EUR/USD Weekly Forecast: Bulls To Aim 1.19 After Powell, Ahead Of NFP

The weekly forecast for the EUR/USD pair is bullish as the US dollar lost ground after Powell’s speech. However, tapering talks may weigh on the pair.

The EUR/USD pair recovered somewhat and closed at 1.1795. While expectations weakened due to the Delta Coronavirus outbreak hitting the state and eroding growth potential, the US dollar was down in the first half of the week (FXE, UDN).

On Monday, Markit released its August Business Activity Index (PMI). Even though business growth in the US is the slowest in eight months, the data suggests growth. According to the official report, despite a broad expansion in business activity in the Union, it also cooled down over the month. A weaker-than-expected set of numbers prompted investors to increase the cost of financial support at the dollar’s expense.

Fed officials rekindled rumors of a rate cut on Thursday, curbing the weakness in the dollar. James Bullard, president of the St. Louis Federal Reserve, said the cut should happen in October, while Dallas Federal Reserve President Robert Kaplan echoed this sentiment. Esther George, the president of the Kansas City Fed, also said the US Federal Reserve should wind down asset purchases “soon rather than later.”

Nevertheless, the focus was on Chairman Jerome Powell, who spoke at the Jackson Hole symposium. When Powell made pre-planned comments about the tapering starting this year, the EUR/USD surged to new weekly highs. A cautious stance was expected from market participants, but he surprised them with his hawkish tone.

On the other side of the Atlantic, the European Central Bank is maintaining its cautious tone. A revised outlook for interest rates was published in the minutes of the last meeting, which confirmed the central bank’s decision not to raise rates until it is clear that the rate of price rises will “persist.”

These days, there haven’t been any impressive growth figures released. The US gross domestic product for the second quarter was revised up from 6.5% to 6.6%, slightly below the 6.7% expected. During the same period, Germany’s GDP grew by 1.6%, improving over its preliminary estimate.

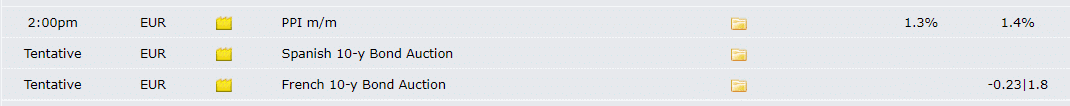

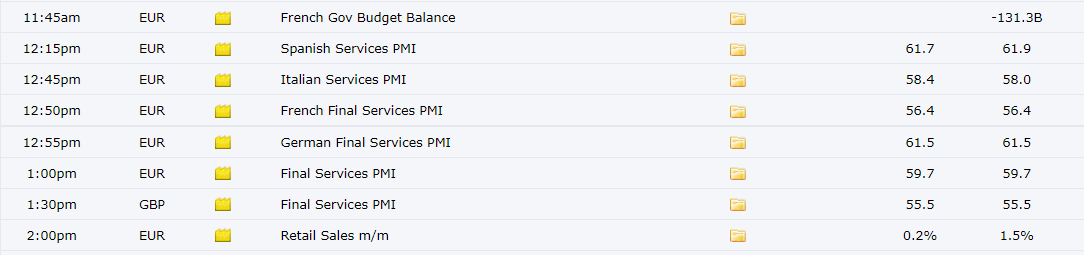

Key Data From EU During Aug 30 – Sep 03

The macroeconomic calendar is loaded with events from Europe. In addition, the data regarding inflation and PMIs will be released. However, the market is not expecting a significant impact from these events.

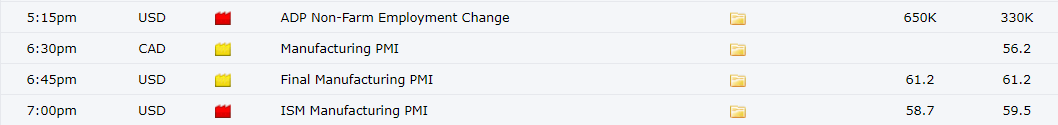

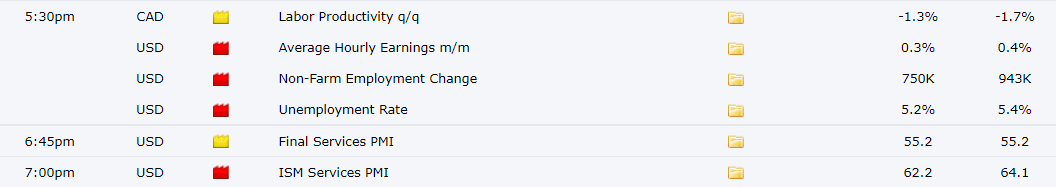

Key Data From The US During August 30 – September 03

The most important event next week in US NFP which is expected to decline to 750k as expected to 943k jobs created in July. The ADP nonfarm employment numbers are expected to rise to 650k against 330k reading of July. ISM PMIs for manufacturing and services are also expected next week that may provide some impetus to the market.

