Epic Flip-Flop: From Surefire Inflation To ‘Muted’ In Three Weeks

And like that, it’s all different. For more than a year, two years, really, we’ve heard constantly about wage pressures. The US economy buoyed by several domestic factors as well as globally synchronized growth was in danger of getting too far out of hand. The unemployment rate said it was time – three years ago in 2015.

The lower the unemployment rate fell, the more likely the dangers of labor pressures. Orthodox thinking is consistent in its Phillips Curve rituals. This was the basis for “rate hikes” plus balance sheet normalization (what some call QT, or quantitative tightening).

The last hike was barely three weeks ago. In announcing it, the Federal Reserve’s Chairman Jay Powell played resoundingly confident. Not just in the view of economic risks, inflation, but also why. The economy was strong, stronger, and stronger still.

The minutes of that meeting, just released, curiously paint a very different picture of both the debate and offered result. This actually isn’t a surprise. Outwardly, officials project what they think is required. Monetary policy has no money in it, therefore what’s left is confidence and confident-sounding declarations. Powell featured exactly that.

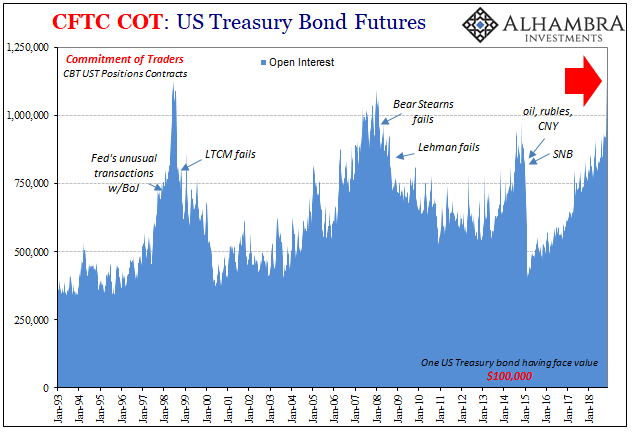

Markets responded quite differently, of course, explaining the not-so-subtle change. The Chairman bluffed, eurodollar futures, oil prices, stocks and UST futures (pretty much everyone) called him on it.

The result is how the same FOMC meeting has produced very different interpretations of it. Powell says strong, the official minutes say “muted”. As in:

With an increase in the target range at this meeting, the federal funds rate would be at or close to the lower end of the range of estimates of the longer-run neutral interest rate, and participants expressed that recent developments, including the volatility in financial markets and the increased concerns about global growth, made the appropriate extent and timing of future policy firming less clear than earlier. Against this backdrop, many participants expressed the view that, especially in an environment of muted inflation pressures, the Committee could afford to be patient about further policy firming. [emphasis added]

Wait a minute. Inflation was in danger of being a monster the Fed could ill-afford to delay in resisting. That was the whole “strong” economy thing. Now it’s muted?

Some participants cited a weaker near-term trajectory for economic growth or a muted response of inflation to tight labor marketconditions as factors contributing to the downward revisions in their assessments of the appropriate path for the policy rate. [emphasis added]

The highlighted parts give it all away; the labor market can’t have been “tight” if there aren’t any inflation pressures, and if it was and they failed to materialize in broader fashion among consumer prices the economy can’t have been “strong” else companies would most certainly have passed on the increased input costs.

Something big is clearly missing, and the official minutes admitted this fact (in their own muted fashion).

Of course, this is all theater. The only thing moving the CPI was WTI, not wages. That didn’t stop the media from playing along with its constant, fatuous writings about the non-existent labor shortage. The LABOR SHORTAGE!!!! was nothing short of emotional projection (including the Beige Book).

The greatest boom in decades has turned out to be the most fragile boom ever; therefore, it wasn’t a boom.

This more than anything explains what happened in December, as well as all the escalating warnings leading up to it. It wasn’t financial market volatility so much as the curtain being pulled back exposing reality.

Globally synchronized growth would have benefited EM’s more than anyone after the beatdown they suffered in the last downturn three years ago. But Eurobonds and currencies reversed to begin last year, leaving the entire system a May 29 to puzzle over. Central bankers chose to pay it little mind, lip service suggesting “strong worldwide demand for safe assets” was somehow a mispricing of them (the FOMC should’ve consulted 2007 Bill Dudley about this first).

Rather than stay an EM crisis, or “overseas turmoil” in the parlance of 2015, after May 29 the cancer (contagion) spread inward. Late in the year, it became pretty obvious the disease was serious. If slight eurodollar futures inversion wasn’t enough to get your attention, then WTI contango. And if that wasn’t enough, broad UST and eurodollar inversions.

And like that, from inflation hysteria and a resistant strong economy to “muted” and “volatility in financial markets and the increased concerns about global growth.” Always behind, concerns about global growth was January 2018, not January 2019; we’re way past that.

I can’t recall before ever seeing meeting minutes so opposed to the crafted message of the actual meeting they were taken from, and I don’t think on balance that’s a good sign. Bernanke wanted transparency but ambiguity benefits a central bank at times (the Montagu Norman doctrine). The difference is Bernanke (and his successors) believed the central bank was actually a powerful and accurate economic tool, becoming even more effective when opened up. He wanted the world to marvel in, and be reassured by, the technocratic prowess he was sure would always be on display.

We’ve been treated instead to the bumbling dissembling and absurd psychology of the emotionally desperate.

Transparency in this latter case only confirms what people increasingly suspect. Policymakers really have no idea what they are doing and that’s what’s being exposed. I expect that over the coming months policymakers here and elsewhere are going to really regret overhyping 2017’s small economic uptick. Market reaction, more than what’s already at stake, might not be muted.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

I noticed that the head of the Chamber of Commerce cited a labor shortage. Perhaps it is just that where labor is needed, there are no skilled workers to be found. They are elsewhere. I think the lack of ability to relocate these days is a big factor in labor shortages when there are workers still looking for work in other regions.