EUR/USD Weekly Forecast: ECB Expected To Retain Rates

The EUR/USD weekly forecast is bearish as most economists believe the ECB will hold rates steady in its next meeting.

Ups and downs of EUR/USD

The EUR/USD had another bearish week as the dollar strengthened on upbeat data. While the US released positive data, the Eurozone released data showing an economic slowdown. Consequently, there was a divergence that saw the Euro plummet.

The US released better-than-expected data on services sector activity. Moreover, the initial jobless claims report showed fewer claims, indicating a robust labor market. These reports had investors scaling back bets on Fed rate cuts.

Meanwhile, In the Eurozone, Europe’s largest economy, Germany, experienced a slightly larger-than-anticipated decline in industrial production for July.

Next week’s key events for EUR/USD

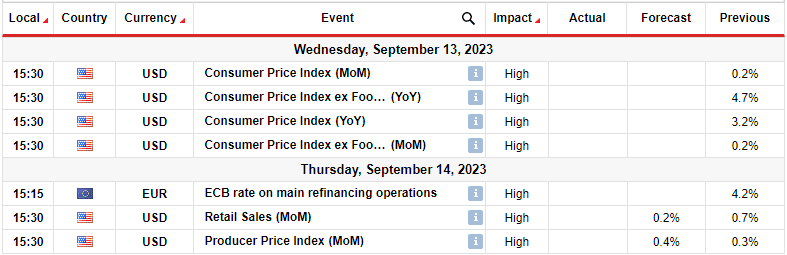

(Click on image to enlarge)

Next week will be big for the EUR/USD as investors will receive critical US and Eurozone reports. The US will release its inflation report on Wednesday.

Notably, recent data from the US has pointed to still high inflation. This has driven the dollar higher in the past week. Therefore, a higher-than-expected reading could see more dollar strength and a weaker euro.

On the other hand, investors will watch the ECB monetary policy meeting on Thursday. Although a rate hike is possible, most economists believe the ECB will pause. This is because recent data has shown an economic slowdown in the euro area.

EUR/USD weekly technical forecast: Will 1.0701 hold or fold against bears?

(Click on image to enlarge)

EUR/USD daily chart

The EUR/USD is looking to break below a significant support level at 1.0701. The price is in a downtrend, and the current swing started at the 22-SMA resistance. Bears took over with solid momentum, pushing the price below the 1.0775 support to make a new low.

This RSI is also approaching the oversold region, indicating solid bearish momentum. However, the 1.0701 key support level has stopped bears before. Moreover, it led to a reversal with a break above the 22-SMA. Therefore, bears might find it difficult this time as well to break below the level. This might lead to a consolidation period or a reversal. However, if they break below the level, the price will likely drop to the 1.0600 support level.

More By This Author:

USD/CAD Weekly Forecast: BoC Hike Odds Rise On Jobs DataEUR/USD Price Analysis: Heading For Straight 8 Weeks Of Losses

GBP/USD Outlook: Dollar’s Longest Weekly Rally In A Decade

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more