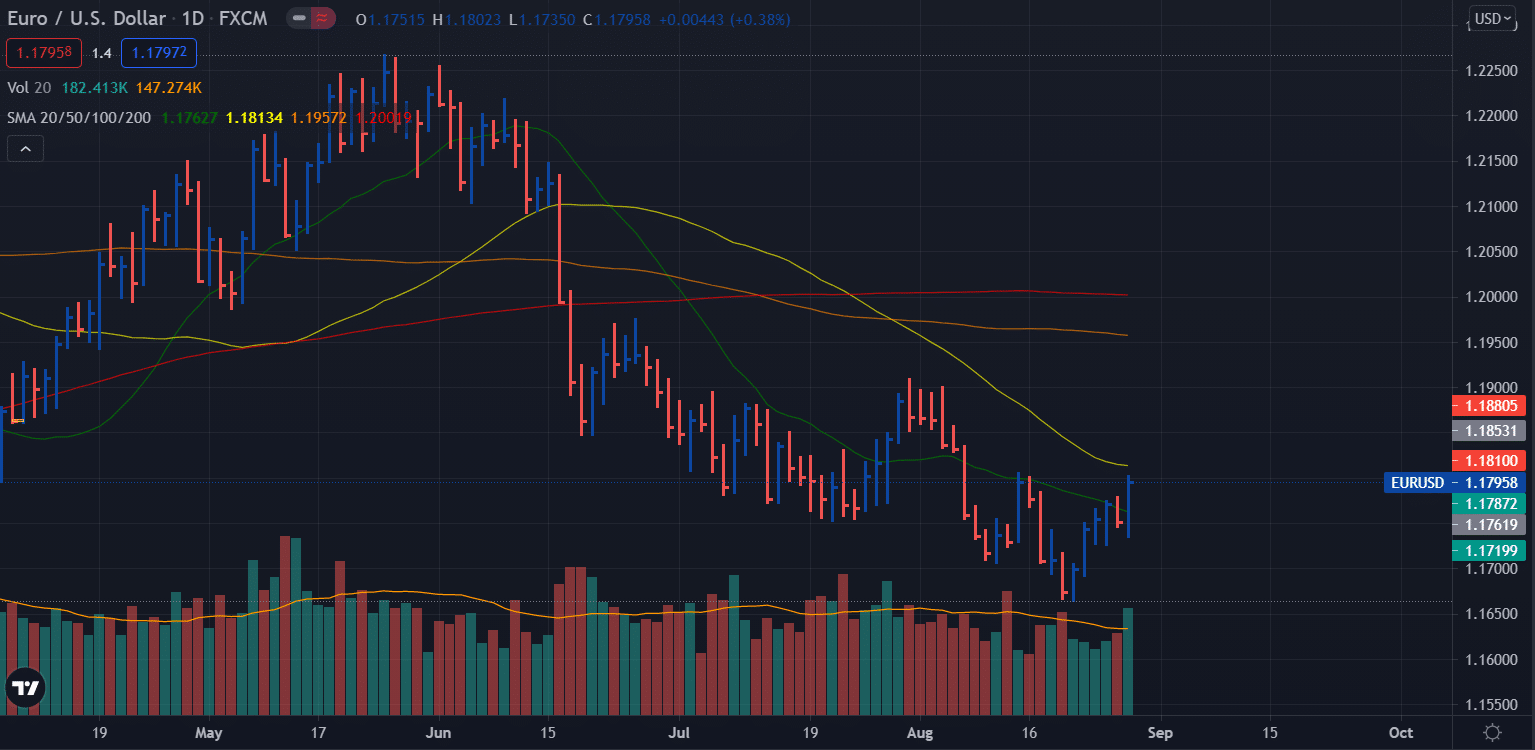

EUR/USD Weekly Technical Forecast: 20 DMA Indicating A Bullish Reversal

EUR/USD weekly forecast – daily chart

The EUR/USD daily chart suggests a bullish reversal. The price closed above the 20-day moving averages while volume was above average. However, the price paused near the 50-day moving average. The 100-day and 200-day moving averages have gone flat, which indicates that the bears have paused and bulls are likely to emerge. The upside targets lie at swing highs around 1.1850 ahead of 1.1900.

On the flip side, the pair may retrace gains and touch 1.1770 followed by 1.1750.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more