EQT Corp: A Solid Energy Company Poised To Benefit From Rising NGL Demand

Image Source: Pixabay

While dramatic growth in US oil and natural gas production and exports garner plenty of attention in the mainstream and financial media, natural gas liquids (NGLs) are largely ignored even though NGLs demand and exports have been growing at an even faster pace in recent years. While there are no pure-play NGLs producers, EQT Corp. (EQT) is a good proxy, notes Elliott Gue, editor of Energy and Income Advisor.

'NGLs' is a catch-all term for a long list of hydrocarbons found naturally in the raw natural gas stream produced from wells in certain regions of the US. Specifically, natural gas is really methane – CH4 – a carbon atom bonded to 4 hydrogen atoms.

The two most common NGLs are ethane (C2H6) and propane (C3H8), which combined typically account for around three-quarters of a mixed barrel of NGLs by volume produced. Generally, raw natural gas is processed to separate NGLs from methane. Then, NGLs can be fractionated to separate a mixed barrel of NGLs into volumes of ethane, propane, butane, and other hydrocarbons.

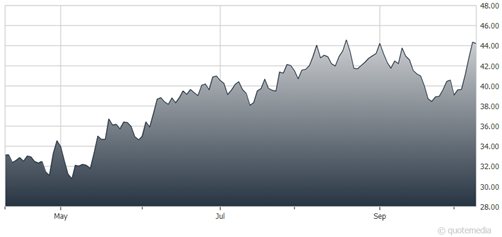

EQT Corp. (EQT)

Many of the oil- and gas-focused exploration and production companies in our coverage universe have some exposure to NGLs output and will benefit from a healthier supply/demand balance in coming years. We’ve generally preferred to focus on gas-focused producers with exposure to two major gas shale fields, the Marcellus Shale of Appalachia and the Haynesville Shale of Louisiana.

The former is the lowest cost gas-focused field in the US with breakeven costs for quality producers like EQT generally under $2.40/MMBtu. We also like the Haynesville Shale because while it’s a higher cost gas field than the Marcellus, it’s located close to the US Gulf Coast, home to most US LNG exports, reducing transport costs.

Producers also have the potential to ramp up production from the Haynesville more quickly to meet growing demand for exports, provided gas prices are at or above the $3.50/MMbtu to $4/MMBtu region that’s required for Haynesville producers to generate significant free cash flow.

While we still favor the Haynesville as a play on LNG growth and natural gas specifically, it’s almost entirely a dry gas field – gas produced in the region typically continues only tiny volumes of NGLs or oil. In contrast, the Marcellus Shale contains both wet gas and dry gas windows.

My recommended action would be to consider buying shares of EQT Corp.

About the Author

Elliott Gue is chief strategist at Capitalist Times, an investment research firm he co-founded ten years ago. Prior to founding Capitalist Times, he shared his expertise and stock-picking abilities with individual investors in several highly regarded research publications, including The Energy Strategist, and as chief editor of Personal Finance, one of the largest and oldest financial newsletter publications in the US.

Mr. Gue is one of the foremost experts on energy investing and has dedicated himself to learning the ins and outs of this dynamic sector, scouring trade magazines, attending industry conferences, touring facilities, and meeting with management teams.

He is also the co-author of two investment books published by the FT Press, The Silk Road to Riches: How You Can Profit by Investing in Asia's Newfound Prosperity and Rise of the State: Profitable Investing and Geopolitics in the 21st Century

More By This Author:

McCormick: A Leading Spice And Seasoning Maker With A Solid DividendWhat Our Bond/Stock Model Says About Allocating Assets

Looking To Improve Your Results? Here Are 50 Laws For Better Investing

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.