Euro Remains Under Pressure And Revisits 1.0550, New Six-month Lows

The Euro (EUR) experiences an increasing bearish sentiment against the US Dollar (USD), prompting the EUR/USD to decline and reach fresh six-month lows near 1.0550 on Wednesday.

Conversely, the Greenback continues to strengthen for the fourth consecutive session, reaching new highs for 2023 around 106.30 when gauged by the USD Index (DXY), an area last seen in late November 2022.

The further decline in the pair this time is accompanied by a corrective move in US and German yields, which abandon the area of recent multi-year highs despite unchanged expectations in the monetary policy scenario.

Regarding the latter, investors persist in factoring in an additional 25 bp rate increase by the Federal Reserve (Fed) by year-end. Meanwhile, discussions in the market continue to lean towards an impasse at the European Central Bank (ECB), even in light of persistent inflation levels significantly surpassing the bank's target and concerns about a recession.

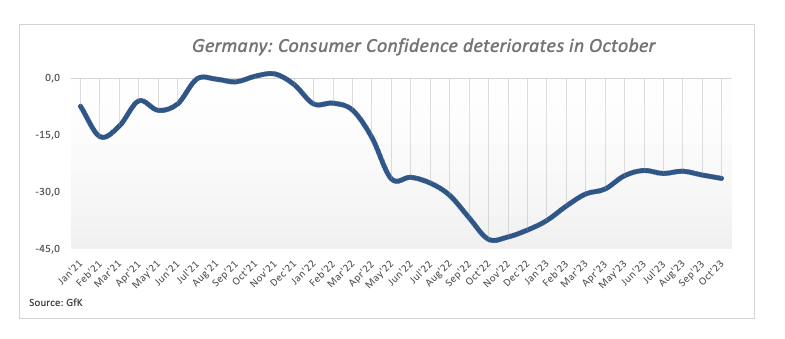

In the domestic calendar, Consumer Confidence in Germany weakened to -26.5, according to GfK.

(Click on image to enlarge)

In the US, Mortgage Applications tracked by MBA are due in the first turn, seconded by the more relevant Durable Goods Orders for the month of August.

Daily digest market movers: Euro leaves the door open to extra losses

- The EUR keeps the offered stance unchanged vs. the USD.

- US and German yields correct lower across different maturities.

- Investors continue to see the Fed raising rates by 25 bps before end of 2023.

- Markets speculate on probable interest rate cuts by the Fed in Q3 2024.

- Market chatter over a pause by the ECB remain on the rise.

- ECB’s Frank Elderson says rates haven’t necessarily peaked.

- Intervention concerns remain well and sound around USD/JPY.

- BoJ Minutes favoured the continuation of the current monetary stance.

Technical Analysis: Euro trades closer to 1.0516

The EUR/USD continues to demonstrate signs of weakness and is trading in close proximity to the March low, around 1.0515.

On the downside, immediate support for the EUR/USD can be found at the March low of 1.0516 (March 15), followed by the 2023 low of 1.0481 (January 6).

Regarding potential resistance levels, there is a minor obstacle at the weekly high of 1.0767 (September 12), and a more significant barrier at the 200-day SMA at 1.0828. If the pair manages to break above this level, it could pave the way for further recovery, targeting the temporary 55-day SMA at 1.0879, with the possibility of reaching the weekly high of 1.0945 (August 30). Surpassing this level could shift the focus towards the psychological level of 1.1000, followed by the August peak of 1.1064 (August 10). Beyond that, the pair may retest the weekly top at 1.1149 (July 27) and potentially reach the 2023 high at 1.1275 (July 18).

However, it is essential to note that as long as the EUR/USD remains below the 200-day SMA, there is a possibility that downward pressure will persist.

More By This Author:

Natural Gas Futures: Further Consolidation In The PipelineEUR/USD Price Analysis: A Drop To 1.0516 Looms Closer

Euro Remains Under Pressure Near The 1.0600 Region, Looks At US Calendar

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more