EUR/USD Price Analysis: Hits 1-Yr Top As USD Struggles

Today’s EUR/USD price analysis is bullish. On Friday, the Euro reached a one-year high while the US dollar fell to a one-year low versus a basket of currencies. The dollar fell on hopes that the Fed’s cycle of rate hikes was about to end due to signs of slowing inflation.

Last week saw a greater-than-expected increase in the number of individuals submitting new claims for unemployment benefits. This provided more proof that the labor market was gradually easing as higher borrowing prices dampened demand.

Other data released by the Labor Department on Thursday showed producer prices declining by the most in almost three years in March and a decline in sticky services inflation. This highlighted the economy’s decreasing momentum.

The producer price index, which was stable in February, fell by 0.5% in March, the highest since April 2020, according to the Labor Department.

The PPI rose 2.7% during the previous 12 months, ending in March. It came after a 4.9% increase in February and was the lowest increase since January 2021.

According to CME Group’s FedWatch tool, financial markets are betting the Fed will boost rates by a final 25 basis points at its policy meeting on May 2-3.

Ray Attrill, from National Australia Bank, said, “The euro has been the simplest way to express a dollar negative view.”

EUR/USD Key Events Today

Investors will see the state of consumer spending in the US when the retail sales and core retail sale reports are released. This might also influence the Fed’s policy path.

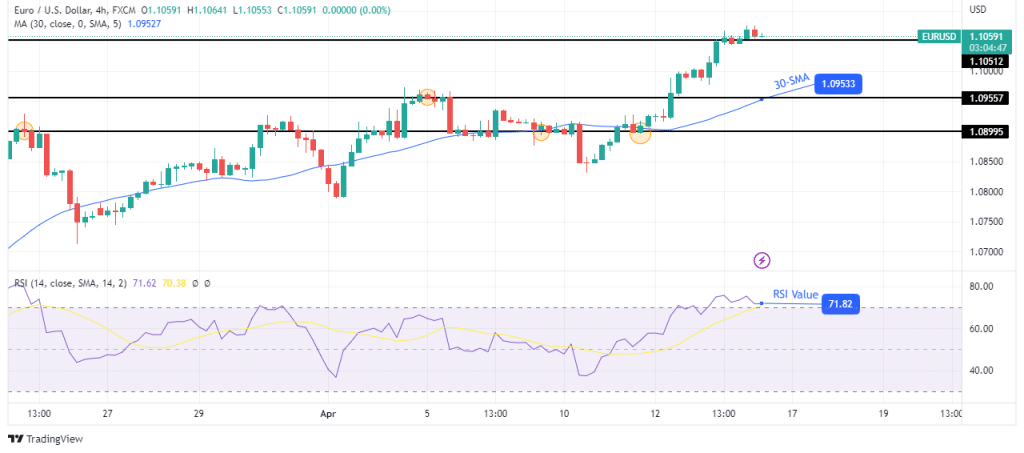

EUR/USD Technical Price Analysis: A Pause In The Uptrend At 1.1060

(Click on image to enlarge)

In the 4-hour chart, the bias for EUR/USD is bullish. The price is trading far above the 30-SMA, and the RSI is overbought, showing strong bullish momentum. The price made a strong impulsive leg after breaking above the 1.0955 resistance level. It broke above the 1.1051 resistance but must push higher to confirm the break.

There is a high chance the price will pull back as it is overbought. Therefore, we might see it retrace the recent move before the uptrend continues.

More By This Author:

USD/CAD Outlook: Tumbling to 1.33 Amid Easing US InflationGold Weekly Forecast: Bulls Dependent Over US CPI Data

USD/CAD Weekly Forecast: Upbeat Canadian Data Aiding Bears