EURUSD Consolidates Uptrend: Further Gains Or Reversal On The Horizon?

EURUSD has been navigating an uptrend, but recent price action suggests a potential shift. This analysis examines the technical outlook and explores potential scenarios for the currency pair.

Uptrend on Hold: Consolidation Phase Emerges

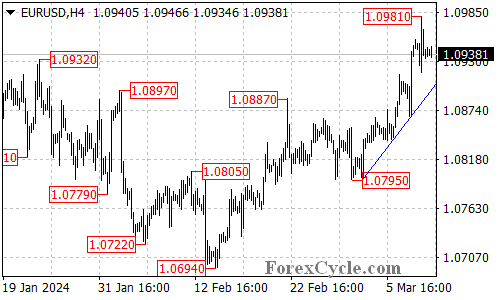

- Rising Trend Line Intact: EURUSD remains above the rising trend line on the 4-hour chart, indicating the uptrend that began at 1.0795 is still technically in play.

- 1.0981 High Reached: The uptrend recently extended to a high of 1.0981.

- Pullback Signals Consolidation: However, a subsequent pullback suggests a period of consolidation for the uptrend is underway. This means the price may trade sideways within a defined range for some time.

- Rangebound Trading Expected: In the coming days, we may see range trading between 1.0900 as support and 1.0981 as resistance.

Upside Potential Remains:

- Uptrend Resumption: As long as the price stays above the rising trend line, the uptrend could resume. A further rise towards the 1.1050 area is still possible after a successful breakout from this consolidation phase.

Key Support to Watch:

- 1.0900 Breakdown Critical: The key support level to watch is at 1.0900. A breakdown below this level could signal a break of the consolidation and trigger a further downside move towards 1.0850.

Overall Sentiment:

The technical outlook for EURUSD is currently uncertain. While the uptrend remains intact on the longer timeframe, the recent consolidation phase suggests a potential pause or even a reversal if support breaks. Close attention should be paid to the price action around the mentioned support and resistance levels to determine the future direction of EURUSD.

More By This Author:

GBPUSD Bulls Charge Higher: Can the Uptrend Break New Ground?USDCAD Slides Below Support: Downward Spiral Or Short-Term Correction?

USDCAD Slides Lower: Can The Bulls Find Support Or Face Deeper Decline?

Disclaimer: Futures, options, stocks, ETFs and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against ...

more