ES Market Observations

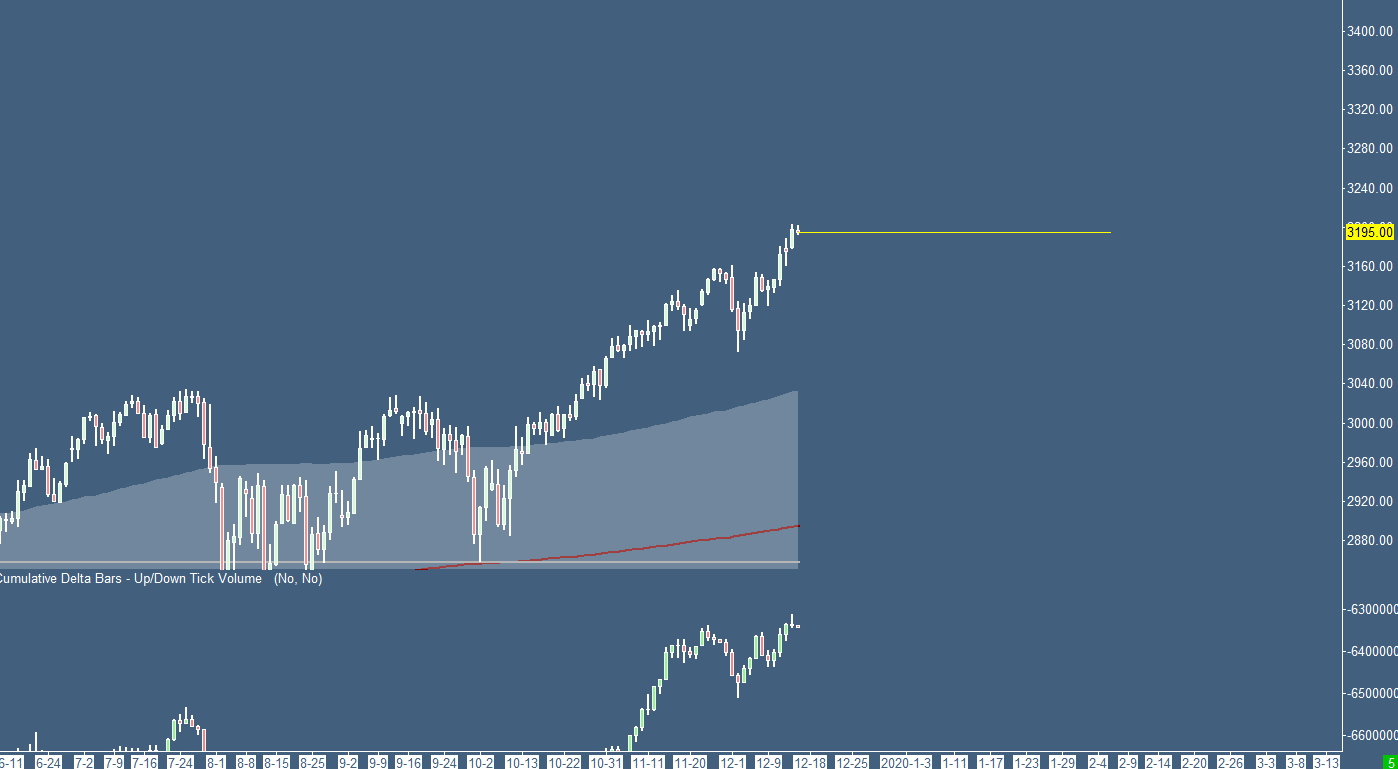

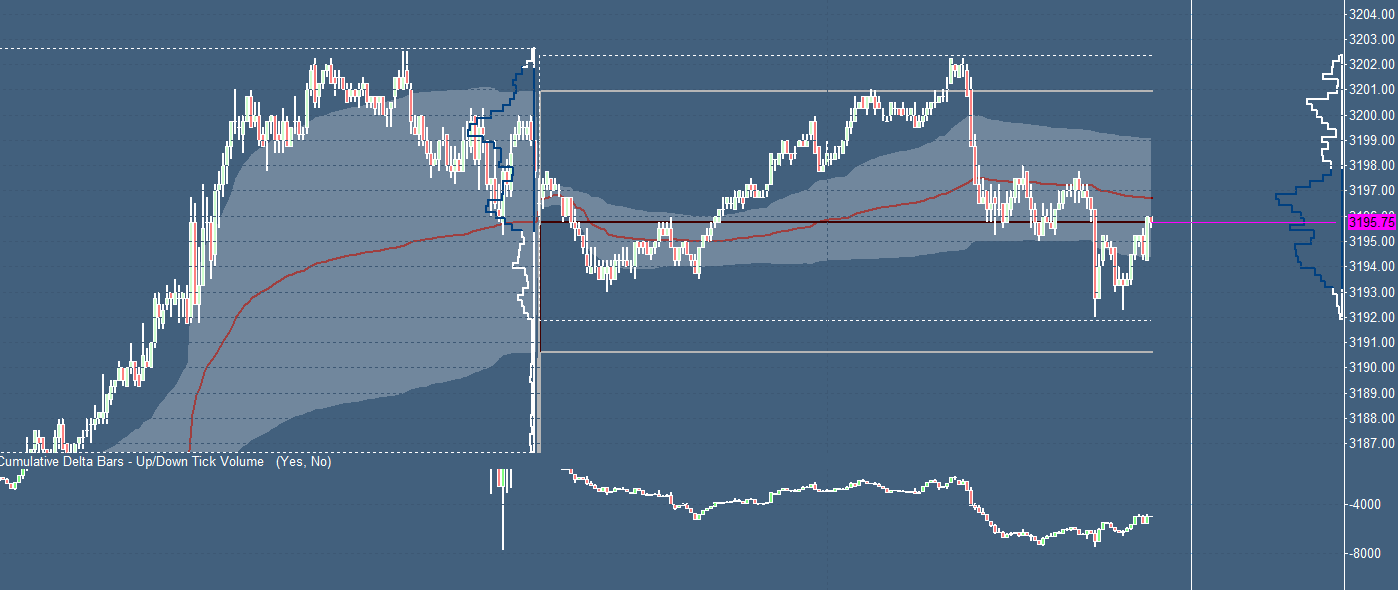

Looking at the daily perspective with a Yearly VWAP we can observe a one-time-framing higher behavior that occurs for 4 days. The market is trading quite far away from the Yearly developing value area. Taking a look at the Cumulative Delta we can see an absorption yesterday which gives a bearish view for today.

(Click on image to enlarge)

