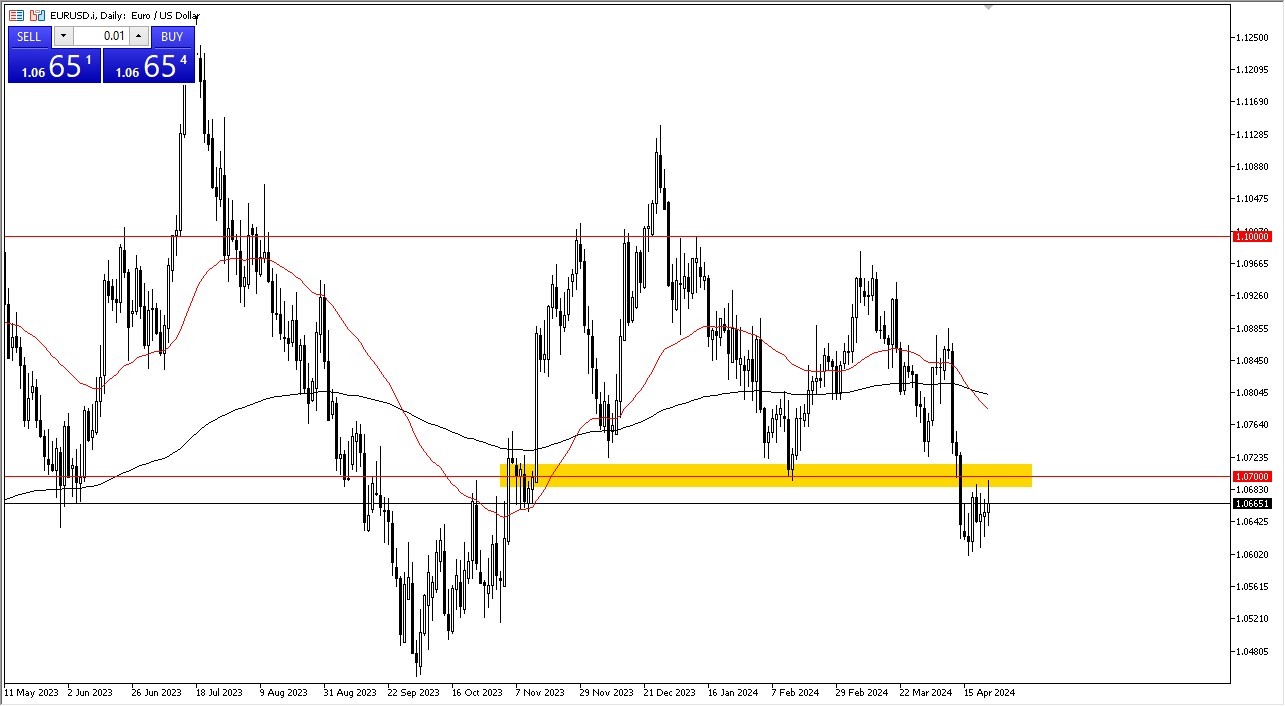

EUR/USD Forecast: Rangebound And Tight

Essentially you have a market that doesn't know which direction it wants to go, but at this point in time I think it's somewhat obvious that we are going to consolidate in the short term. This does make sense considering that there are a lot of concerns out there and we did just fall rather significantly due to the fact that the ECB looks likely to cut rates before the Federal Reserve.

Tit-For-Tat Trading?

That being said, we now find ourselves in a situation where the EUR/USD market is likely to continue to see a lot of tit-for-tat trading here as the Federal Reserve is likely to cut later as well. So really at this point, I don't see a clear winner here with the exception that the US dollar does get a little bit of a boost due to geopolitical concerns. So perhaps this remains a fade the rally type of trade.

(Click on image to enlarge)

The 50 day EMA above would be a target if we break above the 1.07 level, but I think also would also end up being a significant barrier. If we break down below the 1.06 level, then the 1.05 level underneath would be a target. While I don’t see that happening easily, it is a very real possibility at this point in time as there are so many things that people will be concerned about overall. This market will continue to see a lot of chop more than anything else from what I see. However, if you are a short-term trader, you might find value in this type of behavior.

More By This Author:

USD/JPY Forecast: Dips are OpportunitiesGBP/CHF Forecast: British Pound Has A Wild Ride Against The Franc

Pairs In Focus - Sunday, April 21

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and ...

more