EUR/USD Forecast: The Euro Is Still Exhibiting Lack Of Momentum

Euro's trading session sees little change, holding around 1.09 with focus on upcoming PPI figures for potential USD momentum. Market awaits ECB, Fed rate decisions.

- In the early hours of Wednesday, the euro did very little as we continue to search for some kind of momentum.

- Maybe the PPI figures, which are released later this week, will provide the necessary impetus for the US dollar to begin rising once more.

(Click on image to enlarge)

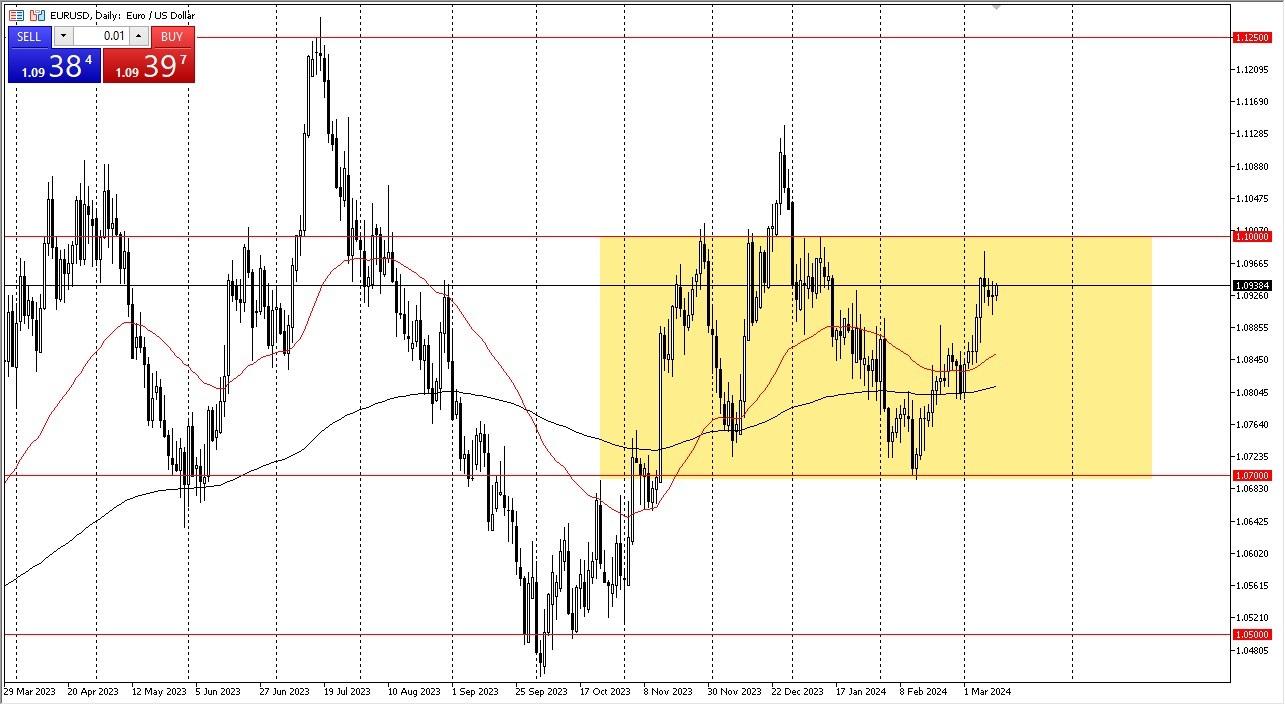

Euro Continues to Range Trade

As you can see, not much has changed during the trading session for the Euro. As a result, I believe that we will just keep bouncing around the 1.09 level, which serves as upward support. The resistance level is at 1.10. This is an area that a lot of people will be paying attention to as per usual with this being such a “large round figure” that people are typically attracted to.

Nevertheless, there is a much wider area of consolidation that is receiving attention. If everything else is equal, I believe that this market will serve as a proxy for the US dollar since both central banks are expected to lower interest rates later this year. The Fed has already acknowledged that they will do so, in fact. We'll have to wait and see, but the ECB has been making indications about that lately. This year's market is most likely going to be extremely limited. Having said that, we are approaching what might be a bit of a top. While I am keeping a close eye on this, there isn't really much to do in terms of swing trading.

On Thursday, the PPI numbers are expected to be released, which is likely to cause some volatility. However, at this point, if we can find enough exhaustion around the 1.10 level, I actually prefer shorting. I basically just avoid this pair until then, but I do explore lower timeframes to see what the dollar might do in relation to other currencies. Recall that this is the most frequently traded currency pair globally, and its inclusion of the dollar provides you with a sense of its relative strength. To put it simply, I use it as a tertiary indicator to determine how to position the US dollar in relation to a number of other currencies. I believe that this is a market that you should generally be aware of, even though you don't have to be actively involved in it right now.

More By This Author:

NASDAQ 100 Forecast: There Is Still Upward Pressure On The NASDAQ 100 IndexSP 500 Forecast: Buyers Are Still Found For Every Dip

AUD/USD Forecast: Hesitation Suggests Potential Retreat