Equity Market May Be Entering A Period Of Further Strength

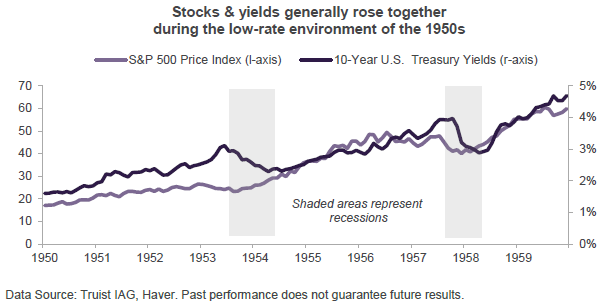

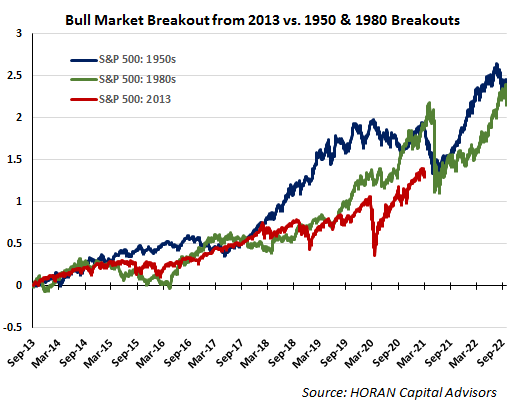

Going back to 2016 I was writing about the current bull market that began in 2013 and how it resembled the bull market of the 1950's and 1980's. At the time of those earlier posts I certainly did not foresee the pandemic and a .5% yield on the 10-year U.S. Treasury. Nonetheless, as this current recovery unfolds, a rise in the 10-Year U.S. Treasury yield has occurred and may continue. Higher interest rates in and of themselves are not necessarily a headwind for stocks though, especially when rising from a very low level.

The higher yield simply is not enough to provide competition to stocks. Also, the higher yield can be the bond market telegraphing a stronger economy. Of course specific events were different in the 1950's, the decade following the end of World War II. However, satisfying pent up demand was a part of the economic strength in the 1950's. As I wrote in the 2016 post:

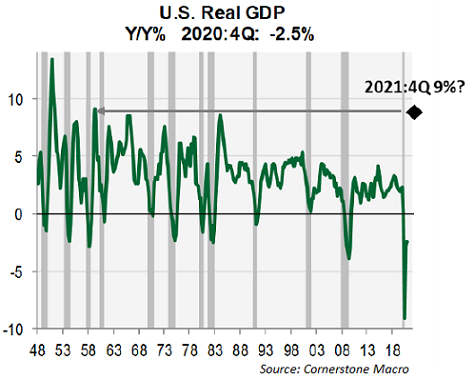

"The decade of the 1950's followed World War II and pent up demand saw the Gross National Product in the U.S. more than double from 1945 to 1960. Government spending in the 1950's was targeted at construction of the interstate highway system, building of schools and an increase in military spending."

Equity markets tend to run in cycles and a secular bull market could run fifteen years or longer. With that assumption the below chart shows the current bull market might be nearing a period of further strength. History does not repeat exactly, but events can have a coincidence of rhyming.

Also supporting a favorable equity market is the continued health of the economy. One research firm we follow is Cornerstone Macro and they are increasing their view for U.S. GDP growth in Q4 2021 to 9%, up from 7%. A number of reasons were cited in their recent report, but some of the obvious ones are massive stimulus at $1.9 trillion, continued vaccine rollout and some shutdown states continuing to reopen, e.g., New York and California. Well, guess where that 9% GDP growth rate falls historically, the 1950's and early 1980's.

The consumer accounts for 70% of the economy (GDP) and more stimulus is headed consumers' way. This is on top of the enormous savings stockpile sitting on the sidelines and I highlighted in a post last week, Spiking The Punch Bowl. The equity market has had a strong recovery since the March 23, 2020 low and some additional downside would not be a surprise. On the other hand, the mantra of "don't fight the Fed", and I will throw the government in here too, still is an adage to be mindful of.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more