Energy, Property, Financials, Tech Lead US Sector Returns In 2021

How’s your US equities strategy doing this year? If you’re outperforming the market overall, there’s a good chance the bullish momentum is linked to overweights in energy, real estate, financials or tech – or perhaps all of the above.

A set of ETFs shows that these four sectors are on track to beat the broad US stock market when 2021 goes into the history books at the end of the month. Energy shares are especially hot this year.

Energy Select Sector SPDR Fund (XLE) is up nearly 55% year to date through yesterday’s close (Dec. 9). That’s far above the market’s 26% rise so far this year, based on SPDR S&P 500 (SPY). It’s also well ahead of the second-best sector performer: Real Estate Select Sector SPDR Fund (XLRE), which has risen 36.8% this year.

The relatively high yield on XLE is part of the attraction, says one analyst. “I don’t think investors need to overthink this,” notes Boris Schlossberg, managing director of FX strategy at BK Asset Management. “I think you could simply stay long XLE, which has got a beautiful [3.8%] yield right now.”

A bull market in stocks generally has lifted all sector boats this year, but there’s still a wide range of results. The weakest performer year to date: Consumer Staples Select Sector SPDR Fund (XLP), which is dominated by consumer-oriented companies such as Proctor & Gamble and Walmart. For 2021, however, this slice of US equities has been a laggard: XLP is up a relatively moderate 10.1%.

What’s weighing on consumer stocks? Price pressures are a factor at a time of elevated inflation. Although many companies are lifting prices, investors appear skeptical that they can raise prices enough to offset increases in input costs.

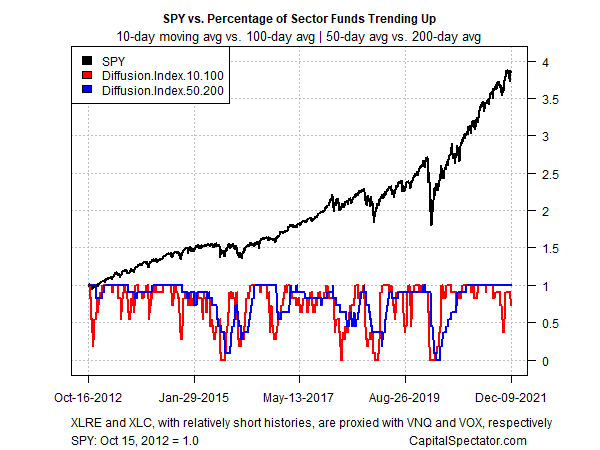

Nonetheless, the momentum bias for sectors, including XLP, remains bullish overall, based on a set of moving averages. Although short-term momentum has wavered a bit recently (red line in chart below), medium-term momentum is uniformly strong (blue line). Trees don’t grow to the sky, but betting on a sector correction at the moment still looks like a contrarian bet with low odds for success.

Disclosures: None.