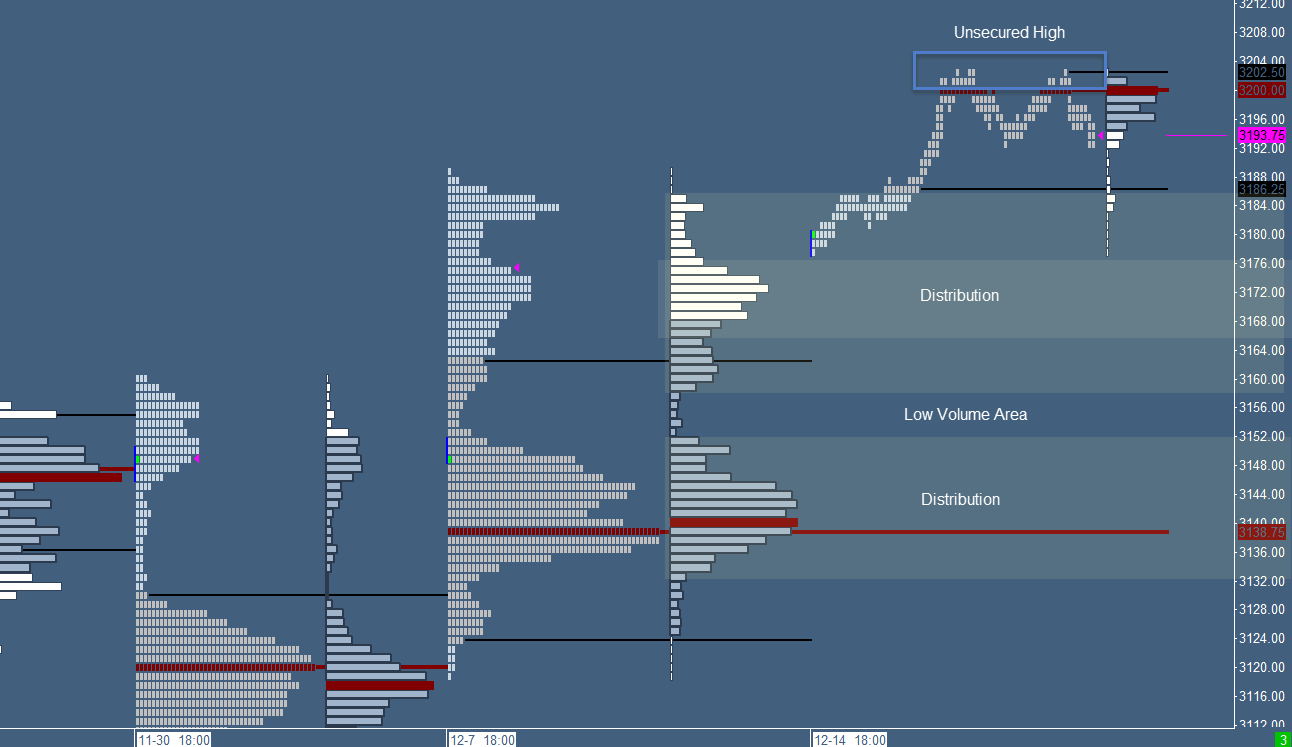

Moving forward to the weekly TPO and volume structure we can observe a double distribution profile with a low volume area. The market opened above the previous value close area and is currently quite rotational at these new highs. We can identify an unsecured high which could be revisited.

(Click on image to enlarge)

