EUR/USD Price Analysis: Euro Tumbles Amid ECB’s Cut In June

The EUR/USD price analysis reveals a compelling downtrend, with the euro declining amid optimism that Eurozone inflation is set to hit the coveted 2% mark. Meanwhile, the dollar strengthened as investors scaled back rate cut expectations after the US inflation report.

On Friday, an ECB poll of economists confirmed that inflation in the Eurozone would decline to 2% and stay there. Markets took this as another sign that the ECB will be ready to cut interest rates in June, well before the Federal Reserve.

The ECB held rates on Thursday and signaled the first rate cut in June. ECB president Christine Lagarde noted that inflation was on a clear path down. Therefore, it will be appropriate to start cutting interest rates. Moreover, she said that the ECB was data-dependent and not Fed-dependent. Consequently, they will not wait for the Fed to start the rate-cutting cycle.

The recent US inflation data has delayed the Fed’s rate-cut cycle significantly, with investors now expecting it to start in September. Furthermore, the US economy is performing much better than the Eurozone economy. For six quarters, the Eurozone economy has stagnated. Additionally, the labor market has slowed down. Therefore, the forces that have driven inflation are subsiding.

On the other hand, the US economy has remained resilient, and the labor market is hot, keeping inflation high. Consequently, the Fed will remain cautious about rate cuts. Nevertheless, there is uncertainty about the ECB’s policy outlook after June, as the ECB will likely monitor progress on US inflation.

EUR/USD key events today

- US preliminary UoM consumer sentiment

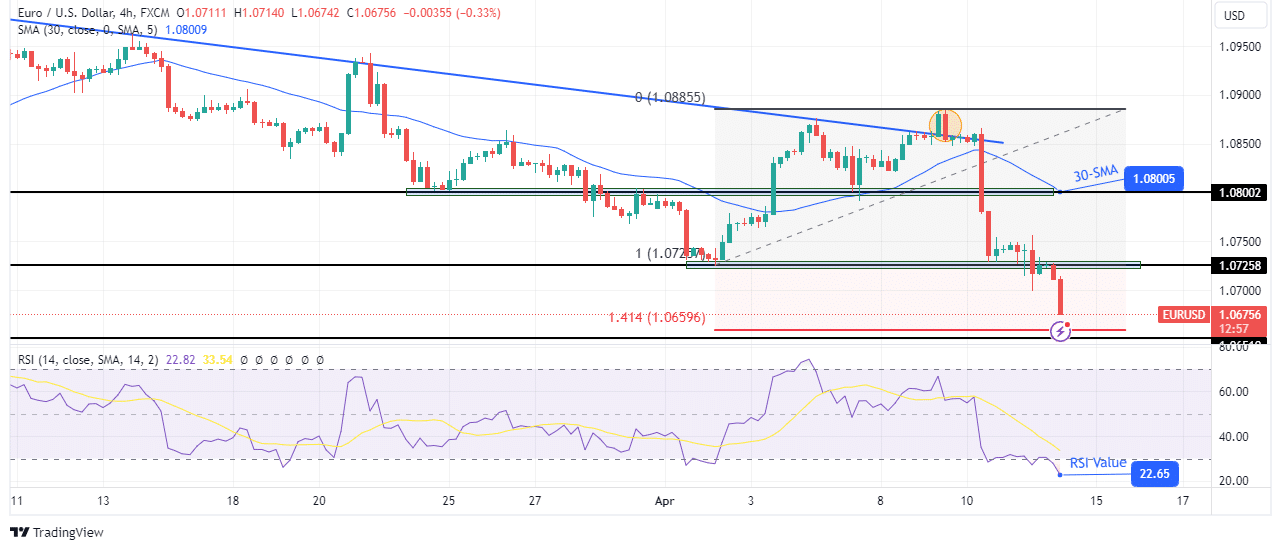

EUR/USD technical price analysis: Price continues downward spiral below 1.0725

(Click on image to enlarge)

EUR/USD 4-hour chart

On the charts, the EUR/USD price is in freefall. Since the false trendline breakout, the price has broken below several major support levels. Recently, it broke below the 1.0725 support to make a lower low. Consequently, the price now sits far below the 30-SMA. Additionally, the RSI is deep in bearish territory, supporting a bearish bias.

Bears will likely soon reach the 1.414 Fib extension level, where the decline might pause or pull back. A pullback would allow the price to retest the 30-SMA resistance before continuing its downtrend.

More By This Author:

USD/CAD Outlook: Bullish As BoC-Fed Divergence WidensUSD/CAD Forecast: CAD Retreats, USD Advances On Jobs Data

EUR/USD Forecast: Dollar Softens Amid Signs Of Economic Easing

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more