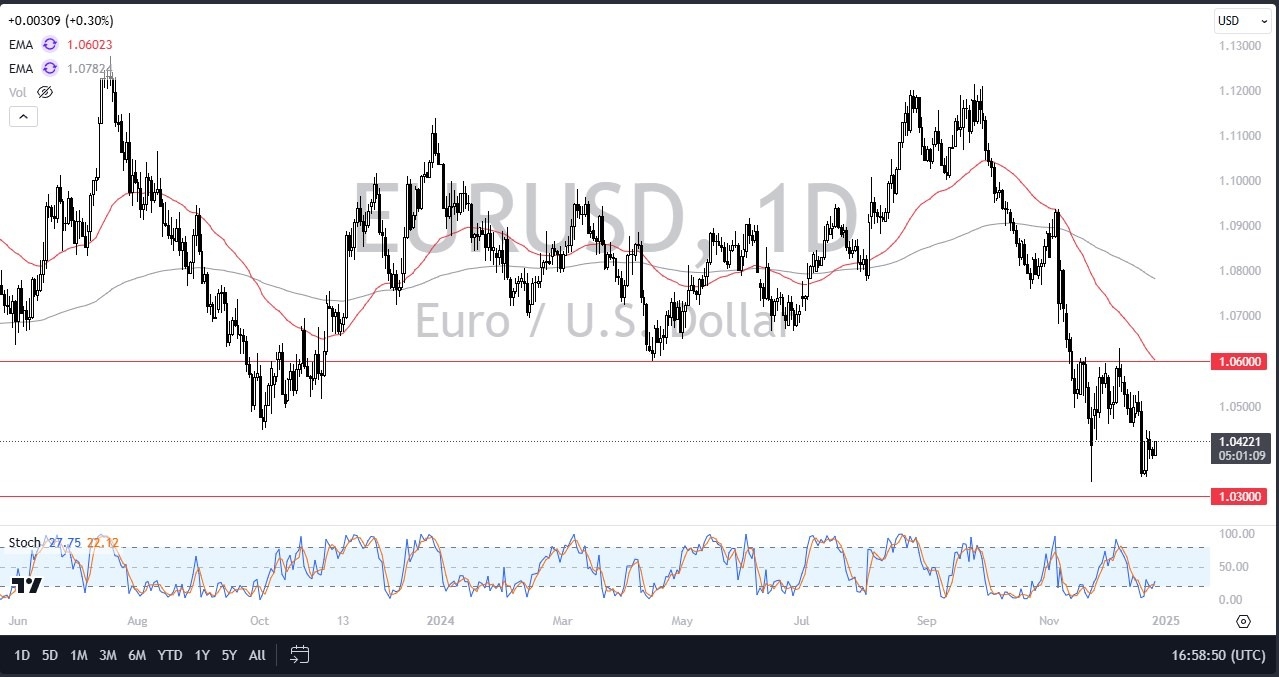

EUR/USD Forecast: Faces Resistance Near 1.06

Furthermore, the 1.06 level features the 50-day EMA, which is dropping pretty heavily, and that in and of itself could have technical traders looking to short the market. In general, I think you have a scenario where maybe the euro doesn't completely

Several Issues in Europe

We've recently had no confidence in the German or French governments. There is a huge problem with political upheavals in the European Union right now with the immigration problems. There's a hot war in Ukraine while not expanding in Europe. It certainly seems like the European leaders and the Russian leaders could be convinced to go after each other.

(Click on image to enlarge)

So, all of this and the fact that the European Union economy is slowing down really adds up for a weaker euro. Remember the ECB has recently cut rates, and they suggest that they're going to continue to do so while the Federal Reserve doesn't really seem to know what it wants to do. More importantly, and this is something most retail traders don't pay attention to, is that the 10-year yield in America is up 100 basis points one full percentage point instead of down as the Federal Reserve cut by 100 basis points. So, in other words, interest rates in America are a percent higher than they were in September, despite the fact that the Federal Reserve has cut interest rates by 1%. Remember, it's the bond market that sets this, not the Federal Reserve.

More By This Author:

GBP/USD Forecast: Stalls Near 1.25BTC/USD Forex Signal: Struggles At $100K

ETH/USD Forecast: Continues To See Upward Movement