EUR/USD Outlook: Europe’s Inflation Expectations On The Rise

Today’s EUR/USD outlook is bearish as the number of Americans who applied for new unemployment benefits grew slightly last week. A sign that the labor market is still tight despite the Federal Reserve’s aggressive interest rate increases intended to reduce demand.

“Fed officials are hitting the brakes hard, but so far, employers are just giving this policy a great, big yawn and holding on tight to their workers,” said Christopher Rupkey, chief economist at FWDBONDS.

In support of the European Central Bank’s further plans to increase interest rates, board member Isabel Schnabel stated on Thursday that price increases and inflation in the Eurozone are expected to be greater and more persistent than previously anticipated.

The ECB increased rates by 125 basis points over its most recent two sessions to combat inflation which is getting close to 10%. The markets have priced more hikes at the ECB’s meetings through next spring.

“There are reasons to believe that inflation may even go up a bit further over the short term,” Schnabel told a conference organized by financial firm Spuerkeess of Luxembourg.

“Inflation may actually be more persistent than we originally thought,” she said

Another concern is that longer-term expectations have started to rise, which may signify that firms and individuals are losing faith in the ECB’s ability to return price growth to its objective of 2%.

EUR/USD Key Events Today

The S&P Global PMI report for the Eurozone will show the state of business activity in the bloc. Investors will also pay attention to Fed Chair Powell, who will speak later today.

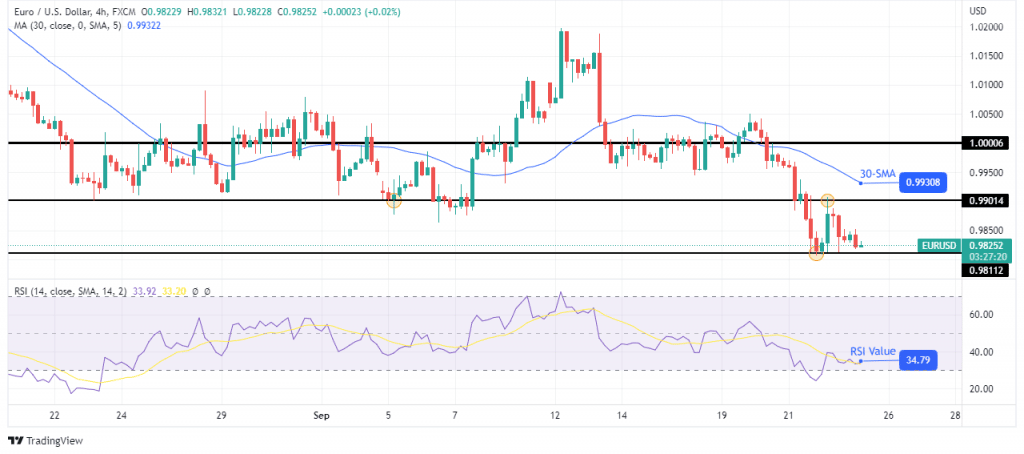

EUR/USD Technical Outlook: Downtrend Bound To Continue Below 0.9811

(Click on image to enlarge)

The 4-hour chart shows the price trading well below parity and the 30-SMA. After a long battle, bears have won, pushing the price below parity. This win was confirmed when the price broke below 0.9901. The RSI also supports bearish momentum trading below 50.

The downward move stopped at 0.9811 as the price was oversold, giving bulls a chance to come in and retest 0.9901 as resistance. The price now looks set to make lower highs and lower lows below 0.9811, and the downtrend will continue if the price keeps trading below the 30-SMA and RSI below 50.

More By This Author:

GBP/USD Weekly Forecast: Bearish Momentum Ahead Of Fed And BoE

EUR/USD Forecast: ECB Express Diverging Views on Rate Hikes

AUD/USD Weekly Forecast: Aussie Decline Pauses Ahead of US Inflation

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more