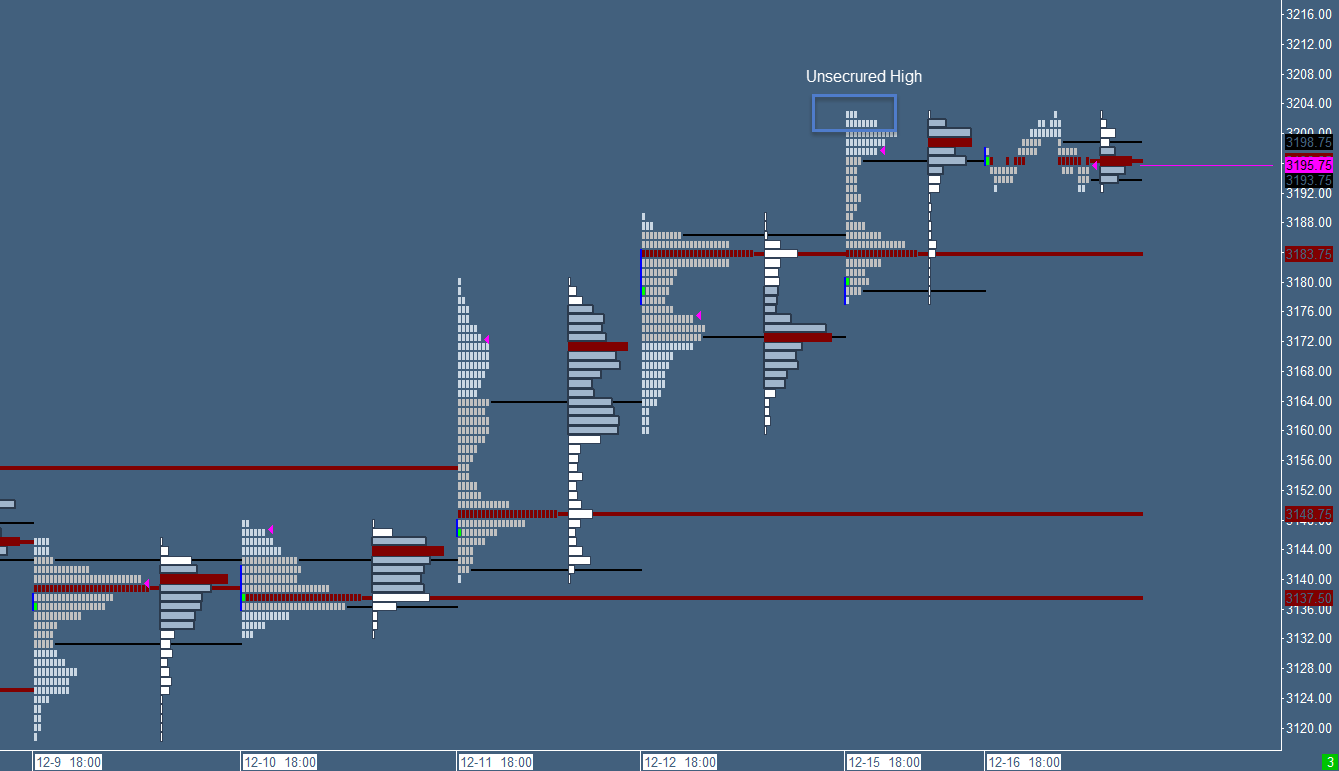

The previous day’s TPO profile closed as a double distribution profile as well. The volume profile closed as P-shaped profile. The market opened at the VAH close level and below the volume profile’s VPOC. The unsecured high and the TPO’s POC could be visted. Currently rotational behavior at the highs.

