EUR/USD On The Edge Of Multi-Year Lows, But May Find Its Feet

- EUR/USD has been falling toward 1.09 amid growing economic divergence, coronavirus headlines.

- Fed Chair Powell and ECB President Lagarde are set to move markets.

- Tuesday’s four-hour chart is pointing to oversold conditions.

How low can the euro go? The world’s most popular currency pair is trading close to the 2019 trough of 1.0879, and a break below this level opens the door to levels last seen in 2017.

What has moved EUR/USD

The main downside driver of euro/dollar has been economic divergence. The US economy enjoys solid growth – with Friday’s jobs report still underpinning the greenback – while the old continent is struggling. Monday’s Sentix Investor Confidence missed with 5.2 points, expressing lower expectations.

The euro has also been suffering from political developments in Germany. Annegret Kramp Karrenbauer resigned from leading Chancellor Angela Merkel’s ruling CDU party and the grand coalition seems vulnerable.

The coronavirus outbreak continues dominating headlines with the death toll topping 1,000. On the other hand, most of China is back to work after extended holidays and the number of new cases has fallen. Stock markets are on the rise and the safe-haven US dollar is edging lower. Nevertheless, EUR/USD’s uptick is minimal – a dead cat bounce. The common currency is exposing its weakness.

Central bankers in focus

Jerome Powell, Chairman of the Federal Reserve, goes to Capitol Hill for his twice-annual testimony. The Fed has been stressing that current interest rates are appropriate, but bond markets foresee a rate cut in September.

Powell will probably try to strike a balance between healthy economic growth at home and risks from the coronavirus. Some analysts expect him to leave the door open to fresh cuts, thus allowing the dollar to slide.

Christine Lagarde, President of the European Central Bank will also be testifying before lawmakers. Lagarde has completed 100 days in her position and she reportedly wants to conclude the bank’s strategic review in July and not by year-end.

The former head of the International Monetary Fund’s comment on recent weak figures in the eurozone may weigh on the euro, but so far, she has been cautious.

Overall, coronavirus headlines will compete with central bankers for influence on euro/dollar.

EUR/USD Technical Analysis

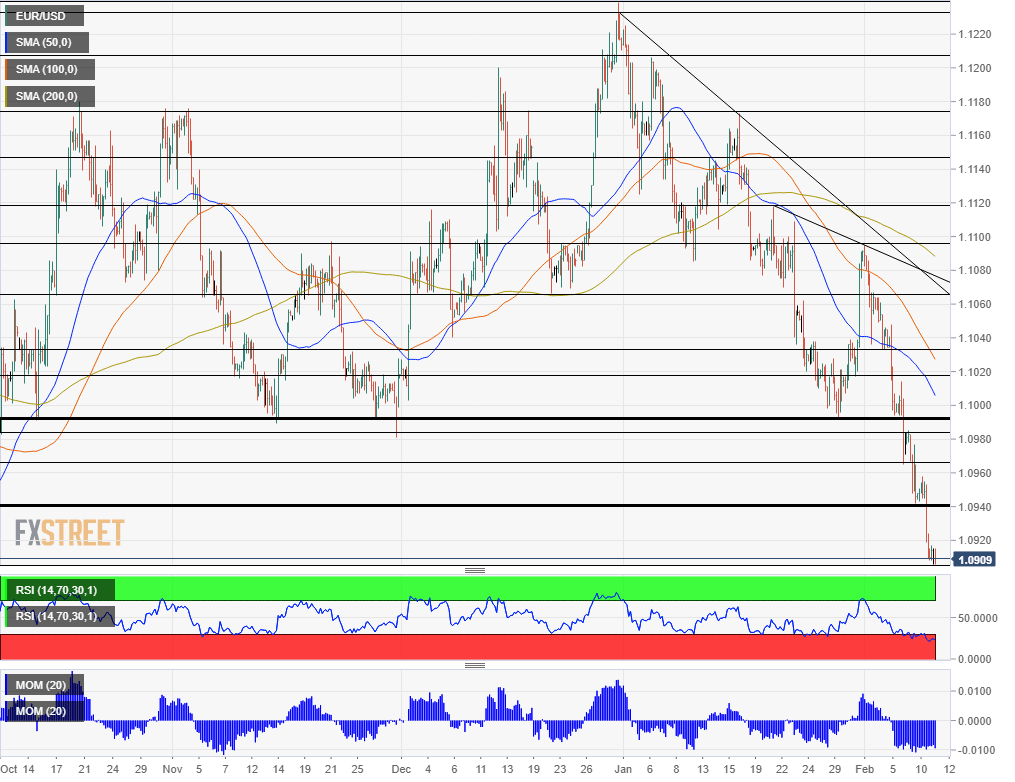

(Click on image to enlarge)

The Relative Strength Index on the four-hour chart is well below 30 – indicating oversold conditions and an upcoming bounce. However, this rise may be shortlived as momentum remains to the downside and the pair continues trading below the 50, 100, and 200 Simple Moving Averages.

Some support awaits at the daily trough of 1.0905, which is also the lowest since October. The next level is critical – 1.0879 was the 2019 low. Further down, prices seen back in 2017 await EUR/USD, and these include 1.0810 and 1.0790.

Resistance is at 1.0925, which had a role in October, followed by 1.0940 which provided support earlier in February. Next, we find 1.0965 and 1.0985.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more