EUR/USD Forecast: Dollar Recovers On Robust US GDP Growth

Today’s EUR/USD forecast presents a bearish outlook as the dollar stages a comeback from its three-month lows. This reversal comes on the heels of higher-than-expected growth in the US economy in the third quarter.

US gross domestic product expanded at a 5.2% annualized rate in the last quarter, exceeding the initially reported 4.9%. Moreover, this marked the fastest expansion since the fourth quarter of 2021. Economists had anticipated a growth revision to 5.0%.

Following the GDP data, futures showed an increased likelihood of a rate cut starting in March. There is an almost 50% chance of easing, compared to nearly 35% late on Tuesday.

The dollar gained against the euro. However, it is set to record its most significant monthly decline since November 2022. This is due to increasing expectations of an interest rate cut by the Federal Reserve in the first half of 2024.

Markets eagerly anticipate Fed Chair Jerome Powell’s response to comments made by Fed Governor Christopher Waller on Tuesday. Notably, Waller hinted at a possible rate cut in the coming months. Consequently, there was a slide in US bond yields and the dollar.

Meanwhile, the euro declined against the dollar after German inflation data on Wednesday indicated a slowdown to 2.3% year-on-year in November from 3% in October. Similarly, inflation in Spain experienced a sharp deceleration.

EUR/USD key events today

- Eurozone CPI

- US core PCE price index

- US pending home sales

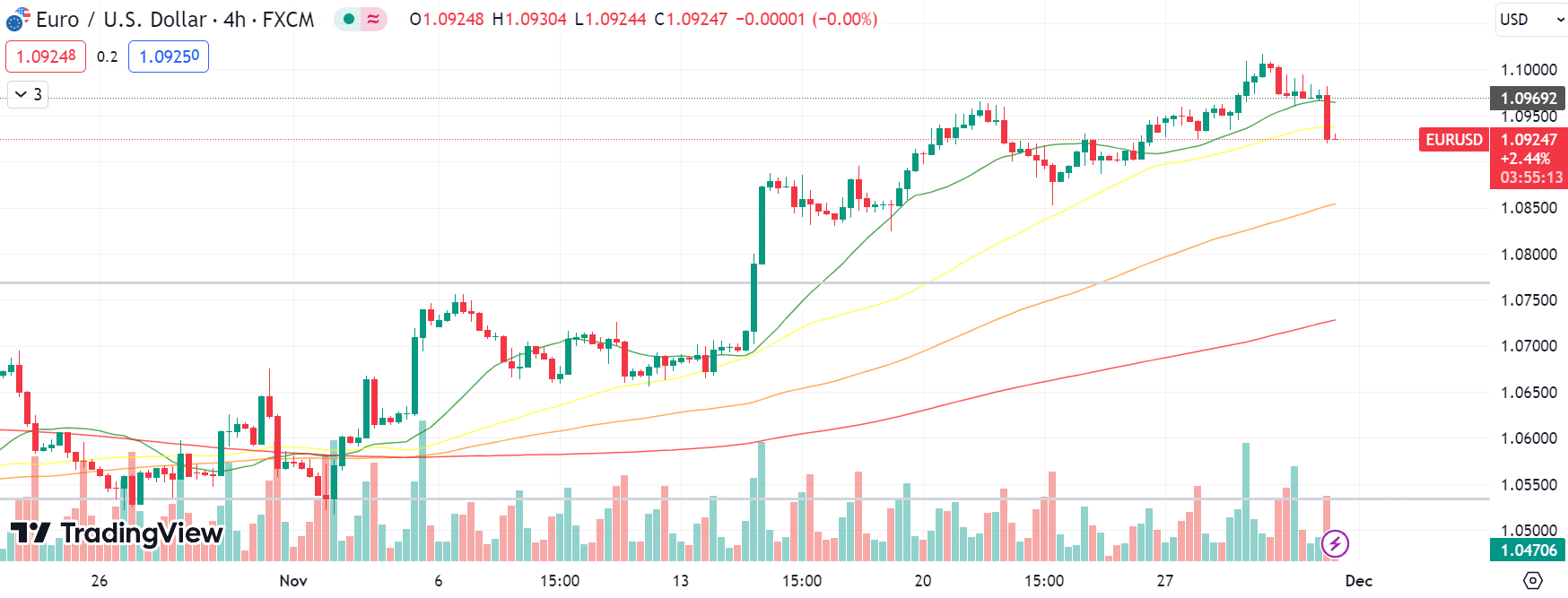

EUR/USD technical forecast: Resistance at 1.1000 prompts pullback

(Click on image to enlarge)

EUR/USD 4-hour chart

The EUR/USD price turned south, breaking the key support of 1.0950. The pair has closed below the 20-period and 50-period SMAs. The next stop for the sellers lies at 1.0860, which was the previous rejection zone and the 100-period SMA.

Alternatively, if the price retraces back above the today’s top, we will assume the resumption of a downtrend after a corrective downside move. However, the probability of the downside seems higher.

More By This Author:

GBP/USD Price Stalls as Buyers Fear US Prelim GDP DataAUD/USD Price Analysis: Bulls Hit 4-Month Top Despite Low CPI

EUR/USD Price Signals Buyers’ Exhaustion Near 1.0960

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more