(Click on image to enlarge)

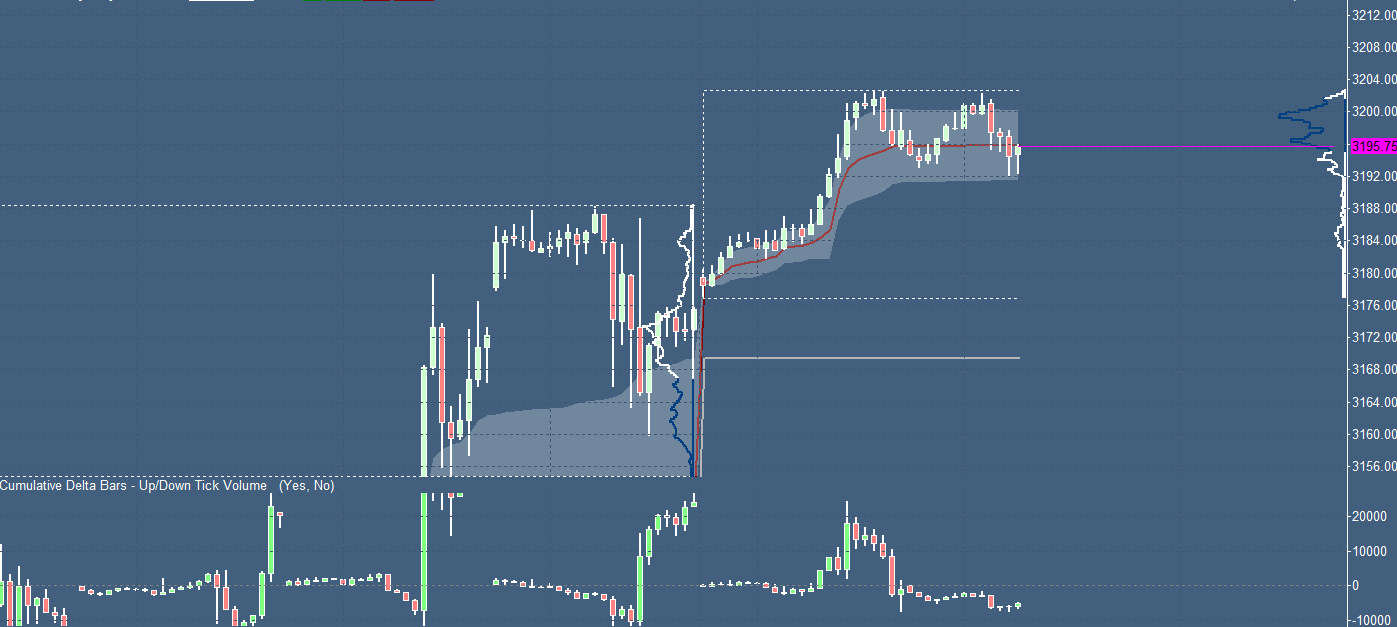

The market opened above the previous week’s VWAP value close area. The slope is currently flat and the market trades rotational inside of the developing value. We can identify a current swing failure which could move the market higher. We simply observe the extremes for any reaction.

