EUR/USD Rally Rattled By NFP Print, US Dollar Bit Back

Image Source: Pixabay

- The euro failed to capitalize on upbeat GDP and retail sales in recent trading. Additionally, the ECB rate cut has been seen as nearing its limit.

- The US economy added 139,000 jobs in May, the second-highest reading in 2025, with the jobless rate steady at 4.2%.

- Hot labor data boosted the US dollar and Treasury yields on Friday, which dampened Fed rate cut hopes.

The EUR/USD currency pair's trip downward extended its losses on Friday after hitting a six-week high near the 1.1500 mark as Nonfarm Payroll figures in the United States came in stronger than expected despite cooling off. The print prompted investors to price in a less dovish Federal Reserve, while the euro failed to gain traction on upbeat economic data that was revealed earlier. The pair was recently seen trading at around the 1.1386 level, down approximately 0.51%.

US jobs data, as revealed by the Bureau of Labor Statistics, depicted the robustness of the labor market and the economy, with the print being the second highest reading in 2025, trailing the 147,000 amount registered in April. Consequently, the Unemployment Rate remained unchanged.

As expected, the US dollar advanced, propelled by the jump in US Treasury bond yields and an optimistic mood among investors, who bought US equities amid the conflict between US President Donald Trump and Elon Musk.

The EUR/USD cross failed to gain traction despite Gross Domestic Product (GDP) figures rising above estimates and surpassing the previous quarter's print. For a whole year, GDP improved from 1.2% to 1.5%, while Retail Sales also advanced in April.

During the week, the European Central Bank decided to cut rates to 2%, as inflation fell below the central bank’s target but signaled that it would pause its easing cycle. Robert Holzmann voted for keeping rates unchanged, and ECB President Lagarde hinted that the easing cycle could be nearing its end.

Next week, the Eurozone economic docket will feature the ECB Survey of Monetary Analysis and Industrial Production. In the US, next week's schedule will feature US inflation figures on the consumer and the producer side, alongside with the University of Michigan Consumer Sentiment preliminary release.

The Euro Price This Week

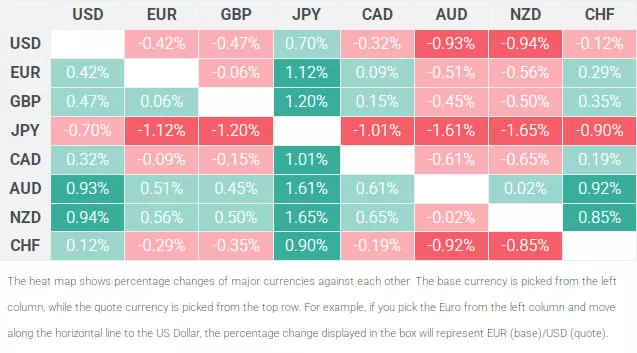

The table below shows the percentage change of the euro against other listed major currencies over the course of the week. The euro was the strongest against the Japanese yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the euro from the left column and move along the horizontal line to the US dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Market Movers: The EUR/USD Pair's Downtrend Stalled on Strong US Data

- The EUR/USD pair's uptrend remained intact on Friday, but it would be premature to assume it will remain so, given the uncertainty on US and Eurozone economic data releases.

- US Nonfarm Payrolls rose by 139,000 in May, beating expectations of 130,000 but falling short of April’s downwardly revised 147,000. While signs of a cooling labor market are evident, overall conditions seem to remain strong even as the economy slows.

- The Unemployment Rate held steady at 4.2%, prompting a repricing of rate expectations, with markets anticipating fewer than two Fed cuts by the end of 2025.

- ECB officials reportedly expect rate cuts to be paused at the July meeting, according to Bloomberg. “Some officials see reductions in borrowing costs as maybe already finished, while others still back another move — probably in September, according to the people.”

- Financial market players do not expect that the ECB would reduce its Deposit Facility Rate by 25 basis points at the July monetary policy meeting.

Euro Technical Outlook: EUR/USD Pair Plummeted Beneath 1.1400

The EUR/USD currency pair appeared to be upwardly biased on Friday despite its retreat to the two-day low of 1.1371, as buyers failed to break the 1.1500 mark, which could have exacerbated a move to the 1.1600 level. Momentum faded, while the Relative Strength Index remained bullish but aimed toward its neutral line. However, while the euro remained near the 1.1380-1.1400 range, buyers were seemingly in charge.

The next area of resistance would be the 1.1500 mark. A breach of the latter would expose April’s peak at the 1.1572 level, followed by 1.1600.

Conversely, if the EUR/USD pair fell below the June 2 daily low of 1.1344, a move to the 1.1300 level could be in the cards. A breach of the latter would expose the 20-day Simple Moving Average at the 1.1284 mark, followed by the 50-day SMA at 1.1218 and 1.1200.

(Click on image to enlarge)

More By This Author:

USD/JPY Price Forecast: Soars To Weekly High, Near 145.00 On Hot U.S. Jobs ReportGold Slips As Trump-Xi Call Eases Trade Tensions, Markets Await U.S. NFP

USD/CAD Slips Below 1.3650 As US Jobless Claims Rise, Canada’s PMI Contract

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more