EUR/USD Weekly Forecast: Bets For Fed’s Dec Hike Diminish

The EUR/USD weekly forecast shows a slight edge for the euro over the dollar as the market adjusts its expectations for the Fed’s policy move. The recent data and comments from Fed officials have reduced the chances of a rate hike in December, which has weakened the dollar’s appeal.

Ups and downs of EUR/USD

As the dollar weakened despite upbeat US data, the EUR/USD had a bullish week. Notably, the dollar weakened amid reduced rate hike bets in December. Fed Chair Jerome Powell indicated that increasing market interest rates might lessen the need for more policy tightening.

Consequently, the likelihood of a Fed rate hike in December has decreased from 39% to 24%. Moreover, it is now considered almost certain that there will be a pause in November.

Meanwhile, US retail sales rose while initial jobless claims fell, indicating a robust economy.

Next week’s key events for EUR/USD

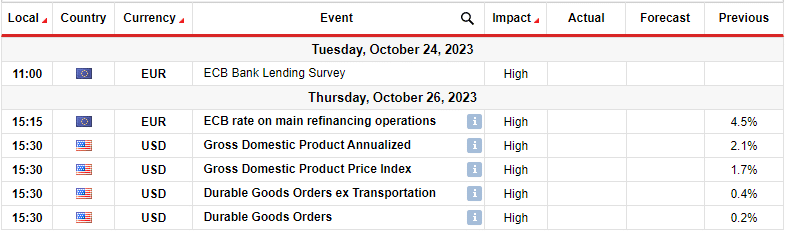

Investors are eagerly awaiting the ECB policy meeting next week, which will likely cause a lot of volatility for EUR/USD. Moreover, they expect data from the US on GDP and core durable goods orders.

All economists surveyed by Reuters agree that the European Central Bank’s rate hike cycle has concluded. Therefore, the bank will likely hold rates next week. However, it won’t be until at least July 2024 before the bank starts to ease its monetary policy.

In September, the ECB raised its key interest rates by 25 basis points. Nonetheless, it indicated that this 10th rate increase in a 14-month streak is likely the final. French central bank Governor Francois Villeroy de Galhau reiterated last week that the ECB should maintain its key interest rate at current levels.

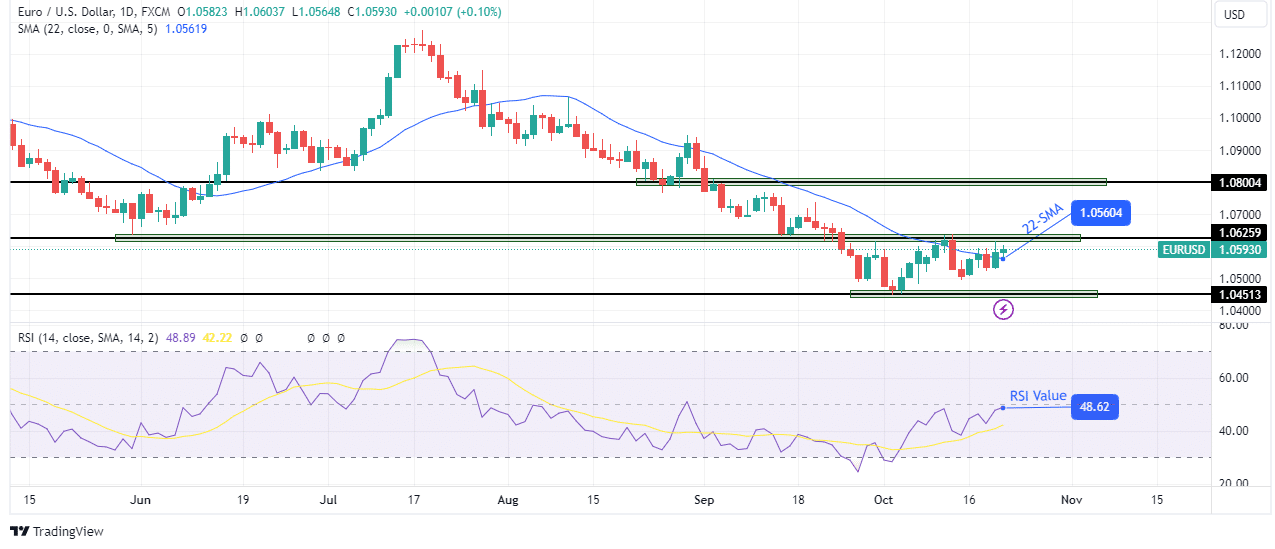

EUR/USD weekly technical forecast: Bulls locked in battle for control at the 22-SMA.

EUR/USD daily chart

The EUR/USD bulls are battling for control at the 22-SMA resistance. However, the price is on a downtrend. It has consistently made lower lows and highs, and the RSI sits below 50, supporting bearish momentum. Therefore, it will be difficult for bulls to take control as there is strong resistance from the 22-SMA and the 1.0625 level.

Still, if they break above this resistance zone, sentiment will shift with the next target at 1.0800. If the resistance zone holds, the price will likely retest and break below the 1.0451 support level to continue the downtrend.

More By This Author:

USD/CAD Outlook: Dollar Edges Higher with 0.3% Weekly LossGold Price Tops Near Major Resistance After Fed Speech

USD/JPY Price Analysis: Inching Closer To Pivotal 150 Yen Level

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more