(Click on image to enlarge)

Looking now at the daily VWAP perspective we can observe a open in the middle of the previous day’s value close area. The market already tested the higher extreme and probability to test the other lower extreme is quite high. The market trades inside of the developing value currently. Waiting for some pattern to develop.

(Click on image to enlarge)

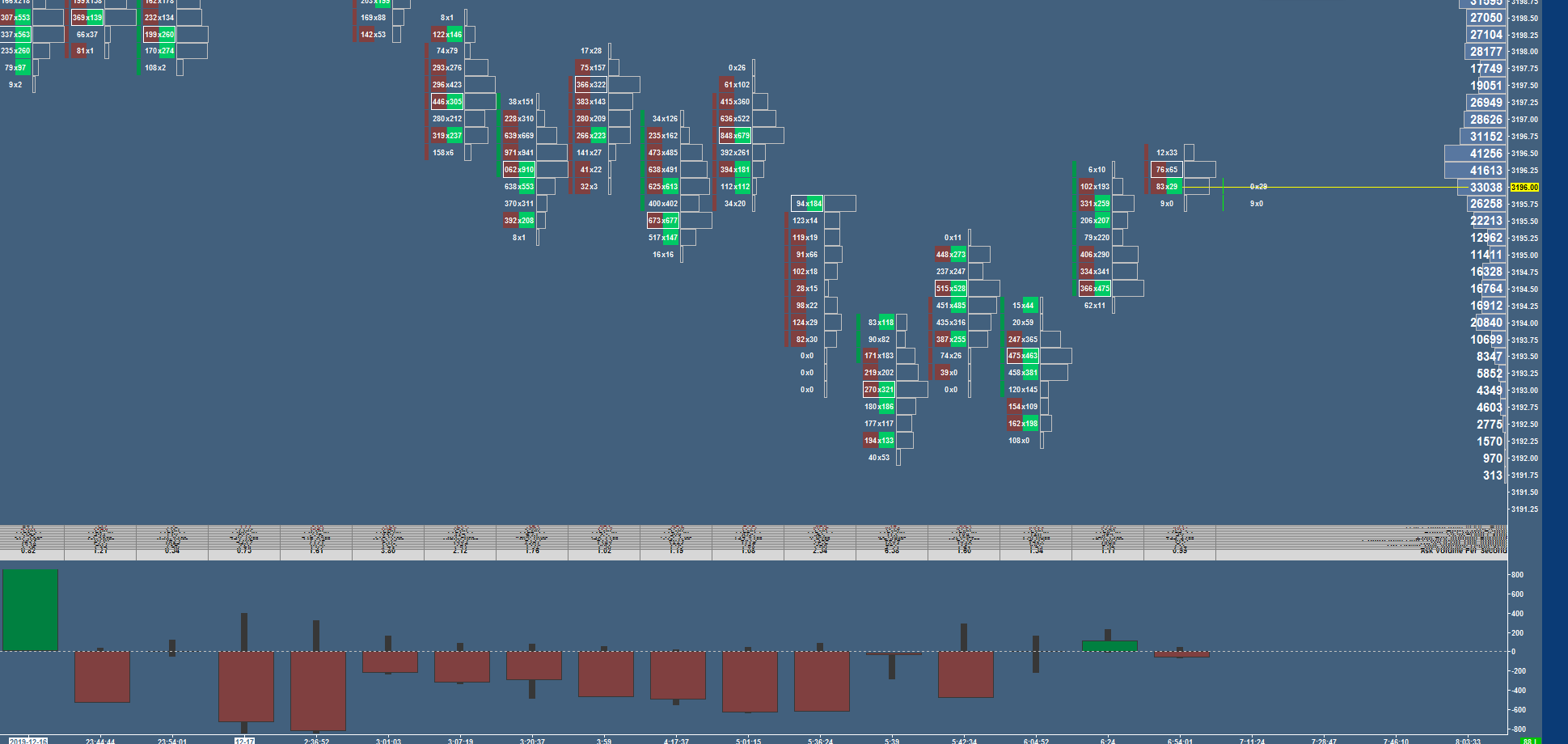

Here a quick glance at the Footprint chart in a diagonal manner to follow the current order flow. However, thinking about to change it back to the horizontal manner in order to see the dominant auction at a particular price level.

(Click on image to enlarge)

Please visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint ...

more

So what does all this mean?