EUR/USD Slips As Trump Drops Tariff Threats, Lifts The U.S. Dollar

Image Source: Pixabay

EUR/USD retreats late Wednesday during the North American session, registers losses of over 0.30% as US President Donald Trump refrained from its threats of imposing tariffs over eight European countries over discussions of Greenland.

Euro retreats as easing US–EU trade tensions boost the Greenback

In Davos Switzerland, US President Donald Trump posted on Truth Social that “Based upon a very productive meeting that I have had with the Secretary General of NATO, Mark Rutte, we have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region.” He added that “Based upon this understanding, I will not be imposing the tariffs that were scheduled to go into effect on February 1.”

On the post, risk appetite improved as shown by US equity markets, which recovered as three of the four US equity indices ended Wednesday’s session with gains between 1.16% and 1.21%.

The US Dollar recovered some ground as shown by the US Dollar Index (DXY). The DXY, which tracks the buck’s value versus six currencies, is up 0.20% at 98.75.

Other data revealed that the US Supreme Court expressed skepticism about Trump’s authority to fire Fed Governor Lisa Cook, revealed CNBC.

Across the pond, the Eurozone docket featured speeches by members of the European Central Bank, led by President Christine Lagarde and Kocher.

Ahead on Thursday, the economic docket will feature US Q3 2025 Gross Domestic Product final reading, jobless claims and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index. In the European Union, the schedule will feature the ECB’s Monetary Policy Meeting Accounts and EU’s Consumer Confidence data.

Daily digest market movers: Euro on the defensive as Trump TACO trade re-emerges

- US President Donald Trump reunion with the North Atlantic Treaty Organization (NATO) Secretary General Mark Rutte created a framework of a future deal over Greenland. Trump called the framework “fantastic,” but offered no details.

- A Reuters poll revealed that over 100 economists expect the Fed to hold rates unchanged in January. Also, the majority expect the US central bank to stand pat until the current Fed Chair Jerome Powell finishes his term In May.

- US Pending Home Sales plunged 9.3% in December, marking the weakest reading since July. The report highlighted that inventory of existing homes remains constrained, as many homeowners are locked into mortgage rates below 5%, reducing incentives to list properties and weighing on transaction activity.

- Newswires reported that the European Union is delaying the ratification of the US-EU trade agreement.

- ECB Kocher said that using trade policy threats to exert political pressure, increasing the risks for global economy. In other words, ECB’s Lagarde said that monetary policy “is in a good place” and that the bloc’s economy would be stronger if not for tariffs.

Technical outlook: Euro drops below 1.1700 as risk appetite improves

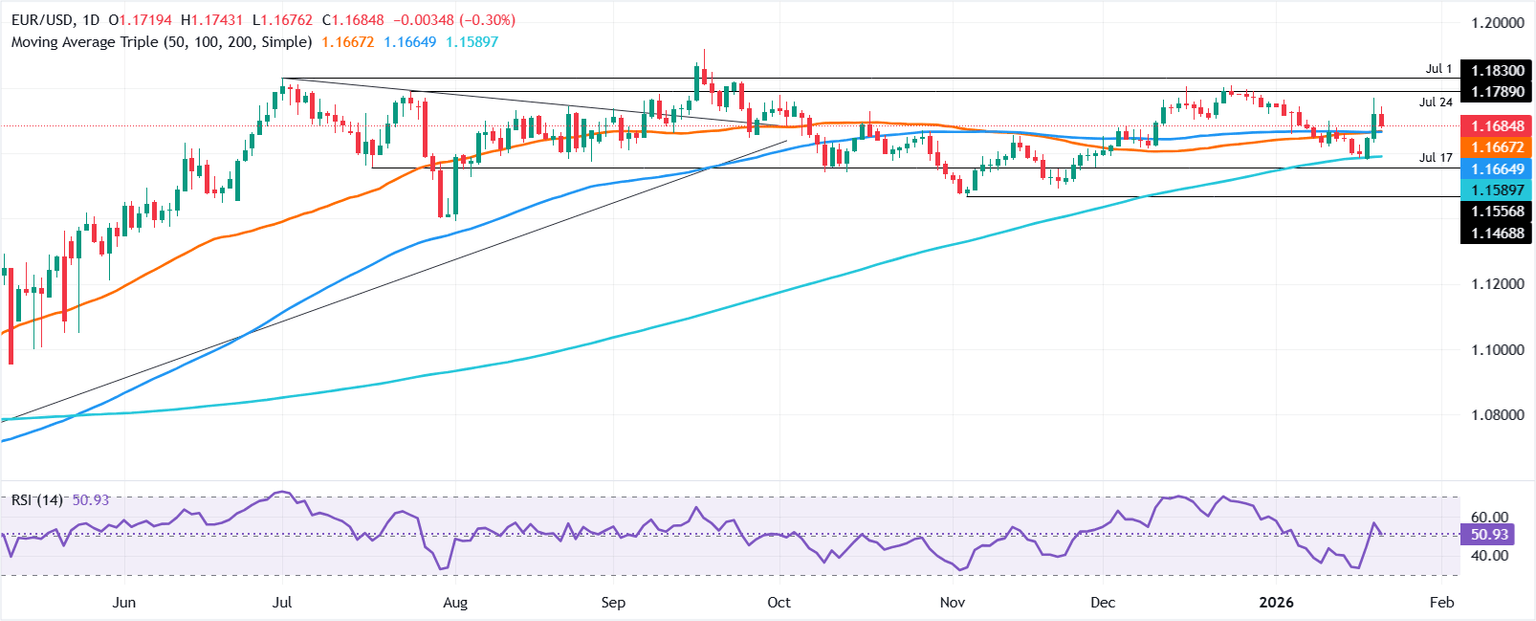

EUR/USD retreated after hitting a daily high of 1.1743, dropping below the 1.1700 figure, which opens the path for lower prices. The Relative Strength Index (RSI) shows a shift of momentum from bullish to bearish. Therefore, in the short term, the pair could test lower prices.

If EUR/USD drops below the 50-day Simple Moving Average (SMA} at 1.1662, the next support would be the 1.1600 mark ahead of the 200-day SMA at 1.1590.

Conversely if the pair climbs above 1.1700 the first resistance would be January 21 high at 1.1743, followed by the January 20 swing high at 1.1769.

(Click on image to enlarge)

EUR/USD Daily Chart

More By This Author:

Gold Holds Firm Near $4,770 As Trump Softens Greenland Stance

Silver Price Forecast: XAG/USD Retreats As Momentum Fades Near ATH

EUR/USD Surges Toward 1.1725 As Trump Tariff Threats Sink Dollar