EUR/USD Weekly Forecast: EU Inflation Dips Below Projections

The euro could collapse further as inflation in the Eurozone drops faster than expected, making the EUR/USD weekly forecast bearish.

Ups and downs of EUR/USD

While EUR/USD had a bearish week, the price closed the week well above lows. The week started with the US consumer confidence report that came in below forecasts. Moreover, the dollar strengthened against the euro when the US released upbeat data on core durable goods and initial jobless claims.

On Friday, the pair fluctuated amid Eurozone and US inflation reports. Inflation in the Eurozone dropped well below the estimates. At the same time, the core PCE price index from the US fell, meeting forecasts and indicating a drop in inflation.

Next week’s key events for EUR/USD

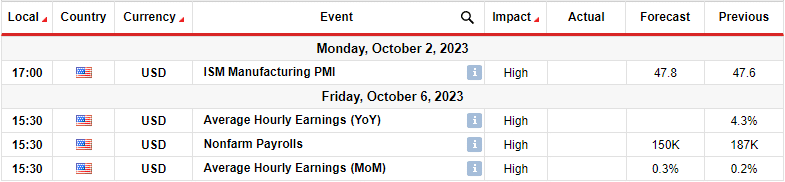

(Click on image to enlarge)

While the Eurozone will not release any key reports, the US will release important figures on manufacturing and employment. Investors expect a higher reading for the ISM manufacturing PMI than the previous one. However, the forecast is still below the 50 mark that separates expansion from contraction.

Meanwhile, the employment report will contain the non-farm payrolls report. Investors are expecting this figure to drop. Consequently, it would indicate a slowing labor market. Moreover, a lower figure would lead to a rally in the EUR/USD.

However, if the figure beats forecasts and the previous reading, it could lead to a decline in the pair.

EUR/USD weekly technical forecast: Bears eyeing the resistance for reentry.

EUR/USD daily chart

The bias for EUR/USD on the daily chart is bearish. The price has consistently made lower lows, breaking below support levels and respecting the 22-SMA as resistance. Moreover, since the price broke below the 22-SMA, the RSI has stayed below 50, supporting the bearish bias.

However, at the moment, the price has paused at the 1.0500 support level and is pulling back to retest the 1.0650 level. This is a temporary rebound, given the general direction is down. Therefore, bears are likely waiting to reenter the market when the price meets resistance.

If bears take back control at the 1.0650 level in the coming week, the price will likely fall below 1.0500. However, if bulls manage to break above 1.0650 and the 22-SMA, there will be a shift in sentiment.

More By This Author:

Gold Price Facing Deeper Retracement As Dollar Demand Surges

USD/CAD Forecast: Interest Rate Worries Fuel Dollar Demand

USD/JPY Forecast: More Gains Intensifying Yen Intervention

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more