecast indicates the pair found a brief relief after moving to the 1.1550 support area, followed by a modest rebound to 1.1620. However, the pair signals bearish momentum, staying beneath both the 50- and 100-day MAs, which continue to limit recovery attempts.The overall structure favors the downside, with the 200-day MA around 1.1220, which could be the medium-term target for the sellers. Meanwhile, immediate resistance stands at 1.1630, 1.1690, and 1.1725.

The RSI has edged higher near 47, moving out of the oversold territory. It suggests a temporary corrective bounce before renewed selling. Failing to hold above 1.1600 could reinforce a bearish bias toward 1.1500-1.1450. In contrast, a sustained move above 1.1700 could shift sentiment toward a more neutral or bullish outlook. The pair stays vulnerable as long as it remains below the key moving averages.

More By This Author:

Gold Outlook: Safe-Haven Appeal Intact Despite Gaza Ceasefire

USD/JPY Outlook: Yen On Edge Amid Policy Divergence, Political Chaos

EUR/USD Price Softer Amid Political Uncertainty, Divergent Policy Outlooks

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more