EUR/USD Jumped As Trump Held Fire On Iran, Waller Fueled Cut Bets

Image Source: Pixabay

- The EUR/USD currency moved up by 0.36% on Friday, as it appeared set to end week flat after Trump delayed military action against Iran.

- Waller’s call for a July cut contrasted with the recent Fed report and Barkin’s cautious stance.

- The EU-US trade deal looks to be in jeopardy as the July 9 deadline nears, capping upside potential.

The euro recovered some ground against the US dollar on Friday, and it appeared set to finish the week virtually flat as risk appetite continued to deteriorate. This price action took place despite the delay of military intervention in the Israel-Iran conflict by US President Donald Trump. At the time of writing, the EUR/USD currency pair was seen trading at around 1.1534, up 0.36%.

Market appetite turned negative due to US trade policies restricting chipmakers with production interests in China, as a top US official seeking to revoke waivers sent major US indices tumbling. In the meantime, Trump’s decision to support diplomacy over fighting, delaying a possible attack for two weeks, underpinned the shared currency. Nevertheless, Iran said it would not negotiate while Israel continued hostilities.

Another event that boosted the euro was Federal Reserve Governor Christopher Waller announcing that he supports a rate cut in July. Contrarily, the Fed monetary policy report suggested that current policy is well-positioned amid uncertainty of external shocks, while Richmond Fed President Thomas Barkin favored further patience before reducing rates.

Despite this, the EUR/USD pair could be pressured in the coming days due to the failure to reach a trade agreement between the European Union and the United States. The chances of a deal are diminishing as the clock ticks toward the July 9 deadline.

On the data front, the EU revealed that the EU Consumer Confidence index disappointed investors, though traders shrugged off the bad reading and drove the EUR/USD pair higher.

The Euro Price This Week

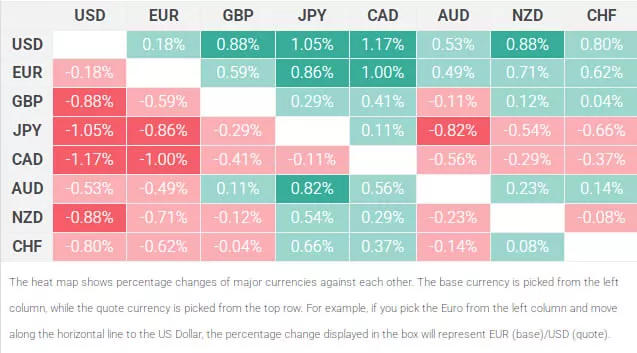

The table below shows the percentage change of the euro against other listed major currencies over the week. The euro was the strongest against the Canadian dollar.

Market Movers: The EUR/USD Pair Shrugged Off Fed Hawkishness and Rallied

- Geopolitics will continue to drive price action, which so far has benefited further US dollar appreciation. Hence, a risk-off environment is most likely to push the EUR/USD pair downward, even though the “Sell America” trade has remained intact.

- Fresh data from the United States signaled a cooling economy, with the Philadelphia Fed Manufacturing Index holding at -4 in June, unchanged from May but falling short of expectations for a more minor contraction of -1.

- Fed Chair Jerome Powell said the bank is in wait-and-see mode, adding that policy is modestly restrictive. He added that as long as the labor market remains solid and inflation cools down, holding rates is the “right thing to do.”

- During the week, the Fed held rates unchanged at 4.25%-4.50%. Fed officials updated their economic projections, downgrading the 2025 GDP growth outlook to 1.4% from 1.7% in March. The Unemployment Rate forecast was revised up to 4.5% from 4.4%, while the core PCE inflation projection rose to 3.1% from 2.8%.

- EU Consumer Confidence in June fell to -15.3, which was worse than the expected -14.5 reading.

- Financial market players do not seem to expect that the ECB will reduce its Deposit Facility Rate by 25 basis points at the July monetary policy meeting.

Euro Technical Outlook: The EUR/USD Pair Climbed Above 1.1500, Bulls may Target 1.1550

From a technical standpoint, the EUR/USD uptrend seemed to be resuming. The “morning star” three-candle chart pattern seemed to suggest that buyers have been accumulating, poised to drive the exchange rate higher. Further confirmation was provided by the Relative Strength Index (RSI), which aimed upwards after it stalled for two days.

Hence, the EUR/USD first resistance would be the 1.1550 mark. A breach of the latter would expose the 1.1600 level, followed by the YTD high of 1.1631. Conversely, a move below the 1.1500 level would pave the way to test the 1.1450 area. The next key support would be the 20-day Simple Moving Average (SMA) at 1.1438, followed by the 1.1400 level.

(Click on image to enlarge)

More By This Author:

EUR/USD Capped Below 1.1500 As Fed Stays Put, Trump Fuels Dollar StrengthGold Holds Steady Near $3,390 As Fed Projects Two Cuts In 2025

EUR/USD Jumps As Traders Look Past Iran-i\Israel Turmoil Ahead Of US Retail Sales

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more