Euro Weekly Forecast: EUR/USD Faces Inflation Packed Week

EURO FUNDAMENTAL FORECAST: WATCHFUL

Last week’s fundamental catalysts gave the euro a boost towards the end of the week beginning with a better than expected services PMI figure for October as well as relatively hawkish commentary from ECB President Christine Lagarde. In her speech on Friday, Christine Lagarde eluded to past trends showing slowing growth has minimal impact on inflationary pressures. The message of utilizing all tools at their disposal was reiterated once more to bring down inflation to the 2% target level. Towards the end of the European session, U.S. Non-Farm Payroll (NFP) results were released and despite the fact that employment beat estimates, unemployment missed expectations coming in higher which is what markets ultimately reacted to, pushing the euro higher.

From an energy standpoint, the warmer int eh eurozone has helped lower energy prices and is expected to extend further into November and possibly December. The decline in prices should provide additional backing for the EUR against the USD but does not take away from other economic woes facing the region. Germany’s factory orders plummeted -4% MoM heightening recessionary fears and limiting the upside outlook for the euro.

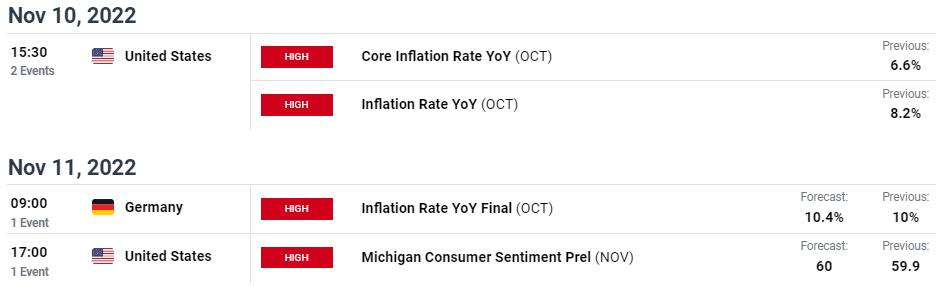

Looking ahead, EZ retail sales and CPI out of Germany dominate the economic calendar (see below) for the euro while inflation and consumer sentiment is the focus for the U.S.. While the line up in the upcoming week is comparatively mild, these inflation figures are almost as important as interest rate decisions under the current global backdrop. Central banks including the Fed and ECB are continually reminding us how data dependent they are and these releases can give a good gauge in terms of forward guidance.

EUR/USD ECONOMIC CALENDAR

(Click on image to enlarge)

(Click on image to enlarge)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

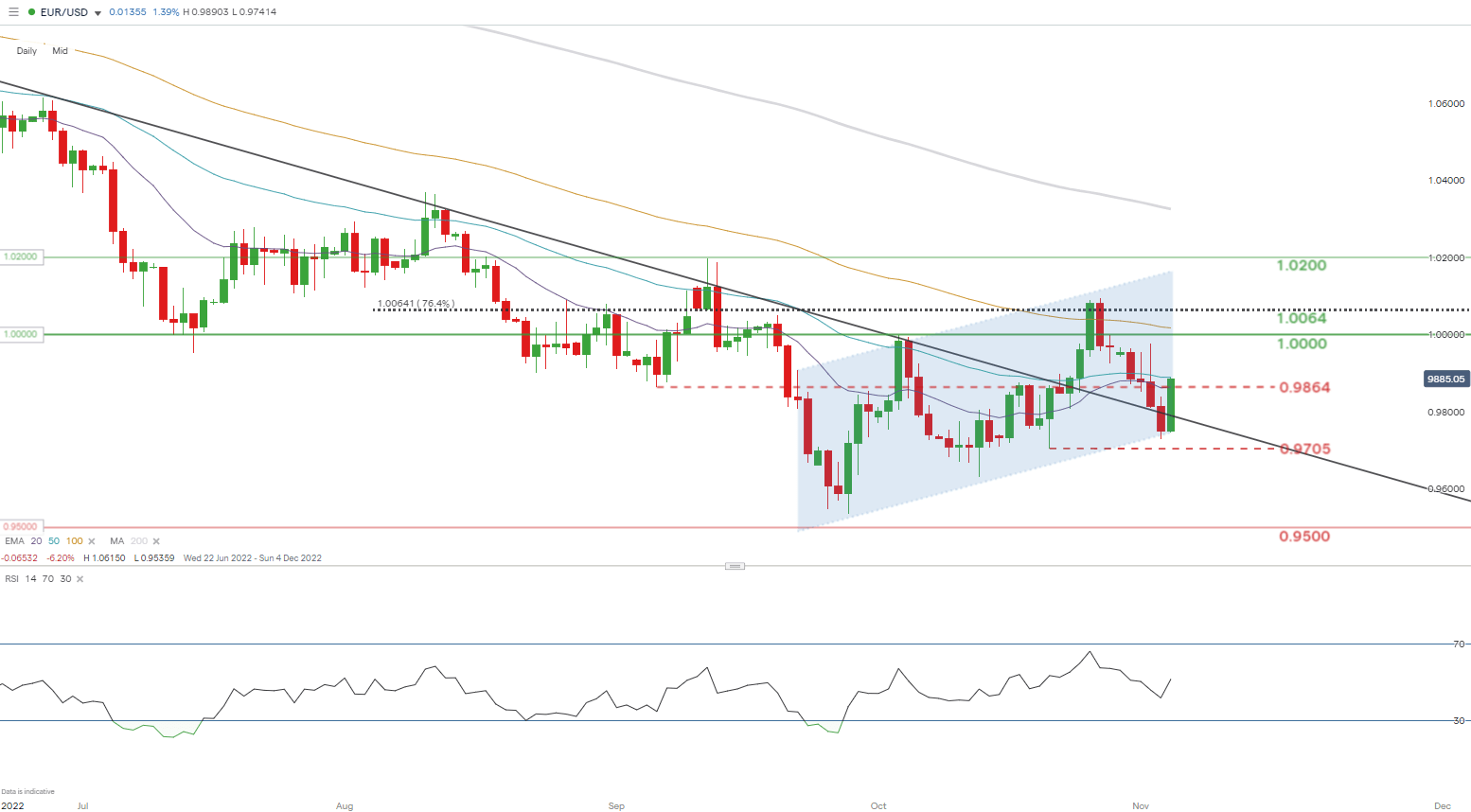

EUR/USD DAILY CHART

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action has bulls testing the key area of confluence around the 0.9864 handle, while the Relative Strength Index (RSI) shows market hesitancy going into next week. The mixture of push and pull factors clearly is being reflected in the lack of directional bias at this point which opens up room for increased volatility around next week’s economic events.

Resistance levels:

- 1.0000

- 50-day EMA (blue)

Support levels:

- 0.9864/20-day EMA (purple)

- 0.9705

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on EUR/USD, with 58% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning, we arrive at a short-term cautious disposition.

More By This Author:

Japanese Yen Fundamental Outlook: USD/JPY Turns to US Inflation ReportJapanese Yen Technical Outlook: USD/JPY, CHF/JPY, AUD/JPY Charts To Watch

Canadian Dollar Forecast: Hawkish BoC And Strong Jobs Data Should Keep The Loonie On The Front Foot