EUR/USD Price Analysis: Downbeat EU CPI To Weigh On Euro

The EUR/USD price analysis reveals a gloomy outlook as the pair struggles to recover from the recent lows triggered by the disappointing Eurozone inflation report on Tuesday. The dollar, on the other hand, holds steady as investors await the outcome of the FOMC policy meeting.

Notably, inflation in the Eurozone is rapidly decreasing, and the economy has started contracting. It demonstrates the combined effects of continuous European Central Bank interest rate hikes.

According to a flash reading by Eurostat, prices increased by only 2.9% in October. It marked the slowest pace since July 2021, when the ECB was still concerned about inflation remaining below its 2% target. However, the significant drop from double-digit figures just a year ago has consequences. The Eurozone economy contracted by 0.1% in the three months ending in September. Consequently, it is on the brink of entering a recession.

Furthermore, these two pieces of data suggest that the ECB has likely concluded its series of interest rate hikes. Therefore, the central bank will now observe the effects of these hikes before considering further actions.

Meanwhile, Yannis Stournaras, the Greek central bank governor and an ECB policymaker, noted the possibility of a rate cut around the middle of next year if inflation remains below 3%.

EUR/USD key events today

Investors are expecting a large number of economic events from the US, including,

- The FOMC policy meeting.

- The JOLTs job openings report.

- The ISM Manufacturing PMI report.

- The ADP Nonfarm Employment Change.

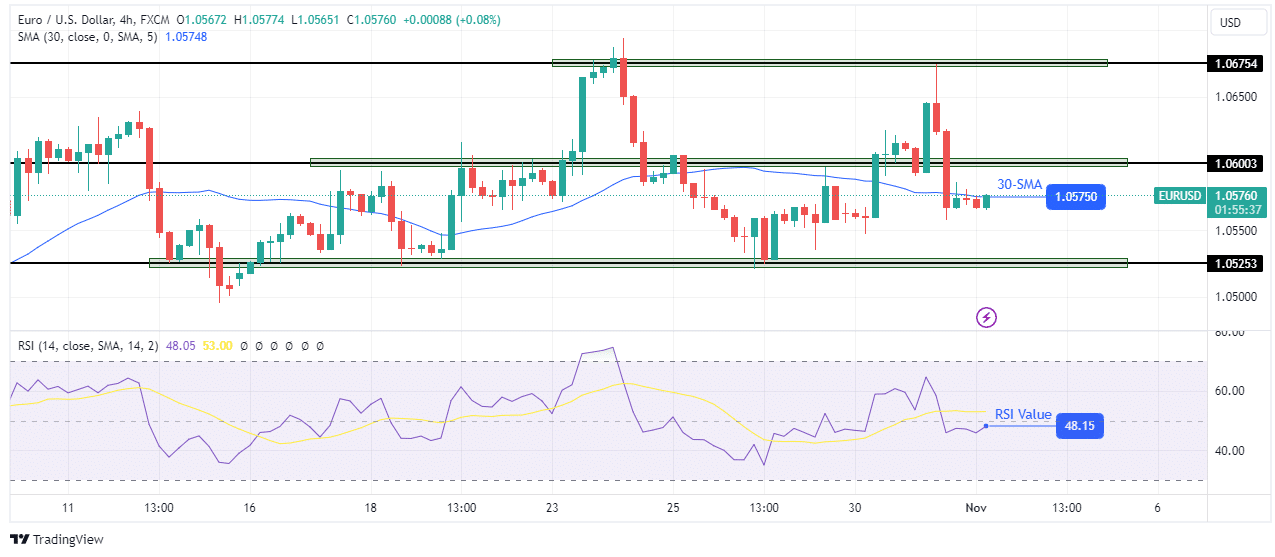

EUR/USD technical price analysis: Bearish Momentum Grows, Targeting Key 1.0525 Support.

(Click on image to enlarge)

EUR/USD 4-hour chart

The EUR/USD price fell sharply after touching the 1.0675 resistance level. Consequently, the price broke below the 1.0600 key level and the 30-SMA. At the same time, the RSI fell below 50, signifying a shift to bearish sentiment.

EUR/USD does not yet have a clear direction as the price has mostly chopped through the 30-SMA. This lack of direction can also be seen in the RSI, shifting between bullish and bearish territory. Currently, bears have seized control and are targeting the 1.0525 support. However, the price will only start a downtrend if the price breaks below 1.0525 and stays below the 30-SMA.

More By This Author:

USD/JPY Outlook: Yen Slides Amid BoJ Policy ShiftGBP/USD Price Analysis: Dollar Pauses Ahead Of FOMC

GBP/USD Weekly Forecast: BOE’s Tightening Nears Finish Line

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more