EUR/USD Price Fails To Recover Amid Upbeat US Retail Sales

The EUR/USD price dropped to 1.0622 on Friday, registering a fresh multi-week low. After such a plummet, the buyers took the lead and corrected higher. The pair is located at 1.0639 at the time of writing and is struggling to recover.

Despite minor retreats, the downside pressure remains high as the US dollar is still bullish. Fundamentally, the greenback took a hit from the US Prelim UoM Consumer Sentiment, which came in at 77.9 points below 79.0 points expected and compared to 79.4 in the previous reporting period.

Now, the EUR/USD has dropped again as the US retail sales reported a 0.7% growth, beating the estimated 0.4% growth, while core retail sales registered a 1.1% growth, beating the 0.5% growth forecasted.

The greenback is strongly bullish even though the US Empire State Manufacturing Index came in worse than expected, at -14.3 points, versus -5.2 points expected.

Later, the US is to release the Business Inventories and NAHB Housing Market Index data. On the other hand, the Eurozone Industrial Production rose by 0.8%, matching expectations.

Tomorrow, the ZEW Economic Sentiment and the Canadian inflation figures could have a big impact.

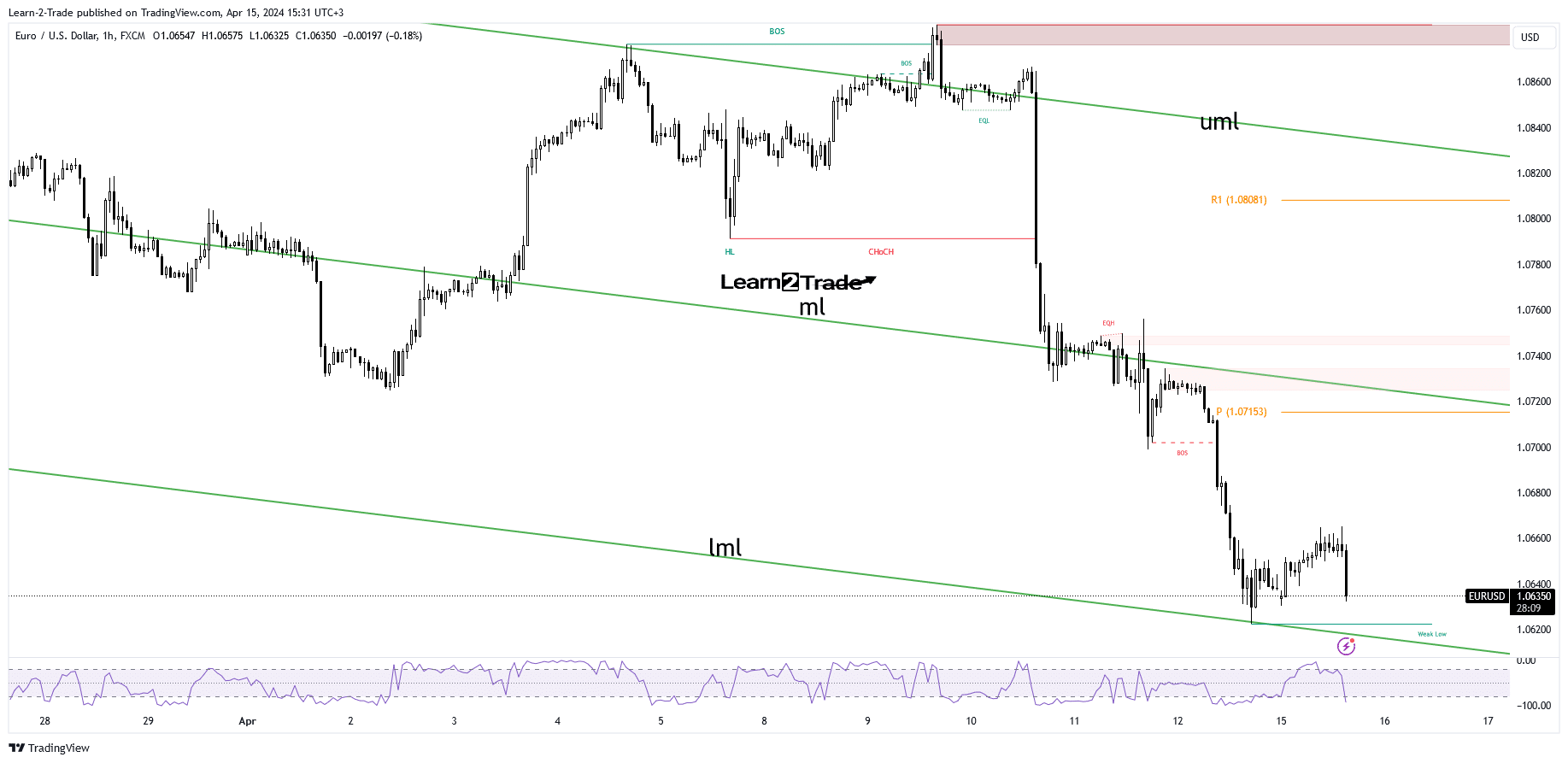

EUR/USD Price Technical Analysis: Strong Bearish Pressure

(Click on image to enlarge)

EUR/USD 1-hour chart

Technically, the EUR/USD pair found support right on the descending pitchfork’s lower median line (lml) and tried to rebound. This is dynamic support, and the price could be returned to rechallenge it.

Only a new lower low, dropping and closing below 1.0622, activates more declines, a deeper drop.

On the contrary, new false breakdowns below the lower median line could announce an oversold situation. Still, a potential reversal is far from being confirmed.

More By This Author:

GBP/USD Outlook: Pound Maintains 5-Month Low Following DataGBP/USD Weekly Forecast: Fed’s Delayed Cut Weighs On Pound

EUR/USD Price Analysis: Euro Tumbles Amid ECB’s Cut In June

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more