EUR/USD Weekly Forecast: Fed Confident Idn Taming Inflation

The EUR/USD weekly forecast is bullish as Fed policymakers gain confidence inflation will reach the target, weakening the dollar.

Ups and downs of EUR/USD

The EUR/USD pair had a bearish week. However, during the week, prices reached new highs as the dollar fell. Notably, the dollar was weak at the start of the week, as Powell indicated that policymakers were more confident about lowering inflation.

As a result, investors got more confident that the Fed would cut rates in September. This pushed the dollar down, allowing the euro to rally. Furthermore, although the US reported better-than-expected sales for June, the dollar continued falling.

However, the trend shifted towards the end of the week as the euro plunged after the ECB policy meeting. The central bank held rates but failed to give clear guidance on the future, saying it would depend on data. This created uncertainty about the rate cut outlook, weighing on the euro.

Next week’s key events for EUR/USD

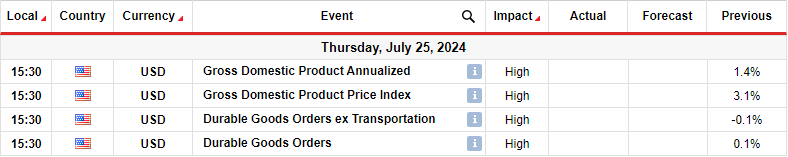

(Click on image to enlarge)

Next week, investors will focus on data from the US, including the gross domestic product and durable goods. These reports will continue shaping the outlook for Fed rate cuts. Notably, markets are fully pricing in a rate cut in September.

The last GDP report showed an expansion of 1.4%, slightly better than estimates. However, it was well below previous readings, indicating weaker economic activity. Further economic deterioration will put pressure on the Fed to lower borrowing costs.

The durable goods orders will also show the state of demand that will influence the outlook for rate cuts.

EUR/USD weekly technical forecast: Price retraces after hitting channel resistance

(Click on image to enlarge)

EUR/USD daily chart

On the technical side, the EUR/USD price is pulling back after reaching its channel resistance. Moreover, it has confirmed the shallow bullish trend by making a higher high. Currently, the price sits above the 22-SMA, showing bulls are in the lead. At the same time, the RSI sits above 50, showing solid bullish momentum.

However, since the price trades in a shallow trend, bears are nearly as strong as bulls. Therefore, the price might continue falling next week, past the 22-SMA support to retest the channel support level. The bullish bias will remain if the price continues making higher highs and lows.

More By This Author:

GBP/USD Forecast: Pound Weakened On Dismal Retail SalesUSD/CAD Weekly Forecast: Cooling Inflation Prompting Cut In Sep

USD/JPY Outlook: Yen Retreats Following Solid Rally

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more