EUR/USD Forecast: Selling Pressure Intensifies Ahead Of US Inflation Data

Our EUR/USD forecast sees the pair plunging after failing once again to stabilize above the 1.16 psychological level. The price drops as the Dollar Index accelerates its rally.

We have a strong negative correlation between these two. Still, the currency pair moves somehow sideways, so maybe we’ll wait for a clear direction and for a fresh and strong trading opportunity.

The volatility started to grow as the United States is to release its inflation data later.

The Consumer Price Index could register a 0.6% growth in the last month versus 0.4% in September, while the Core CPI may report a 0.4% growth in October compared to only 0.2% in the previous reporting period.

If you are interested in how to set up automated forex trading around economic calendar events, read our guide.

Moreover, the Unemployment Claims economic indicator is expected to drop from 269K to 257K in the previous week. A deeper drop could help the USD to appreciate versus the other major currencies.

The Final Wholesale Inventories and the Federal Budget Balance figures will be released as well, but I don’t expect these to have a significant impact on the EUR/USD pair.

The Euro drops even if the German Final CPI has come in line with expectations, while the Italian Industrial Production reported a 0.1% growth versus a 0.1% drop expected.

EUR/USD Forecast: Price Technical Analysis – Bearish Bias

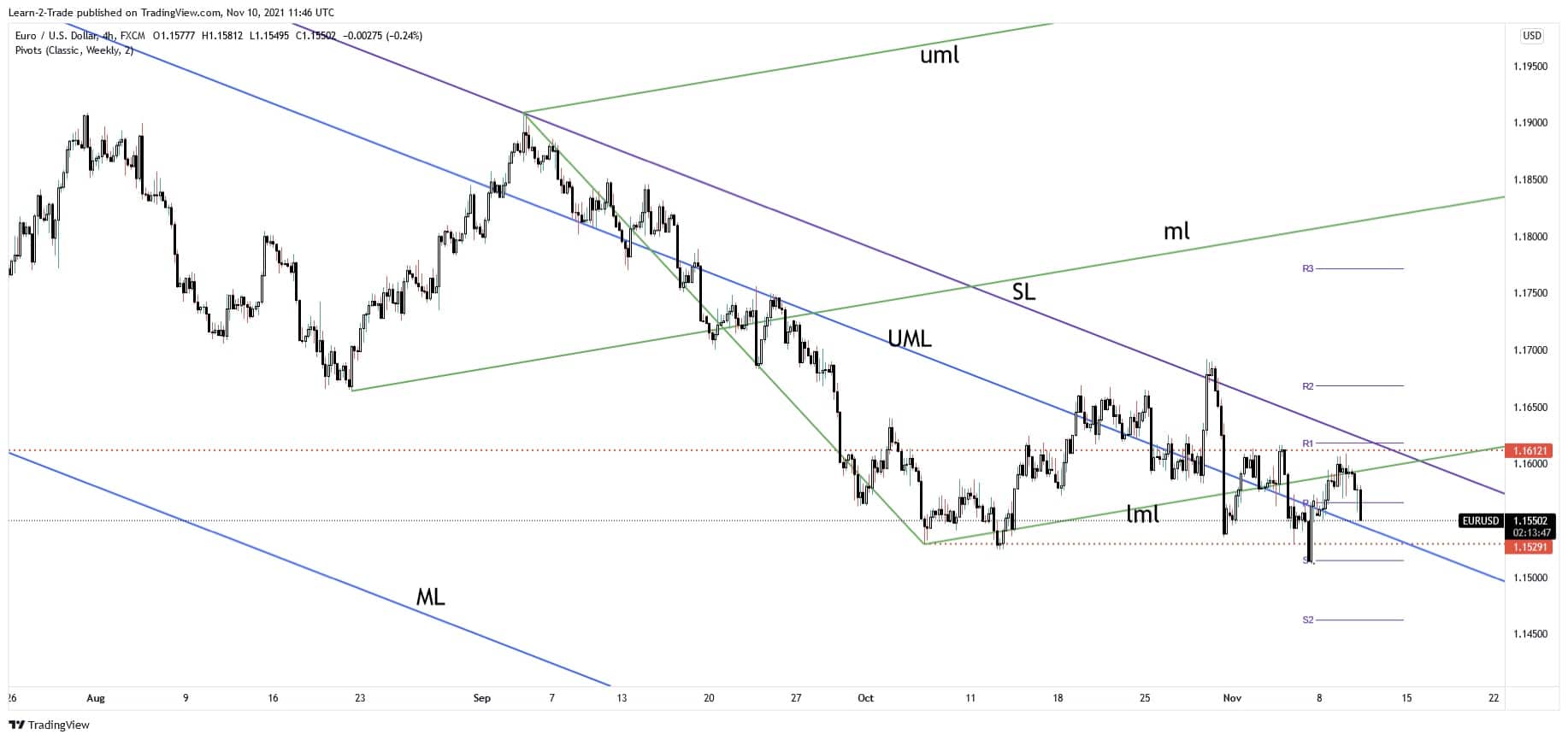

(Click on image to enlarge)

The EUR/USD pair failed to reach and retest the 1.1612 resistance, to stabilize above the ascending pitchfork’s lower median line (lml), or to reach the weekly R1 and the descending pitchfork’s sliding line. Now it is trading below the weekly pivot point 1.1566 and it challenges the upper median line (UML).

It’s trapped between 1.1612 and 1.1529 levels. Escaping from this pattern could bring us fresh trading opportunities. Coming back below the upper median line (UML) and making a new lower low could activate a larger downside movement.

On the other hand, a new bullish momentum followed by a valid breakout through the outside sliding line (SL) of the major descending pitchfork could signal potential leg higher.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more