EUR/USD Price Under Selling Pressure After Upbeat US CPI

The EUR/USD price slumped again, trading around the 1.0700 psychological level at the time of writing. The greenback dominates the currency market after the US inflation figures beat expectations.

The Consumer Price Index m/m reported a 0.3% growth in January, beating the 0.2% growth in December. CPI y/y came in at 3.1% above the 2.9% forecasted, while the Core CPI surged by 0.4%, exceeding the 0.3% growth estimated.

The currency pair dropped like a rock after inflation, ignoring the Eurozone data. The German ZEW Economic Sentiment and Eurozone ZEW Economic Sentiment came in better than expected.

Today, the Eurozone Industrial Production rose by 2.6%, even if the traders expected a 0.2% drop, while Flash GDP and Flash Employment Change matched expectations.

Tomorrow, the US Retail Sales, Core Retail Sales, Empire State Manufacturing Index, Philly Fed Manufacturing Index, Capacity Utilization Rate, and Industrial Production should move the rate.

EUR/USD Price Technical Analysis: Support at 1.0694

(Click on image to enlarge)

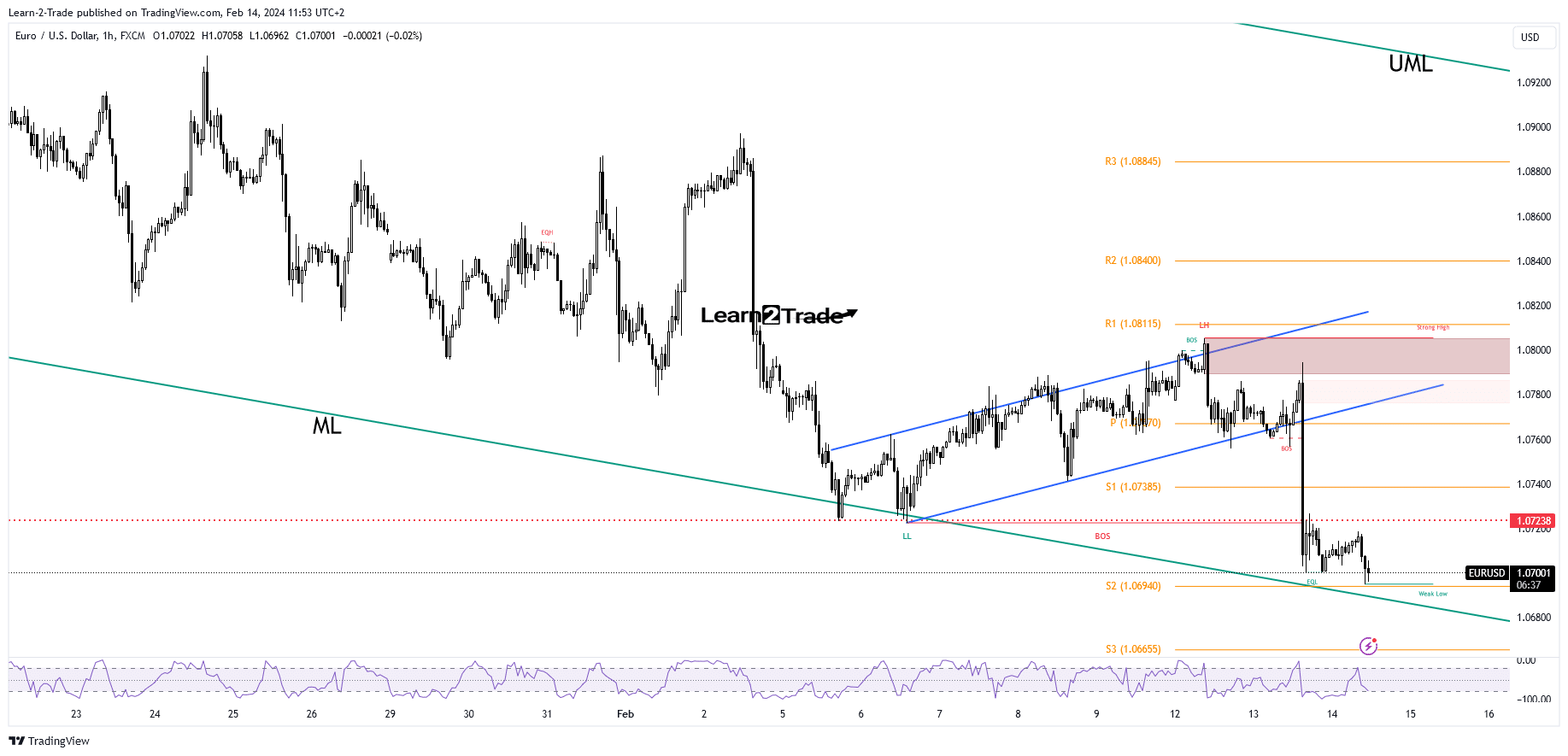

EUR/USD 1-hour chart

From the technical point of view, the EUR/USD price failed to stay above the 1.0800 psychological level in the last attempt. Now, it has extended its downward movement.

The flag pattern was seen as a bearish continuation formation. Staying on the minor uptrend line announced an imminent breakdown and continuation.

It has taken out the 1.0723 historical level and is about to reach the weekly S1 (1.0694) and the major descending pitchfork’s median line (ML). These represent potential downside targets and obstacles, so it remains to see how it reacts around these support levels. Taking out these levels activates more declines.

More By This Author:

GBP/USD Forecast: UK Inflation Steadies, US Inflation RisesUSD/JPY Price Analysis: Yen Slips as Focus Shifts to US CPI

Gold Price Turns Up As Traders Await US Inflation Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more