EUR/USD Outlook: ECB Fails To Suppress Rate-Cut Bets

ECB policymakers fell short in reducing rate-cut expectations, resulting in a bearish EUR/USD outlook on Thursday. Two influential ECB hawks tried to discourage traders from speculating on impending rate cuts on Wednesday. However, their efforts failed to yield any results. Moreover, investors remained cautious ahead of the US GDP report.

Bundesbank President Joachim Nagel and his Dutch counterpart Klaas Knot emphasized the need for the ECB to take time before signaling victory over historically high inflation.

Nagel stated, “We must initially remain at the current interest rate plateau so that monetary policy can fully develop its inflation-dampening effect.” Additionally, he warned speculators about expecting an imminent interest rate cut, advising them to be careful as some have already miscalculated.

However, Nagel admitted that rates had likely reached their peak. This sentiment was echoed by Knot. Still, traders maintained their expectations. Notably, after a weaker-than-expected inflation print in Britain, they raised their bets on lower ECB rates.

Moreover, money markets fully expect 150 basis points of cuts for the next year. It would take the ECB’s deposit rate to 2.5%. Moreover, there is a slight risk ECB rates will end the year at 2.25%.

At the same time, investors eagerly awaited more US economic data for additional insights into the global interest rate trajectory. The final estimates of US third-quarter GDP and the weekly jobless claims report will give clues on Fed rate cuts.

EUR/USD key events today

- The US Gross Domestic Product report

- The US initial jobless claims report

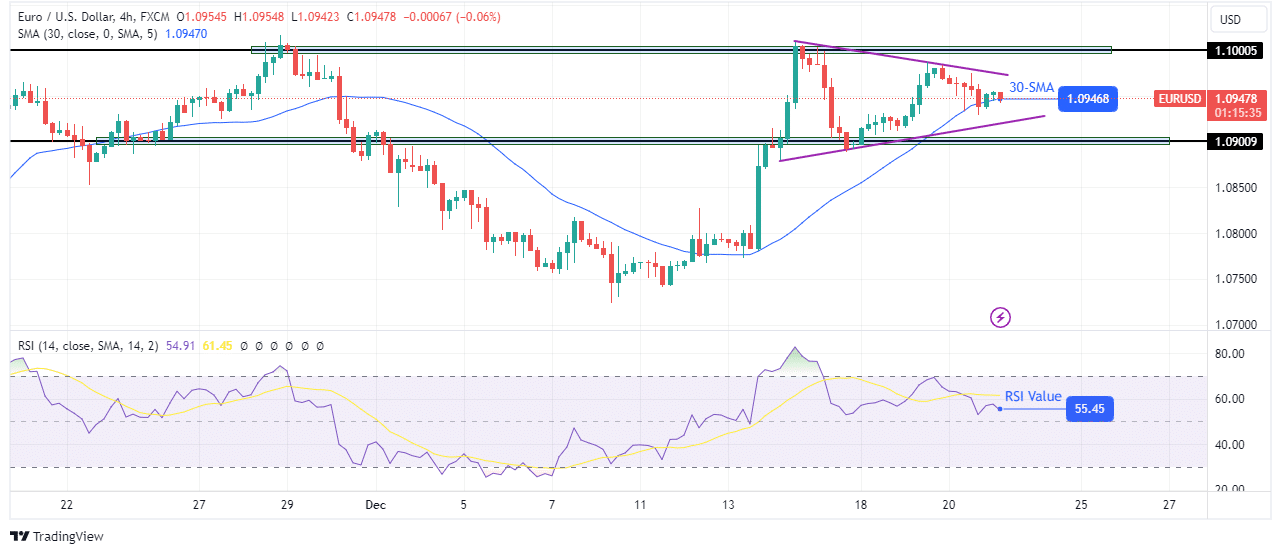

EUR/USD technical outlook: Price consolidates after hitting strong resistance

(Click on image to enlarge)

EUR/USD 4-hour chart

On the charts, the EUR/USD uptrend has paused to consolidate after meeting strong resistance at the 1.1000 key level. The price now trades between the 1.1000 resistance and the 1.0900 support levels. Moreover, the price respects clear trendline support and resistance levels, forming a wedge pattern.

Looking at the indicators, the RSI is above 50, while the 30-SMA sits below the price, pointing to a bullish bias. Therefore, bulls might get another chance to retest the 1.1000 key resistance level. However, if the price breaks below the SMA, it might continue consolidating between the 1.1000 and 1.0900 key levels.

More By This Author:

Gold Price Turns Soft After Downbeat UK Inflation FiguresUSD/CAD Price Analysis: Investors Reevaluate BoC Rate Cuts

USD/CAD Outlook: Dollar Weakens Amid Fed Rate Cut Bets

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more